Financial Services: Banking

Quantify Physical Risk, embedding climate risk to your workflow to build a stronger business.

Spectra is the enterprise-wide risk solution to fully integrate physical risk into your business strategy and risk management.

Understand risks and opportunities, comply with regulations and identify high-ROI investments to mitigate risks to expand your green services offering.

Climate Risk Data for

Corporate / Retail & Investment Banks

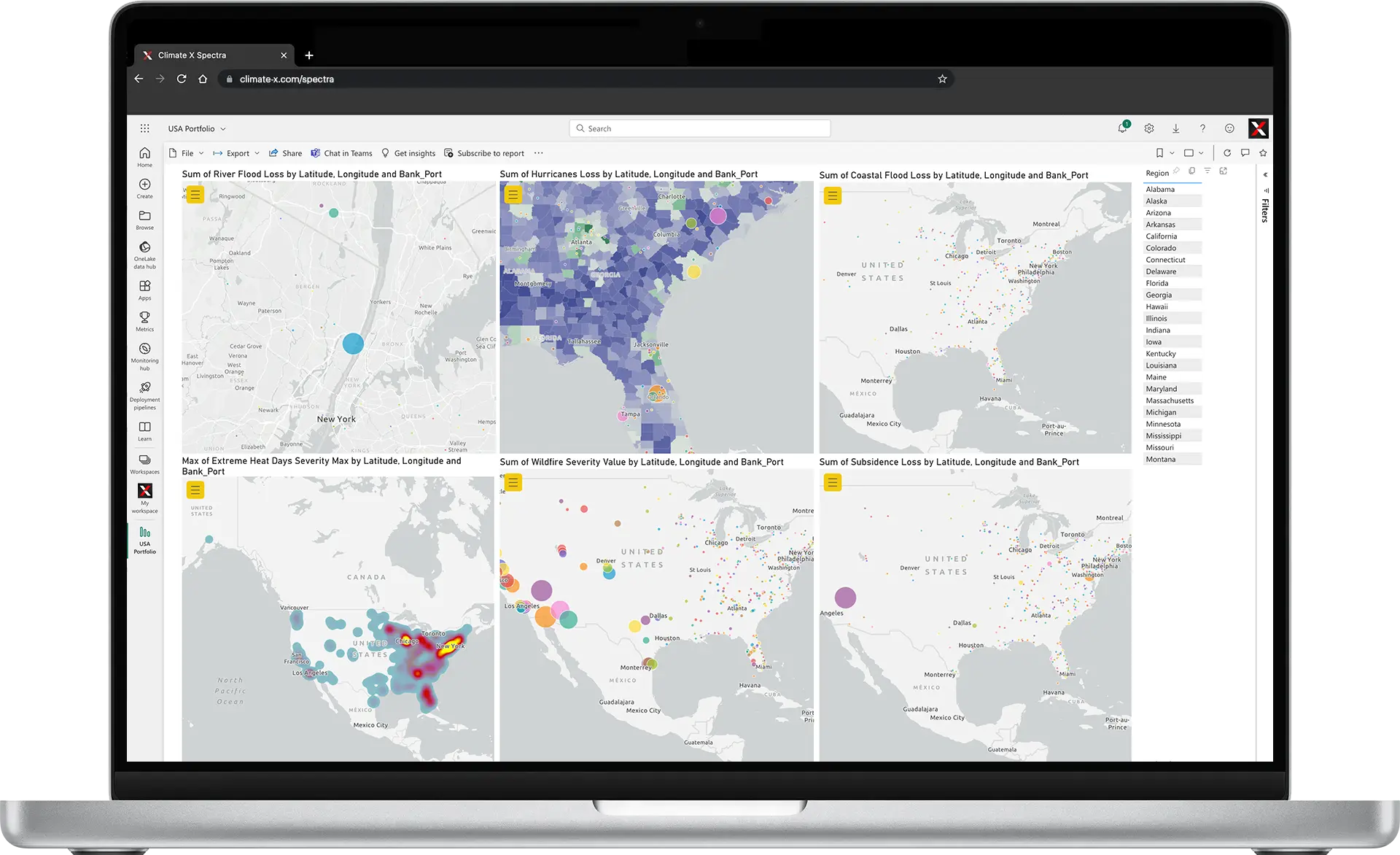

Spectra allows you to assess your climate-related materiality exposure and quantify potential financial losses — in few clicks, at your convenience and without intermediaries.

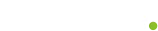

Transparent Science to Navigate Climate Risk Data

Our models are peer-reviewed by industry specialists for accuracy and we back them with detailed methodology in every report with even more detail in our knowledgebase.

Our data is reliable, transparent and updated with a regular cadence.

A platform that goes beyond

climate risk

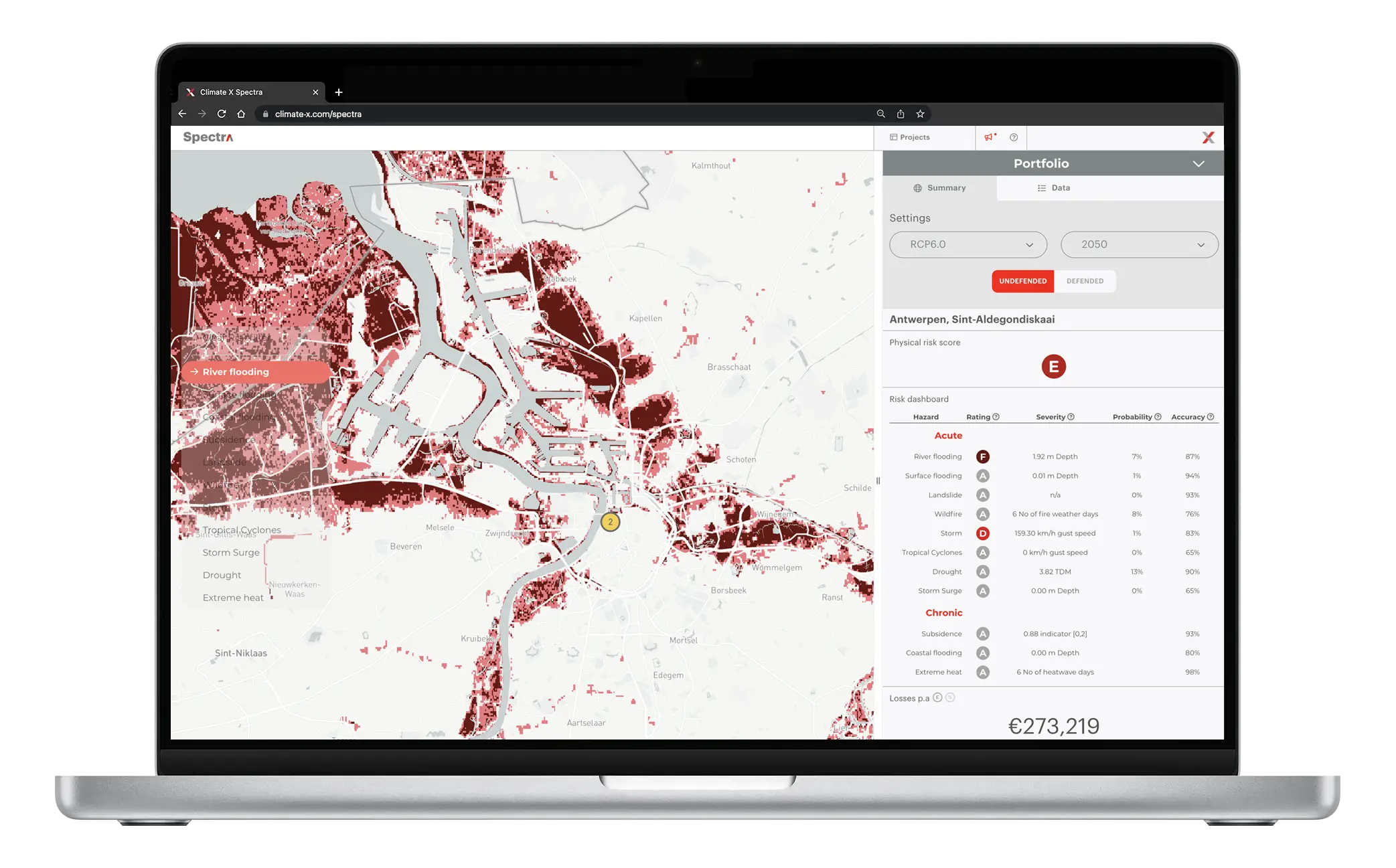

Identify your firm's portfolio critical risk drivers, quantifying climate impacts on collateral valuation and insurability considerations.

Leverage the power of our enterprise-wide climate risk solution to enable effective risk management and decision making across your organisation.

Workflow Management Made Simple

It’s easy: Log in to Spectra, upload a .csv with up to 500k addresses and download the user-friendly PDF report for enterprise-wide use and communication.

Make business decisions and complete regulatory disclosures in minutes, with all the data and methodology supporting it.

Physical Risk translated into financial impacts

Access data on your Expected Annual Losses (EAL) from climate-related hazards.

Empower your decision-making with actionable insights on 15+ physical risks based on multiple RCP/SSPs.

Want to dive straight into Spectra?

Book a demo now and begin assessing your portfolio today. If you’re just approaching climate risk, you can also take a look at our free Operation Manual for Banking Professionals.

of physics

data points

of infrastructure

mapped assets

of coastline

perils

We speak your language.

Our team boast decades of experience in the financial services sector, while we speak your language, we also adhere to industry standards. We're InfoSec compliant and work in accordance with the PRA's Model Risk Management (MRM) frameworks.

Navigate complex climate risks with banking-focused reports

Spectra delivers extensive reporting tailored for the banking industry in as little as two clicks with our online self-service platform or the ability to plug straight into the digital core via our customisable API to easily integrate data with your existing systems to power dashboards and widgets.

- Perfect for Stress Testing, Annual Reports, ICAAP, Capital, ECL and other statements.

- Create comprehensive Asset & Portfolio-level Reports in seconds as a PDF.

- Compare climate risk exposures between portfolios to implement robust risk management procedures and make strategic decisions that drive long-term value.

- Compare your investment performance at a regional level.

Trillions of data points with global coverage down to as little as 10m

Enhance your credit assessments and lending decisions, assessing your materiality exposure to the impact of climate hazards.

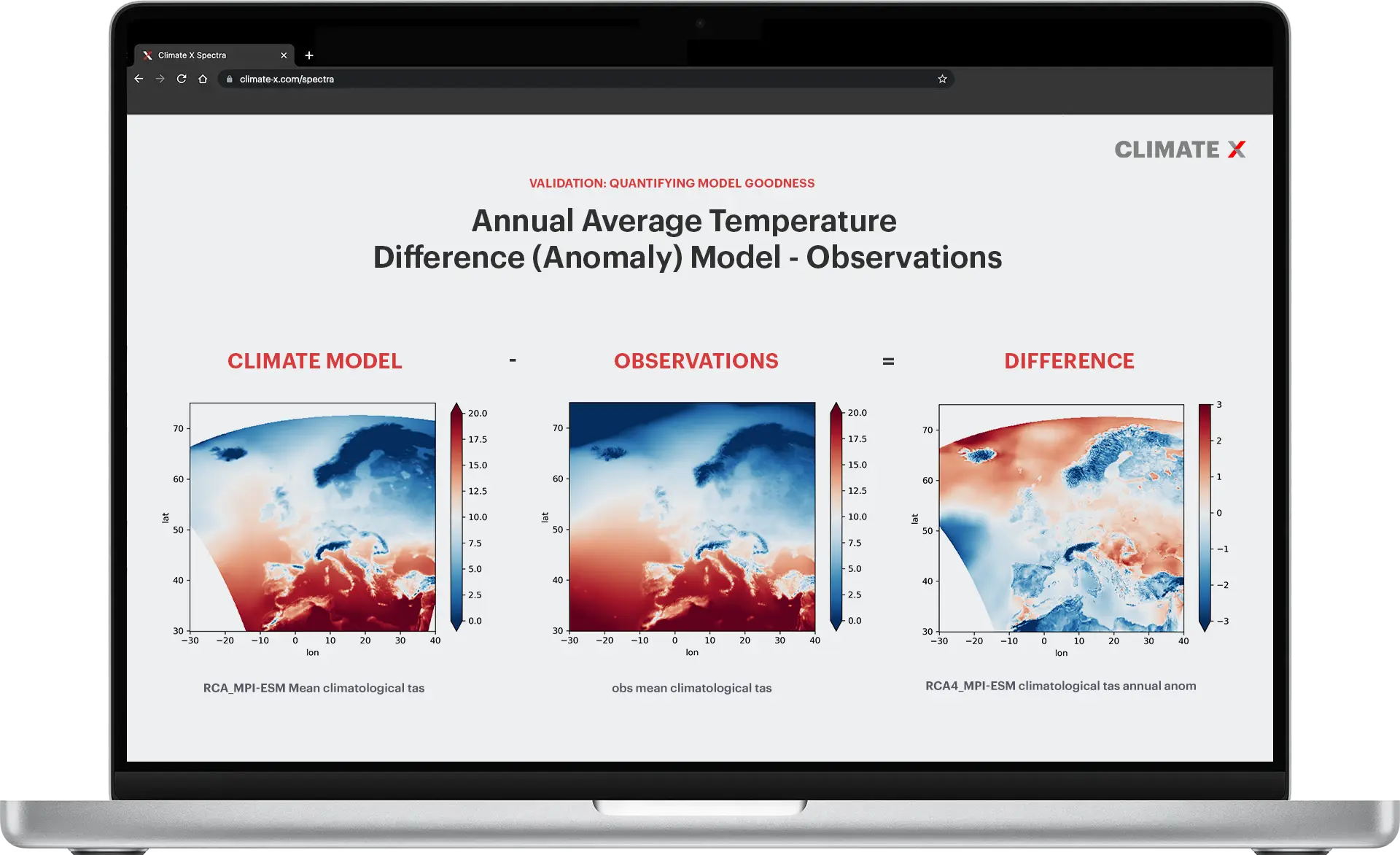

15+ Physical Risks: includes river flooding, coastal flooding/sea level rise, surface flooding, subsidence, landslide/coastal erosion, wildfire, heat stress, storms, hurricanes, and drought/water stress, etc.

Multiple RCPs, 80-year span: RCP 2.6, 4.5, 6.0, & 8.5 (EA/LA) + SSPs, in as little as 5-year intervals from 2020-2100.

Output:

- Portfolio physical risk score and risk volume distribution.

- Hazard-specific risk rating, including accuracy (up to 99%), probability and severity.

- Physical risk annual losses in monetary value and percentage.

Backed by academia, trusted by industry

Leveraging climate risk data you can trust is essential - we go beyond mere data aggregation by providing granular and actionable data for climate resilience.

- Built in-house by a value-led, diverse and world-class team of climate scientists.

- Peer-reviewed by industry experts.

- Fully validated models.

- Detailed and consistent methodology for all hazards/perils.

- Models achieving up to 99% accuracy.

- Detailed and comprehensive documentation & knowledgebase + support framework explaining the science and the data we project.

A future-proofed platform

Governments and Central Banks worldwide are urgently deploying policy, legislation and regulation forcing climate-risk assessments across the global economy.

As the regulatory landscape continues to rapidly evolve to address climate risk, significant reforms are being implemented to ensure that industries are directly aligned with net-zero goals.

We follow the latest developments to make sure you’re always one step ahead, offering granular climate data for effective regulatory compliance and alignment with the evolving landscape:

- EU Taxonomy.

- ECB C&E 2020 Guide

- NGFS aligned pathways.

- ECL / ICAAP / IFRS S2.

- Stress testing/scenario analysis requirements.

Reporting

Turn data into actionable insights to make faster, smarter, informed decisions

Spectra delivers extensive reporting tailored for the real estate industry in as little as two clicks with our online self-service platform or the ability to plug straight into the digital core via our customisable API to easily integrate data with your existing systems to power dashboards and widgets.

- Perfect for Stress Testing, Annual Reports, ICAAP, Capital, ECL, TCFD and other statements.

- Create comprehensive Asset & Portfolio-level Reports in seconds as a PDF.

- Compare climate risk exposures between portfolios to implement robust risk management procedures and make strategic decisions that drive long-term value.

- Compare your investment performance at a regional level.

Physical Risks

Trillions of data points with global coverage down to as little as 10m

Enhance the protection of your global investment exposures to NGFS-aligned physical risks with our state-of-the-art platform.

15+ Physical Risks including: river flooding, coastal flooding/sea level rise, surface flooding, subsidence, landslide/coastal erosion, wildfire, heat stress, storms, hurricanes, and drought/water stress.

Multiple RCPs, 80-year span: RCP 2.6, 4.5, 6.0, & 8.5 (EA/LA) + SSPs, in as little as 5 year intervals from 2020-2100.

Output:

- Portfolio physical risk score and risk volume distribution

- Hazard-specific risk rating including accuracy (up to 99%), probability and severity

- Physical risk annual losses in monetary value and percentage

Quality of Data

Backed by academia, trusted by industry

Leveraging climate risk data you can trust is essential - we go beyond mere data aggregation by providing granular and actionable data for climate resilience.

- Built in-house by a value-led, diverse and world-class team of climate scientists.

- Peer-reviewed by industry experts.

- Fully validated models.

- Detailed and consistent methodology for all hazards/perils.

- Models achieving up to 99% accuracy.

- Detailed and comprehensive documentation & knowledgebase + support framework explaining the science and the data we project.

Regulatory Compliance

A future-proofed platform

Governments and Central Banks worldwide are urgently deploying policy, legislation and regulation forcing climate-risk assessments across the global economy.

As the regulatory landscape continues to rapidly evolve to address climate risk, significant reforms are being implemented to ensure that industries are directly aligned with net-zero goals.

We follow the latest developments to make sure you’re always one step ahead, offering granular climate data for effective regulatory compliance and alignment with the evolving landscape:

- TCFD & EU Taxonomy

- ECB C&E 2020 Guide

- NGFS aligned pathways

- GRESB / CRREM / Article 8/9

- Stress testing/scenario analysis requirements.

Our latest articles

A selection of some of our latest articles covering industry, policy and climate science.