As 2023 commences, the world faces a set of familiar risks. Inflation, geopolitical confrontation, and increased severity and frequency of climate-related physical events are predicted to lead to higher claims and reduce the value of property investments creating a substantial coverage gap and a tremendous impact on the reinsurance sector, with catastrophe premiums expected to soar this year.

The past year of 2022 has reinforced the seriousness of climate change. While insurance companies offer companies piece of mind, the slow-burn climate change crisis over the last five years has exceeded hundreds of billions of claims paid out by insurers from uninsured losses. However, if insurance payouts continue to increase due to more customers filing claims, the insurance industry either has to lower its profits or increase the regular premiums customers pay. Consequently, insurers need to understand how climate risks are likely to evolve under different climate change scenarios to identify where they are uninsurable.

Challenges so far

There is a risk of retreat by insurers from some areas of natural catastrophe coverage. Insurance annual profits are under pressure; “climate change risks also featured at the top of the list for long-term risks”, according to Alex Morgan for Zurich Asia-Pacific. The challenge of a worsening insurance gap is estimated to have grown. The growing protection gap highlights a global need for insurance against the threat of climate change. However, the gap will only increase because many insurers have already announced that they will reduce their natural catastrophes exposures due to the volatility and likelihood of rising claims costs. Furthermore, insurers also face increasing claims from climate-related litigation against their clients. The number of climate litigation cases is rising and spreading from energy to other sectors, including mining, financial services, food, and agriculture.

Firms must integrate climate change into business strategy, governance, risk management, investment and underwriting decision-making, product design, claims handling and operations. Failure to act now might leave firms open to litigation, a challenge from shareholders and regulatory pressure, and unable to adapt their business models to a changing business and economic environment. Furthermore, climate change exacerbates other risks. With more frequent and severe weather patterns, other risks, such as food security, are at risk of worsening.

A 2022 Recap

John Scott, Head of Sustainability Risk at Zurich Insurance Group, shared his concerns about the lack of progress on climate change. “This year, the failure of climate change mitigation is one of the most highly rated risks. Even more concerning… it's one of the risks that is least prepared for, with over 70% of respondents to the global risk perception survey rating mitigation of climate change as ineffective.”

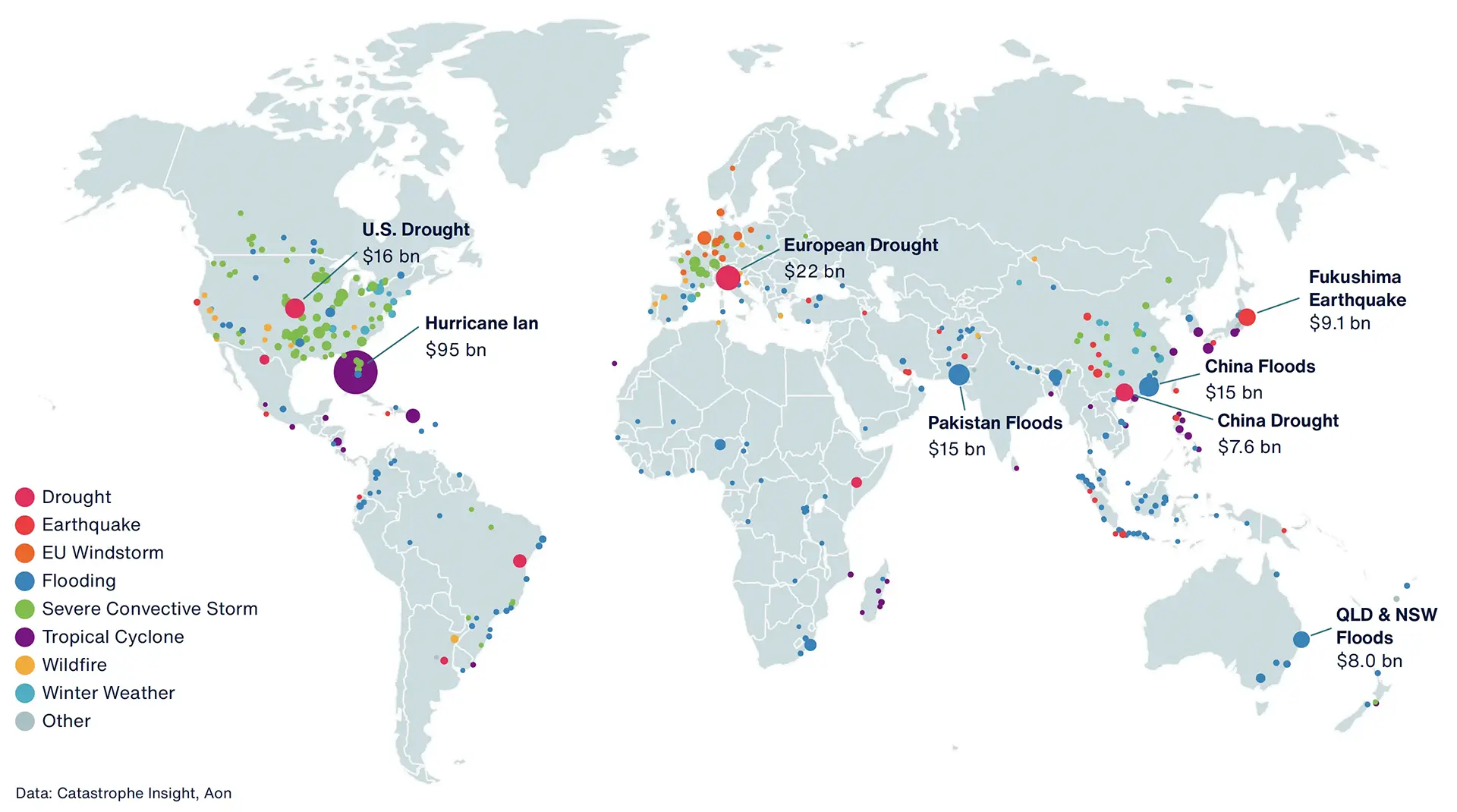

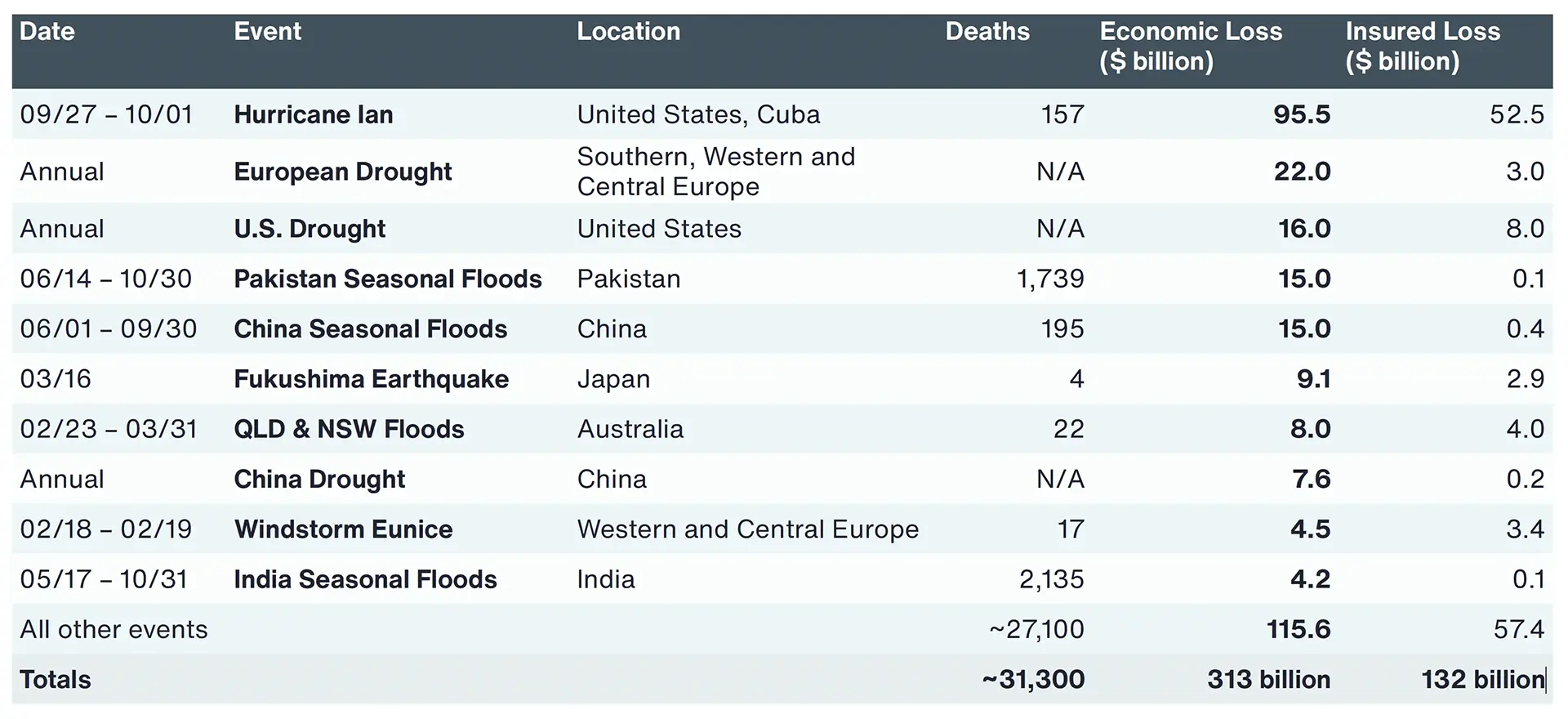

For 2022, economic losses from natural climate disasters amounted to $313 billion. As highlighted in figure 1, approximately 42% of direct aggregated economic losses were covered by public and private insurance entities. The protection gap reached 58%, the lowest on record, remaining a global challenge. While a large part of the global disaster losses remains uninsured, this was one of the lowest protection gaps ever recorded, close to the record year of 2005 when roughly 40% of losses were covered.

Highlighted in figure 2 above, Hurricane Ian, which struck Florida in September, was by far the costliest event of the year for the global re/insurance industry and became the second costliest natural disaster ever recorded in terms of insured loss on a price-inflated basis, only surpassed by Hurricane Katrina, which resulted in more than $99 billion losses (in 2022 $) after its devastating impact in 2005. Ian is anticipated to surpass the second costliest disaster, the Great Tohoku Earthquake and Tsunami of 2011. For the U.S., the Biden administration aimed to collect data from insurance companies utilising the Federal Insurance Office (FIO) to understand how climate change affects insurance property coverage but has received substantial pushback. Although regulatory attempts have been made to reform the insurance industry in tackling climate change, climate-related disasters have forced the insurance industry to face a downturn. Reinsurers are expected to pick up the losses. However, reinsurers have fared worse, and with insurance profits lagging, reinsurers are expected to increase their premiums, limiting their coverage. Insurance companies have been invigorated to be creative to mitigate climate risks. But insurance companies, such as crucial reinsurers of Swiss Re and Munich Re, have taken risk reduction actions by decreasing their capacity in the insurance-dependent state of Florida by as much as 80%, as more cautious about addressing inflation-driven exposures, ensuing reinsurance prices are expected to increase insurers are not solvent to recover all parts of payouts that in turn, means homeowners lose apologies and see ramifications for rates expected to hike as the state is struck by more extreme weather events. The visible consequences of climate change were also increasingly visible in Europe. Two hailstorm episodes in France – in June and July – during the heatwave in central Europe resulted in huge losses for the insurance industry to the tune of €4bn. In the face of rising climate disasters, Nina Seega states that the insurance industry has come far by becoming more data-focused to understand future forecasts. Climate change is making historical data less reliable, needing reliable data like Climate X’s Spectra that provides for insurance companies to make the right decisions.

Expected Regulations in 2023

In the wake of 2022 climate disasters, regulators are driving initiatives to tackle climate risks across the globe. Climate change policy brings many new challenges and opportunities for insurers when adjusting to regulation changes.

The U.S.

- 15 US jurisdictions representing nearly 80% of the US insurance industry require the annual submission of the revised climate risk disclosure survey under the National Association of Insurance Commissioners (NAIC) -adopted TCFD alignment disclosure protocol.

- Invigorated by the 2022 attempts of the FIO for data collection from insurers, State regulators, via the NAIC, could keep pressure on insurers’ risk and consumer interactions at a more granular level in 2023.

- A pressing issue by the SEC for the fulfilment of climate disclosures required by states but may face legal challenges.

The EU

- The EU Corporate Sustainability Reporting Directive (CSRD) will launch their second draft of EU standards proposed by EFRAG to the European Commission.

- The CSRD aims to replace the Non-Financial Reporting Directive (NFRD) after 2024 extending the scope to all large companies and those listed on regulated markets, including insurance companies.

The UK

- The Prudential Regulation Authority (PRA)’s statement of supervisory priorities for 2023 confirmed its continued focus on the financial risks that climate change presents for the sector.

What’s Expected Next?

“The shortfall in protection represents an opportunity for insurers to close this gap and help to build more resilient societies in vulnerable regions for the future,” stated Mabé Villar Vega, Catastrophe Risk Research Analyst at AGCS.

For 2023, continued economic and geopolitical uncertainty is set to continue. Even if inflation begins to slow down, rates in 2023 will remain above the long-term average. In the US, the annual average consumer price inflation for 2023 is anticipated to be around 4.3% (2022: 8.0%). As for the eurozone, the expectation is for inflation to remain very high next year, at 5.8% (2022: 7.9%). Concurrently, insurers' and reinsurers' rates are expected to be exacerbated by inflation and climate change as a top threat. Regulators are increasing their activity to diminish climate risk to meet this threat. According to Deloitte, there will likely be no more pressing issue for insurance regulation than climate change risk. Insurance companies will face increasing pressure to meet the Securities and Exchange Commission's (SEC) new climate disclosure regime framework and as Task Force on Climate-related Financial Disclosure (TCFD)-aligned disclosures. Consequently, the complexity of regulation and the realities of climate risk will mean companies need more guidance to meet expectations. Although the Federal Insurance Office (FIO) assesses climate risk vulnerabilities by collecting data is amounting, insurers need to familiarise themselves with new and developing guidelines while building out their internal systems to meet new and anticipated criteria.

Across the globe, including France, Spain, the US, the UK and other markets, flood, wildfire and other climate risks are considered national security concerns. Some industry analysts have speculated that regulators could mandate that insurers play a more significant role in covering these risks. While unlikely today, the prospect reinforces why insurers should proactively engage all stakeholders to find new solutions. Insurers will need to continue developing more advanced capacities to identify, measure and manage climate risks, including incorporating climate risks in scenario analysis. Furthermore, insurers can make it worthwhile if they approach these incoming regulations not as a “tick box” disclosure exercise but as an investment in strategic risk management. Armed with climate risk assessment tools, insurers can begin to understand how different climate change and transition scenarios will play out for their businesses, develop strategies to navigate the fast-evolving risk landscape, and seize the commercial opportunities associated with the transition. The most opportunistic insurance firms will recognise this as a real commercial opportunity to create targeted products and services that address climate change and the energy transition. Organisations will need greater collaboration with clear coordination, including greater insurance digital transformation cohesion, to deal with complex disclosures and requirements as climate risks go beyond actual disclosures of disastrous weather events that reveal inadequacies in the availability and affordability of coverage and reinsurance capacity.

Insurance Conferences of 2023

Insurtech Insights Europe

1-2 March 2023 I London (UK)

Insurtech Insights is Europe's Largest Insurtech Conference, boasting over 200 speakers and 4,000 attendees. The next Insurtech Insights conference is scheduled in London and promises to be even bigger than in 2022. Europe’s Largest Insurtech Conference includes some of the most well-renowned speakers in Europe, who share their insights and learnings from being at the top of the industry.

Website:https://insurtechinsights.com/europe/

Global InsurTech Summit

18 April 2023 I London (UK)

The Global InsurTech Summit will host hundreds of vetted senior decision-makers alongside the most disruptive InsurTech founders and tech innovators in Europe. FinTech Global is a leading provider of FinTech information services, B2B media products and industry events.

Website: https://fintech.global/globalinsurtechsummit/

Insurance Tech Innovation Conference

20-21 April 2023 I London (UK)

Meet decision-makers across the entire insurance value chain, with 200+ leaders from technology, innovation, data, analytics more at the Insurance Tech Innovation Conference. To keep pace with the competition, insurance companies need to transform at a rapid speed. The Insurance Tech Innovation Conference on April 20 - 21, 2023, invites 30+ insurance technology experts to share their latest strategies, insights, solutions, and innovations to drive your insurance transformation journey.

Website: https://events.altaworld.tech/Insurance-Tech-Innovation-Conference-London.html

Digital Transformation in Insurance Conference

23-24 May 2023 I London (UK)

The next edition of the Digital Transformation in Insurance Conference will be held in London, providing vital insight into how the insurance industry can excel in client engagement and operational agility. The two-day conference will address various industry topics, including digital customer journeys, emerging technologies, new operational models, data integration, and next-generation approaches to delivering insurance products to a growing consumer base.

Website: https://www.arena-international.com/digital-insurance/

Insurance Innovators: Digital Insurance

5-6 June 2023 I Munich (Germany)

Insurance Innovators brought together the leading innovators from the largest established insurers and the most disruptive new entrants from across Europe.

Website: https://marketforcelive.com/insurance-innovators/events/digital-insurance/

Redefine Insurance to Power Profitable Growth

27–28 June 2023 I Chicago (USA)

Join 450+ CEOs and senior industry stakeholders at Reuters Events: The Future of Insurance USA 2023 (June 27-28, Chicago) to ensure people, processes, and products are fully optimised in the face of global disruption.

Website: https://events.reutersevents.com/insurance/future-of-insurance-usa

ITC Europe

27-29 June 2023 I Barcelona (Spain)

Insurtech investment in Europe is expanding faster than anywhere else the world, reaching $483m in the first quarter of 2022 alone. With this accelerating growth in mind, June 2023 will see the world’s largest insurtech event, ITC, set up camp in Barcelona in collaboration with DIA – Europe’s most established insurance innovation show. We are creating a new hub for the European insurance industry to showcase the latest innovations, revolutionise value chains, and ultimately enrich policyholders' lives.

Website: https://www.itceurope.com/

Rendez-Vous de Septembre

9-13 September 2023 I Monte Carlo

Since it first began in 1957, the Rendez-Vous de Septembre (RVS) – the largest gathering in the sector – has enabled all players in the insurance and reinsurance market to meet up and hold bilateral discussions ahead of the renewals.

Website: https://www.rvs-monte-carlo.com/

ITC Vegas

31 Oct - 1 Nov 2023 I Las Vegas (USA)

ITC Vegas is the world’s largest insurtech event – offering unparalleled access to the most comprehensive and global gathering of tech entrepreneurs, investors, and insurance industry incumbents.

Over three days, the industry will convene to showcase innovations, learn how to increase productivity and reduce costs, and ultimately enrich policyholders' lives. Superlative networking, with tens of thousands of meetings, is one of the hallmarks of an ITC event.

Website: https://vegas.insuretechconnect.com/

Sources

- https://www.agcs.allianz.com/content/dam/onemarketing/agcs/agcs/reports/Allianz-Risk-Barometer-2023.pdf

- https://www.aon.com/getmedia/f34ec133-3175-406c-9e0b-25cea768c5cf/20230125-weather-climate-catastrophe-insight.pdf#

- https://www.aon.com/weather-climate-catastrophe/index.aspx

- https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/insurance/insurance-pdfs/ey-2023-global-outlook-report.pdf

- https://www-axa-com.cdn.axa-contento-118412.eu/www-axa-com/15c65a87-4d11-49a4-b88e-be5953965b37_axa_futurerisksreport_2022_va.pdf

- https://www.bankofengland.co.uk/-/media/boe/files/prudential-regulation/letter/2023/uk-deposit-takers-2023-priorities.pdf

- https://www.bankofengland.co.uk/speech/2022/june/anna-sweeney-speech-at-the-association-of-british-insurers-climate-change-summit-2022

- https://www.bloomberg.com/news/articles/2023-01-24/climate-is-forcing-the-most-risk-aware-industry-to-reinvent-itself

- https://www.cdsb.net/what-we-do/policy-work/eu-sustainability-reporting

- https://content.naic.org/article/us-insurance-commissioners-endorse-internationally-recognized-climate-risk-disclosure-standard#:~:text=A%20bipartisan%20group%20of%20state%20insurance%20regulators%20led,international%20Task%20Force%20on%20Climate-Related%20Financial%20Disclosures%20%28TCFD%29.

- https://www2.deloitte.com/us/en/pages/regulatory/articles/insurance-regulatory-outlook.html

- https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32014L0095

- https://www.iaisweb.org/uploads/2022/03/2022-2023-Roadmap.pdf

- https://www.insurancebusinessmag.com/au/news/breaking-news/zurich-risk-expert-on-2023-global-risks-report-434197.aspx

- https://www.munichre.com/en/company/media-relations/media-information-and-corporate-news/media-information/2022/media-release-2022-10-20.html

- https://news.un.org/en/story/2022/02/1112852

- https://www.weforum.org/agenda/2023/01/global-risks-report-2023-press-conference/