Traditionally, financial institutes rely on credit risk models to determine potential losses in their credit portfolios. They are also bound by regulatory capital requirements to withstand losses in times of financial difficulty.

However, with physical and transition uncertainties resulting from climate change, the financial system is facing an unprecedented challenge. Chances are that without proper backstops, a financial firm could face ballooning losses. This could happen if a bank provides mortgage services to farmers uninsured against drought; or, if it lends to oil companies based on reserves that end up losing value owing to policy and market developments, like fuel phaseouts or high carbon prices.

Therefore, the stability of the financial sector—and hence that of our economies and societies—greatly depends on the capability of financial institutions to account for climate risks correctly and absorb losses potentially arising from them resiliently.

The question remains whether risk models and banks’ capital requirements capture both physical risks stemming from catastrophic weather events and transition risks arising from a loss of value of high-carbon assets, as well as a compounded combination of both.

There is, thus, a need for authorities to inspect their prudential frameworks and for financial institutes to review their risk models with a view to taking full account of the implications of climate-related risks for financial stability.

So far, action, e.g., by the European Central Bank (ECB), has focused on Pillar 2 of the Basel Framework, i.e., the supervisory review process to ensure a bank’s capital and asset holdings are adequate, given its individual risk profile. At the same time, the ECB’s and Bank of England’s respective juries are still out on whether action should also be taken within Pillar 1, i.e., concerning regulatory capital requirements.

Many have spoken out against it: Treasury Secretary Janet Yellen said in February 2022 that it was “just premature at this point to talk about raising capital requirements.” Rodrigo Coelho and Fernando Restoy from the Financial Stability Institute (FSI) argue more exhaustively that “the intrinsic flexibility of the Pillar 2 framework makes it the natural candidate for ensuring that banks effectively manage such risks and have sufficient loss-absorbing capacity against them.” Conversely, they maintain that due to the longer time frames and the larger degree of uncertainty associated with the materialisation of climate-related financial risks, “standard Pillar 1 instruments might be suboptimal in addressing such risks.”

Nevertheless, some possibilities for integrating climate risk into Pillar 1 are worth reviewing. The main argument to consider doing so is that only a minimal portion of climate risk is covered by banks’ core capital, i.e., the physical risk as far as it affects banks’ daily operations (e.g., flooding). What ensues is a possible “under-capitalization of climate risk by the financial sector,” argues Benoit Genest from Chappuis Halder.

Climate Risk as a Treasury Problem

One way of accounting for climate risk is to add it as a new type of risk on top of the current four risk types in the capital requirements of Basel Pillar 1, i.e., credit risk, market risk, operational risk, and credit valuation adjustment (counterparty) risk.

For example, a Climate Stability Fund can be set up and managed by central banks and oversight authorities. Such a fund would be financed by banks based on their level of “consumption of climate risk.” For example, from an individual bank’s total allocated to climate risk, one-half will go to the Climate Stability Fund; the remainder of the requirements would still be kept on that bank’s balance sheet. The new Climate Stability Fund could then be used to support banks in withstanding unforeseen losses from “green” financing (favourable impacts on LGD or EAD parameters are also possible). At the same time, specific conditions and thresholds must be determined around the coverage of these unexpected losses in such a fund.

Another proposal comes from the Joint Research Centre (JRC), the European Commission's science and knowledge service. The JRC notes that even a very small depreciation of high-carbon assets could trigger “uncontrolled market dynamics,” where a fire-sale could ultimately lead to losses to the tune of some €335-360 bn for the EU banking system as a whole, i.e. 1% of its total assets. The authors of the study estimate that a capital buffer corresponding to 0.5% of risk-weighted-assets on average would be adequate to prevent similar events from happening; it could also be reduced gradually as the economy and banks’ balance sheets become greener. Such a dynamic buffer could exist as the fifth risk type of Pillar 1.

Climate Risk as a Credit Risk Problem

A number of researchers suggested adding a Climate Risk Progression Factor — a capital charge to reflect transition risk in and increase gradually over time. Periodic (e.g., annual) progression could be indexed upon IPCC reference scenarios, thus generating a scaling factor α. Its starting point (=100) could be based on 2015 (the year of the Paris Agreement) emissions or warming levels, and its annual progression would be indexed on the projections of the 4.5 IPCC scenario (i.e., maintain temperature increase <2 degrees Celsius). This factor could be applied directly to capital requirements levels, as follows:

Moreover, banks could be incentivised to move towards sustainable financing given a variable, weighted climate risk ratio based on Basel III. This ratio could vary based on the “colour” (class) of the financial assets, e.g., from Pillar 1 minimum Core Tier 1 funding of 4.5 percent for the greenest category of funding to higher percentages for “brown funding” (e.g. 12 percent). Importantly, this idea assumes that rating agencies can propose standard ratings in the future. Moreover, it is worth highlighting that such a capital charge would not cover physical risks.

Under the new Pillar 1 risk type, capital requirements may additionally be set to reflect the effects of climate risks on risk-weighted assets (RWAs). For example, Gregg Gelzinis from the Center for American Progress argues that “regulators should increase the risk weights for fossil fuel assets in the capital framework, so banks have to fund these riskier exposures with more loss-absorbing equity capital and less debt.”

Climate risk weight would thus have to include climate effects on credit risk levels (e.g., an increase in the probability of default or loss given default). This would allow to isolate climate effects on credit risk and further ensure the additivity of climate risk on banks’ balance sheets. The assumption is that the RWA climate risk is greater than the RWA credit risk.

Equally, the Basel III Asymptotic Single Risk Factor (ASRF) formula on risk weights may be reviewed to better prepare the financial sector for a potential climate crisis. Any methodology should incorporate a correlation matrix by sector and/or country to reflect the possible impacts without correlation limits.

Risk parameters integrating climate effects are the impact on the cost of risk and expected loss, on average default rates by rating, on rating transition matrices, and on collateral value or recovery rates (LGD). The methodology would have to be reviewed to reflect a correlation matrix by sector and country. Moreover, Benoit Genest maintains that the “confidence interval must be calibrated on a reduced survival rate for a given rating” (0.9993 is illustrative).

Moreover, numerous ways exist to approach climate risk-based adjustment of the risk-weighted assets to account for the new associated credit risk, including the additive climate risk.

Green Supporting Factor (GSF) is a framework used by some financial institutions to adjust the risk-weighted assets of their credit portfolios in order to reflect the positive environmental impacts of a borrower. This approach assigns a higher risk weight to loans that have a negative environmental impact and a lower risk weight to loans that have a positive environmental impact. Brown Penalising Factor (BPF) is similar to GSF, but it works in the opposite direction. Under this approach, loans that have a negative environmental impact are assigned a lower risk weight, while loans that have a positive environmental impact are assigned a higher risk weight. Environment Risk-Weighted Assets (ERWA) is another approach that involves adjusting the risk-weighted assets of a credit portfolio to reflect the environmental risks associated with a borrower. This approach typically involves assigning higher risk weights to borrowers that are exposed to environmental risks, such as those operating in sectors with high greenhouse gas emissions or those located in areas prone to natural disasters. Other approaches include a Green Weighting Factor (GWF), developed by the French banking institute Natixis, or a Sustainable Finance Supporting Factor (SFSF), proposed by the European Banking Federation.

The above proposals redefine the assessment of the impact of climate risk on assets and would, to some extent, provide a better risk management perspective on climate risk. However, they would pose challenges too. Günther Friedl, Sebastian Müller, and Alexander Schult from TU Munich warn that treating climate risks as a separate risk type would likely lead to some double counting. For example, if climate risk, in reality, affects input factors of more than one existing risk type (credit risk, market risk, etc.) through a direct or indirect impact of probabilities of defaults and adverse changes in market prices, “then climate risk would be captured by the new climate risk type, credit risk and market risk.” This would result in an overestimation of the actual risk arising from climate change and subsequently cause complexity to correct it down to the approximate real risk that climate risk poses for an asset.

Extending the Basel Credit Risk Model

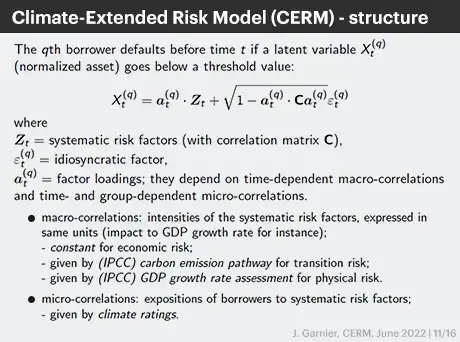

Josselin Garnier, Jean-Baptiste Gaudemet, and Anne Gruz propose to extend the Basel model by adding credit/climate ratings derived from IPCC-based scenarios. The Climate Extended Risk Model can measure the incremental cost of risk and capital to inform credit allocation decisions and thus optimise the overall climate strategy, including “financing existing clients' adaptation/mitigation plans and shifting assets to green lenders and green collateral.” The included physical, and transition scenario gives the evolution of the physical and transition systematic risk intensities.

Compared to the ASRF, the CERM has idiosyncratic risks, with economic risks being stationary. It allows physical and transition risks to evolve over time; however, it needs climate scenarios for the intensities of the systematic risk factors. It also allows for the correlations of the latter (e.g., inversely correlating economic and transition risks).

Risk Management is bound to change

The regulatory options for reflecting climate risks in Pillar 1 capital requirements are seemingly countless. Needless to say, they have as many proponents as opponents. Apart from the FSI, the European Banking Federation also voiced its scepticism.

It remains wide open if and how the regulators include climate risk components in Pillar 1. Whatever their decisions, banks' risk management is bound to change. Even if regulatory capital is not implemented all round, climate risk is already finding its way into the economic capital, which is not ruled by country-specific regulations but rather a “borderless” view of one firm’s need for capital.

Thankfully, the affected stakeholders do not have to adopt a complete wait-and-see approach: They can already take measures to understand risks to boost resilience for their value at risk and be better prepared for the implemented regulatory adjustments.

Reach out to our team and discover how you can benefit from our climate risk platform Spectra to assess the potential risks to your assets and portfolio posed by the progressing climate change.

Author

Written by Kris Ignaciuk. Edited by Kamil Kluza.

Sources

- Alessi, L., Di Girolamo, F. E., Pagano, A., & Petracco, M. (2022). Accounting for climate transition risk in banks’ capital requirements. JRC Working Papers in Economics and Finance. Ispra. Retrieved from https://joint-research-centre.ec.europa.eu/document/download/daf0ee3e-9b09-4d8e-84d0-2dfb501bd4fa_en?filename=JRC129221.pdf

- Alogoskoufis, S., Carbone, S., Coussens, W., Fahr, S., Giuzio, M., Kuik, F., … Spaggiari, M. (2021). Climate-related risks to financial stability. Retrieved from https://www.ecb.europa.eu/pub/financial-stability/fsr/special/html/ecb.fsrart202105_02~d05518fc6b.en.html

- Condon, C. (2022, February 2). Janet Yellen Says Higher Bank Capital Rules for Climate Risk Are ‘Premature.’ Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2022-02-02/yellen-says-higher-bank-capital-rules-for-climate-premature

- European Banking Federation. (2019). Encouraging and rewarding sustainability - accelerating sustainable finance in the banking sector. Retrieved from https://www.ebf.eu/wp-content/uploads/2019/12/ENCOURAGING-AND-REWARDING-SUSTAINABILITY-Accelerating-sustainable-finance-in-the-banking-sector.pdf

- European Banking Federation. (2022). Pillar 1 capital charge for climate risk: Wrong tool for the right purpose. Retrieved from https://www.ebf.eu/wp-content/uploads/2022/05/P1-worng-tool-for-the-right-purpose.pdf

- Friedl, G., Müller, S., & Schult, A. (2021). Approaches to climate risk methodology as an example of ESG risk management in finance, 1–52. Retrieved from https://mediatum.ub.tum.de/doc/1633856/1633856.pdf

- Garnier, J. (2022). The climate-extended credit risk model.

- Garnier, J., Gruz, J.-B., & Gaudemet, A. (2022). The Climate Extended Risk Model (CERM). https://arxiv.org/abs/2103.03275

- Gelzinis, G. (2021). Addressing Climate-Related Financial Risk Through Bank Capital Requirements. Retrieved from https://www.americanprogress.org/wp-content/uploads/2021/05/Addressing-Climate-Financial-Risk.pdf

- Genest, B. (2020). 7 Proposal to Integrate Climate Risk into Capital Requirements. From Basel III To Basel IV: Accelerating Banks’ Integration Of Climate Risk. Retrieved from https://chappuishalder.com/wp-content/uploads/2020/09/2020_Emerging-Risks_Article_7-proposals-to-integrate-climate-risk-into-capital-requirements.pdf

- Ignaciuk, K., & Kluza, K. (2022, November 29). Finding the right place for Climate Risks in regulatory capital frameworks. Climate X. Retrieved from https://www.climate-x.com/articles/industry/finding-the-right-place-for-climate-risks-in-regulatory-capital-frameworks

- Natixis. (2020). Green Weighting Factor and climate trajectory Green Weighting Factor ® and alignment with 2 ° C goals. Retrieved from https://natixis.groupebpce.com/articles/green-weighting-factor-and-climate-trajectory/