The most incredible show in the world is played every four years to bring the world together and showcase how it is more than just a game. By hosting 32 teams to play in 64 different games, the 4-week tournament draws all types of people to become encapsulated by the event. Previously, the tournament has attracted almost roughly half of the world's population to watch the World Cup final in 2018, demonstrating how it has the potential to be a catalyst for positive change across the globe. An opportunity for people of different cultures and nationalities to cross borders, unite and celebrate as one.

The Gulf Kingdom of Qatar is hosting the 2022 World Cup. A tournament already full of tribulations and excitement has marked several historical firsts for a World Cup. The first tournament to be held in a Middle Eastern country, construct a fully demountable World Cup stadium of 974 shipping containers and be the most expensive World Cup costing a total of $220Bn. However, the tournament has faced increasing climate challenges. Needing air conditioning for the debated "carbon neutral" event to cool its open-air stadiums. Rising temperatures across the Arabian Peninsula are rising faster than the world average, with a 5°C increase over pre-industrial levels possible by 2100 to make life unliveable and potentially deprive economic growth by 20% in 2050. For Qatar and the other Arabian Gulf countries, the Gulf Cooperation Council (GCC) - Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates (UAE) - all face adverse side effects of climate change that pose the greatest challenge and threat to the region's long-term development and affluence.

How will physical climate-related risk impact the economic progression of organisations across the GCC region?

Spectacular Growth

The Gulf states, including Qatar, are an allure of modern wealth, growth and innovation. The region's economic transformation has been propelled by global demand and highly-priced oil and gas production over the last few decades. As a result, the region's growth is set to double this year to 6.5% and financial wealth is forecasted to reach $3.5tn by 2026. This substantial growth is most visible in the development of its glittering and bustling urban spaces. These dazzling metropolis cities reflect the region's evolution through extensive investments, especially within construction projects of unprecedented towering skyscrapers, entire new urban quarters and ambitious projects in education, healthcare and culture. The rise of the Gulf cities has enabled them to be compared to the high-rise spectacles of Singapore and Shanghai.

The region's prosperity has contributed to expanding populations, high rural-to-urban migration and a vast increase in personal wealth that has afforded higher standards of living to witness dramatically increased consumption patterns in most GCC countries. However, the enormous regional economic development has cultivated populations that are less willing to sacrifice their less climate-conscious lifestyles. Prosperity afforded them from a time they could only once dream of when living in developing Arab states; hence, public concern for climate change is extremely slow to take root across the region. Moreover, there is a lack of climate awareness on a physical scale. Most evident by colossal land reclamation projects to form luxurious artificial islands such as Palm Jumeirah in the UAE or Pearl Island in Qatar, which are only a handful of incredibly vulnerable projects to the negative implications of climate change.

It's already bad. And it's getting worse”

Regional Vulnerabilities

The climate of the Arabian Peninsula is semi-arid to arid. A shallow water body within a hot desert, the Gulf lies in harsh climate zones exposed to high annual temperatures, low precipitation, and warming sea surface temperatures (SST). These increasing climate changes can intensify physical climate-related risks in the region, stimulating temperature extremes, wildfires, desertification, tropical storms, sand/dust storms, and rising sea levels. Ultimately exacerbating the risks to the people and also infrastructure and industries vital to the GCC's economies that have the potential to aggravate existing challenges of food security, water scarcity and population growth. Furthermore, 90% of the population across the region live in urban areas located on the coastline adjoined by the majority of concentrated buildings, infrastructure and industry, showcasing that a significant proportion of people and urban infrastructure are vulnerable to climate risks.

"It's already bad. And it's getting worse," stated Jos Lelieveld, an atmospheric chemist at Germany's Max Planck Institute. Even an optimistic climate scenario means that by 2050, the Gulf nations will likely see up to 250 dangerous heat days a year. For some places across the Arabian Peninsula, temperatures are projected to exceed 35°C by 2050 shown below in figure 1. Rising temperatures will increase energy demand for cooling beyond current expectations, leading to higher needs for air conditioning, which account for 70% of the annual peak electricity consumption in the GCC. In addition, without restored vegetation, dust and sandstorms are likely to be even more frequent and more severe than in 2050, with an increased intensity of tropical storms and cyclones that will contribute to this on a seasonal basis along the Gulf coastlines.

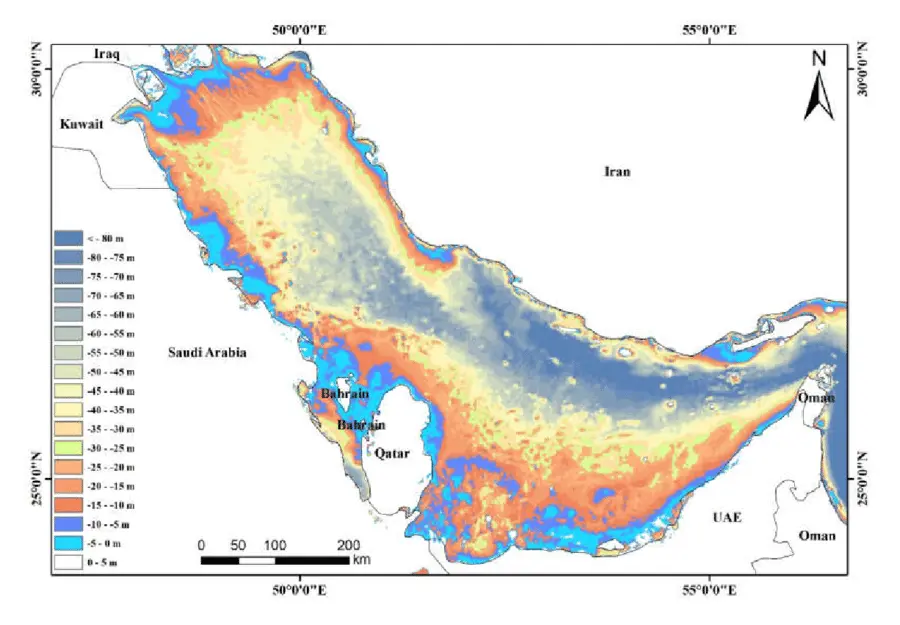

Almost all the countries in the Arabian Peninsula are exposed to the ocean on one side, a major concern for all of them. Specifically in the Gulf within the countries of Bahrain, Qatar, and the UAE, these states have the highest impact of sea-level rise in terms of the population at risk to the total population. Generally, the peninsula has a shallow water body with a maximum depth of 94m, and an average depth of fewer than 50m, as shown below in figure 2. The shallowest coastal zone is in Bahrain, where the island is surrounded by water of less than 5m depth, and in the UAE and Qatar, with extended shallow coastal faces of less than 5m. As proof of this vulnerability, the GCC has experienced several catastrophic floods during the last two decades due to dramatic urbanisation and hazard intensity attributed to climate change in the urbanised areas of GCC countries.

Among the GCC, Qatar has an unclear identification of flood-vulnerable areas. Qatar presents a unique case where a significant urbanisation level characterises it, has no surface water, and the long-term average rainfall is only 76 mm per year, forcing it to rely on absent drainage systems. Figure 3 below highlights Qatar’s vulnerability to flooding, indicating a high overlap between urban areas and flood susceptibility, mainly covering urban areas such as Al Khor and Al Thakira, as well as parts of its capital city, Doha.

Rising sea levels are not the only issue, as a warming sea also worries industries and the local populations. Both rely heavily on channelling seawater for cooling within the existing infrastructure. In addition, renewable energy projects – such as solar farms that are susceptible to the increasing hail storms and flooding – face harmful exposure to climate change, even as they race to be part of the solution. All the GCC countries, except Oman, showcase serious domestic environmental threats posed by climate change. These threats warrant immediate preparation and action to adapt to climate change.

Building Up

The building and construction sectors are highly vulnerable to physical climate-related risks. The industry accounts for 40% of global carbon emissions. Still, it is an industry only set to grow, with building stock projected to double by 2050, replicated in wealthy GCC nations closely linked to their economies — highlighted by the allocation of an estimated $219.56bn in construction contracts between January 2017 and February 2020. However, adapting to climate change is a priority to avoid the negative financial implications of climate-related physical risks for GCC countries. This includes the failure of building structures and infrastructure drainage systems to address floods from severe storm events as sea levels rise could ultimately jeopardise rapid industry growth.

Most construction investment in the GCC region is mainly in building buildings, followed by energy and infrastructure projects. Exemplified by the Burj Khalifa in UAE and the Doha Tower in Qatar. In light of this, GCC's recognise the need for diversification to draw away from heavily hydrocarbon-reliant economies. Deploying capital towards climate-related construction projects is demonstrated by Standard Charter Bank closing a 'transition trade' facility with one of the largest cement producers in the UAE, Lafarge Emirates Cement llcE. "This market-first transition trade finance facility is a result of our local expertise, international network, and robust, sustainable finance proposition," said Rola Abu Manneh, part of a more significant commitment to providing $300Bn in 'green' and transition finance by 2030. Heightening the idea that GCCs are continuing vast construction projects with climate change in mind. For real estate that had a transacted value of $137.4bn in 2021, 42% higher than in 2019 across GCC countries, organisations must assess climate risk across their entire portfolio of tangible assets. Such as offices, factories, and property developments, integrating risk into long-term portfolio management with the support of solutions like Spectra. In addition, the most significant construction and real estate companies, such as Emaar, contribute to building sustainable cities and communities through engineering solutions, including cooling systems. Nevertheless, an enormous leap must be made for the private sector, especially the construction and real estate industries, to integrate physical climate-related risk into risk management procedures to adapt to climate change. When discussing Dubai's real estate position in the region, Thierry Delvaux commented, "it has become acutely apparent that if cities and nations are going to progress up the scale of transparency in the real estate sector, there needs to be tangible sustainability action."

Precautions

Substantial infrastructure investment programs of GGC nations bode well for the region’s insurance market, projected to grow at an annualized rate of 3.2% from $26.5Bn in 2021 to $31.1Bn in 2026. The long-term strategies to diversify the economy and initiatives to draw foreign direct investments (FDI) into regional projects and the governments’ robust investment plan to sustain long-term economic growth. In turn, this has helped increase the number of insurable assets to grow in both UAE and Saudi Arabia to retain their position as the two largest insurance markets in the GCC region. Driven by an understanding of the vital role it has to play in helping the region address its central challenges.

The awareness of the vital role the insurance industry has to play for the future of GCC nations facing climate change is supported by Vincent Keaveny said, “for the UAE to build upon its success, unlocking private capital – particularly in insurance – will be vital.” As climate change becomes a reality in the GCC nations, the complexity of underlying physical climate-related risk exposures will increase, resulting in additional regional insurance premium potential. Hence, insurers and other stakeholders will need to consider addressing these changes pre-emptively to handle uncertainty and prevent unforeseen losses of assets.

Adapt and Diversify

The Gulf states' dependency on hydrocarbons has revolutionised the regional economies. Still, an awareness of climate change is evident by integrating limited climate mitigation commitments into long-term strategic planning. Oman and the UAE have announced net-zero goals by 2050, and the Saudi Green Initiative aims to be net-zero by 2060. The countries have launched several initiatives to support these targets, such as state-of-the-art innovations, carbon capture and utilisation systems (CCUS), and green hydrogen technologies. However, these limited efforts are undermined by the need for GCC governments to prioritise adaptation. Adaptation must be accompanied and synergised with strategic actions from the private sector.

Companies in the Middle East, including GCC countries, need to catch up to the rest of the world in the ability to assess physical climate risk across the private sector, especially the building, construction, and insurance industries that are particularly vulnerable to climate change. Climate adaptation is an urgent priority for the GCC region that needs full embedding in the country's medium-term inclusive growth agendas. This involves including climate risks and policies in all relevant policy frameworks and structural reform agendas. Stepping up adaptation efforts will require substantial additional spending and, thus, financing with climate risk assessments to support that and continue consistent economic growth across the region.

From youth leagues to collegiate teams, millions of athletes have already confronted some climate disruptions, and these will only magnify with time.”

Football is a culture of Adaptation

Football has a significant role in this as the sport itself is increasingly affected by climate risk, specifically from temperature and flooding implications. A UN sport policy report stated, “from youth leagues to collegiate teams, millions of athletes have already confronted some climate disruptions, and these will only magnify with time.” At a professional level, more change is needed with sustainable transport options for game days, the use of renewable energy at the stadiums, and a rethink about fossil fuel emitting sponsors, but climate change is coming home for the sport. Clubs and individuals have demonstrated their commitment to climate change, bringing awareness and action to the lives of billions around the globe. Former Manchester United, Chelsea, and Real Madrid footballer Juan Mata, a co-founder of Common Goal, believes “It’s impossible to ignore the challenges facing people and the planet as they are becoming so critical.” A viewpoint recognised by other footballers such as Mario Götze, Chris Smalling, and Morten Thorsby, who have all individually engaged with climate action in different ways. The largest and smallest clubs are making climate shifts at the club level. Manchester City partnered with water technology company Xylem to promote water scarcity, and Reading launched its kit with 100% recyclable materials.

Despite the Qatar World Cup’s unspecified ‘carbon neutral’ tournament undermining climate efforts by the sport, football is heading in the right climate direction from the very top with the power of football cannot be understated. To support adaptation efforts, tools like Spectra have been developed to support organisations that act together to adapt. It enables the global society to continue our way of life and facilitates future generations to enjoy the simple things of life, such as the beautiful game of football to celebrate the win of preparing for climate change.

Sources

- Darwish, Saad. (2021). Climate change: Economic impacts on the Arab gulf cooperation council. 24. 1-10, https://www.researchgate.net/publication/359816748_Climate_change_Economic_impacts_on_the_Arab_gulf_cooperation_council.

- Driouech, F. et al. (2020), ‘Assessing Future Changes of Climate Extreme Events in the CORDEX-MENA Region Using Regional Climate Model ALADIN-Climate’, Earth Systems and Environment, 4(3): pp. 477–492, https://link.springer.com/article/10.1007/s41748-020-00169-3.

- Eckstein, David & Künzel, Vera & Schäfer, Laura. (2021). GLOBAL CLIMATE RISK INDEX 2021, https://www.germanwatch.org/sites/default/files/Global%20Climate%20Risk%20Index%202021_2.pdf.

- Gelil, I.A. Energy demand profile in Arab countries. Rep. Arab. Forum Environ. Dev. 2015, 84–91. Available online: http://www.afedonline.org/en/reports/details/sustainable-consumption (accessed on 17 September 2022).

- Hereher, M. E. (2020), ‘Assessment of Climate Change Impacts on Sea Surface Temperatures and Sea Level Rise –The Arabian Gulf’, Climate, 8(4): p. 50, doi: 10.3390/cli8040050.

- Kepa Solaun, Emilio Cerdá, Climate change impacts on renewable energy generation. A review of quantitative projections, Renewable and Sustainable Energy Reviews, Volume 116, 2019, 109415, ISSN 1364-0321, https://doi.org/10.1016/j.rser.2019.109415.

- Salimi, M.; Al-Ghamdi, S.G. Climate Change Impacts on Critical Urban Infrastructure and Urban Resiliency Strategies for the Middle East. Sustain. Cities Soc. 2020, 54, 101948, ISSN 2210-6707, https://doi.org/10.1016/j.scs.2019.101948.

- Vargas Zeppetello, L.R., Raftery, A.E. & Battisti, D.S. Probabilistic projections of increased heat stress driven by climate change. Commun Earth Environ 3, 183 (2022), https://doi.org/10.1038/s43247-022-00524-4.

- https://abcnews.go.com/Sports/wireStory/energy-rich-qatar-faces-fast-rising-climate-risks-93990572

- https://apnews.com/article/world-cup-science-sports-soccer-business-7012f26fb54e9fe19a3eece354389282

- https://argaamplus.s3.amazonaws.com/68112185-9470-4399-a3de-5a4b6e5368a7.pdf

- https://argaamplus.s3.amazonaws.com/68f88da4-b648-41f9-bb31-47ebb3414cb6.pdf

- https://www.bcg.com/press/27july2022-gccs-financial-wealth-to-grow-annually

- https://carbonmarketwatch.org/publications/poor-tackling-yellow-card-for-2022-fifa-world-cups-carbon-neutrality-claim/

- https://www.cascades.eu/wp-content/uploads/2022/03/CASJ9418-MENA-Report-220328-v2.pdf

- https://climateknowledgeportal.worldbank.org/country/qatar/vulnerability

- https://climatepromise.undp.org/news-and-stories/how-arab-states-region-scaling-climate-action

- https://www.cgdev.org/blog/after-petro-dollars-gulf-migration-climate-change-future

- https://english.alarabiya.net/business/economy/2022/11/14/Sustainability-becoming-the-new-marker-of-UAE-s-real-estate-transparency-JLL

- https://feeds.dfm.ae/documents/2022/Mar/22/e19df11d-fb5e-4612-ace7-9c62bdf2733a/EMAARDEV_INTGRATED%20report%202021_E_08_4_2022_.pdf

- https://www.gcc-sg.org/en-us/Pages/default.aspx

- https://www.greeninitiatives.gov.sa/

- https://gulfnews.com/business/energy/standard-chartered-signs-middle-easts-first-transition-trade-facility-with-uaes-lafarge-emirates-cement-1.1660714196847

- https://www.imf.org/en/Blogs/Articles/2022/03/30/blog-without-adaptation-middle-east-and-central-asia-face-crippling-climate-losses

- https://www.imf.org/en/News/Articles/2022/11/28/cf-gulf-countries-should-maintain-reform-momentum-despite-oil-boom

- https://www.imf.org/en/Publications/Departmental-Papers-Policy-Papers/Issues/2022/03/25/Feeling-the-Heat-Adapting-to-Climate-Change-in-the-Middle-East-and-Central-Asia-464856

- https://www.nature.com/articles/d41586-022-03346-8

- https://www.swissre.com/institute/research/topics-and-risk-dialogues/climate-and-natural-catastrophe-risk/middle-east-insurance-opportunities-in-the-transition-to-net-zero.html

- https://time.com/6236839/qatar-world-cup-outdoor-air-conditioning-environment/

- https://theathletic.com/3460731/2022/08/01/football-role-tackling-climate-change/

- https://u.ae/en/information-and-services/environment-and-energy/climate-change/theuaesresponsetoclimatechange/uae-net-zero-2050

- https://www.unep.org/news-and-stories/press-release/co2-emissions-buildings-and-construction-hit-new-high-leaving-sector

- https://unhabitat.org/sites/default/files/2022/10/ccs_-_roas_-_final_-_a4_sheets.pdf

- https://www.un.org/development/desa/dspd/2022/02/addressing-climate-change-through-sport/

- https://www.weforum.org/agenda/2022/11/middle-east-climate-change-private-sector/

- https://worldpopulationreview.com/country-rankings/most-urbanized-countries

- https://www.zawya.com/en/press-release/events-and-conferences/ministry-of-climate-change-and-environments-fifth-national-dialogue-for-climate-ambition-explores-role-of-insurance-sector-in-building-climate-change-resilience-vauyh1by