Across the European financial system, EU banks are failing to meet the European Central Bank (ECB) climate risk standards set by 2024. In recent years, ECB Banking Supervision has taken significant steps to include climate-related and environmental risks (C&E risks) in its ongoing supervision to help mitigate banks' exposure to current and future C&E risks.

Despite banks making considerable C&E risk management progress, they remain incohesive, slow to act and unprepared when meeting ECB’s standards. This is highlighted by most banks needing to increase C&E risk disclosures, improve climate risk stress-testing frameworks and enhance the collection of accurate and precise data to measure C&E risk.

Climate Risk Management Pitfalls

The ECB’s recent keynote speech by Anneli Tuominen prominently expressed that there remain clear gaps in banks' C&E risk profiles relative to the ECB’s supervisory expectations. This includes a greater emphasis for banks to focus more on physical risks instead of transition risks, a higher understanding of their exposure and investment targets, more reliable disclosure practices and the need for high-quality risk management improvements when assessing climate risk to appropriately adjust their business strategy, governance and risk management frameworks.

While a growing number of banks have deemed themselves to be materially exposed to C&E risks in the short to medium term, there are some that have still not performed a materiality assessment. As reported by Steven Maijoor, Executive Director at De Nederlandsche Bank, “we see an increase in frequency and materiality of climate-related and environmental risks. And as a result, banks’ exposures may be affected simultaneously through multiple channels.” If such risks remain unaddressed in the future, regardless of their size, reputation or business model, C&E risks could also invigorate risk exposure across other traditional risk categories, such as credit and operational risk.

Disclosure Alignment

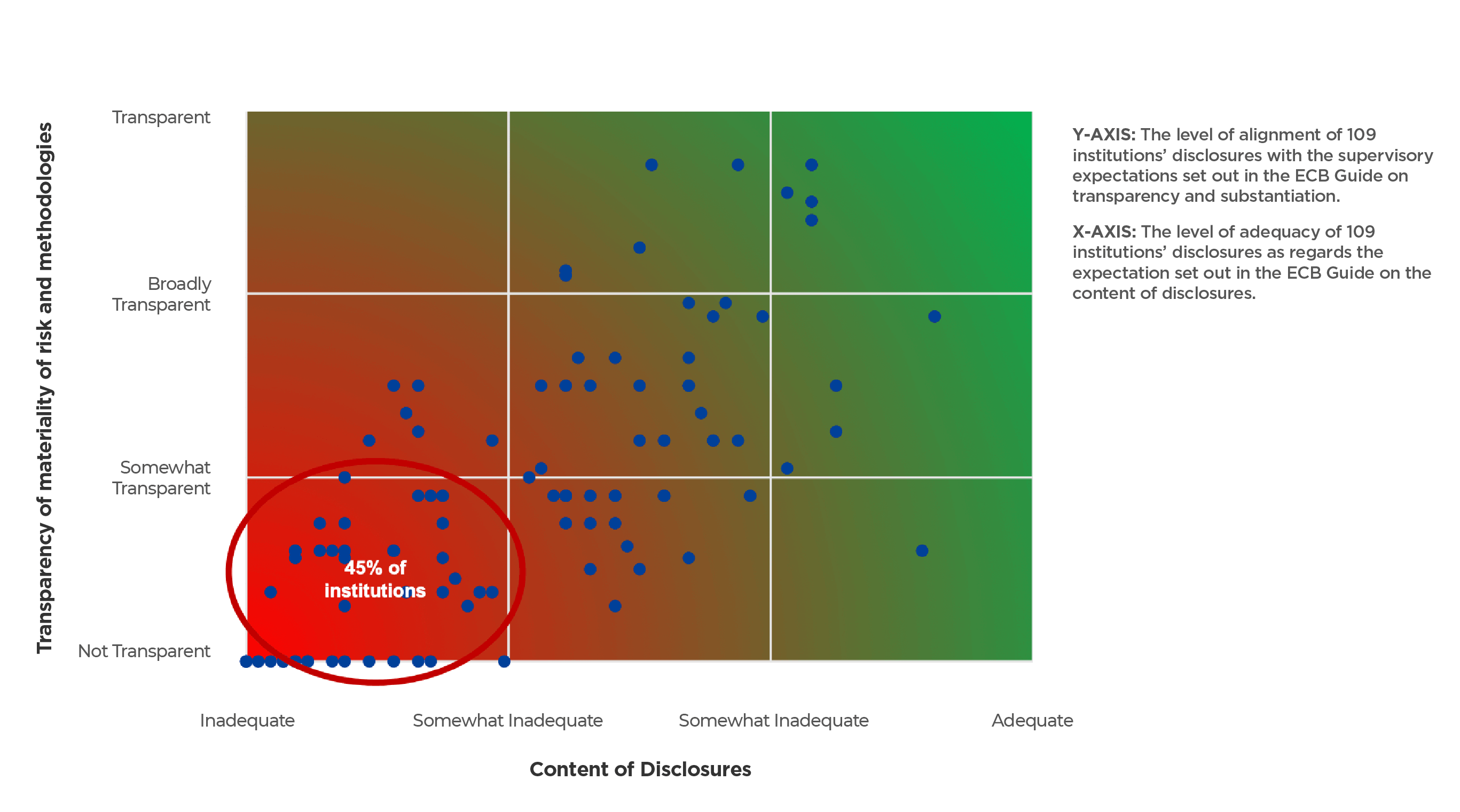

The ECB stressed that a small subset of institutions has integrated climate-related and environmental risks into their disclosure policies. Only 20% of institutions disclose the outcome of their assessment of the materiality of information in their public disclosure report, only one institution has included the underlying considerations for this assessment in its internal disclosure policy.

It’s only a matter of time before companies will have to report on their climate-related risks. They should get ahead by putting the processes in place to do so now."

Disclosure has increased across the financial system but it is clear that most banks still need to make significant efforts to transparently disclose their exposures to C&E risks and further improve their disclosure practices. Understanding that universal standards are lacking climate disclosure accountability as the practice of disclosure remains hard to come by.

Banks need to transparently and improve C&E risk disclosure practices by developing and integrating robust frameworks with risk management metrics that enables them to improve their own risk preparedness but also the global financial system to respond more effectively to climate change risk. Otherwise, by not providing sufficient qualitative or quantitative disclosures may lead to reputational and litigation risks that could have financial consequences across the entire financial system.

Climate Stress Tests

104 large eurozone banks participated in the ECB’s 2022 climate risk stress test with three modules hypothesising that the banks must sharpen their focus to measure the risks of global warming amounting to €71 billion on aggregate for the bottom-up stress test within the third module limited to 41 banks. The stress test was intended as “a learning exercise” according to Frank Elderson, vice-chair of the ECB supervisory board, the stress test verified that 60% of banks do not have robust climate risk stress-testing frameworks and only 20% consider climate risk as a variable when granting loans.

Many of those banks involved were identified to have a lack of harmonised legislation on energy performance certificates, insufficient models and the disclosure of greenhouse gas emissions (GHG), in particular Scope 3 emissions, which hampered banks’ ability to collect accurate hard data and insights into their clients’ transition plans.

“Euro area banks must urgently step up efforts to measure and manage climate risk, closing the current data gaps and adopting good practices that are already present in the sector,” said Andrea Enria, Chair of the ECB’s Supervisory Board. The climate stress learning exercise highlights that banks are not incorporating sufficient climate risk into their stress-testing frameworks and internal models in accordance with the ECB’s standards. This is especially in regard to banks’ long-term projections under different climate risk scenarios with banks lacking robust long-term strategies, other than to reduce exposure to high-polluting sectors and to support low-carbon emitting businesses.

Meeting ECB Standards

Some banks have improved their C&E practices. In more than 80% of cases, banks intend to accomplish their plans by the end of 2023 to meet ECB’s standards for C&E risk integration into the financial system. Kerstin af Jochnick, Member of the Supervisory Board of the ECB, states that it is “reasonable that banks can be fully compliant with all our expectations by the end of 2024 at the latest.”

To meet these targets, not only will banks need to improve climate disclosures, data collection and climate-stress frameworks, but banks will also need to adjust their business models, range of products and services as well as decision-making processes to adapt to C&E risk management practices. The Association for Financial Markets in Europe, a bank lobby group, acknowledged there was “much more to do” but said its members were “defining data collection templates” to close gaps in the data they have on climate risks at corporate clients.

A helping hand

To act as a helping hand, Climate X can support banks to deliver precise and accurate climate risk data when taking a harder look at mounting under-assessed physical risks posed by climate change.

Climate X can enable banks to reshape their long-term strategy and improve risk management frameworks - not only to vitally meet the ECB’s C&E risk standard targets that are expected to be met by the end of 2024 - but also to allow banks to simply prepare ahead for increasing climate change risks.