- The Basel Committee proposes mandatory climate risk disclosures for banks to highlight climate change impacts as part of a broader strategy to manage financial risks related to climate.

- The proposal includes both qualitative and quantitative disclosure requirements for banks, aimed at providing detailed insights into banks' governance, risk management, and exposure to climate-related risks, influenced by geographical and sector-specific factors.

- Additional disclosures on real estate energy efficiency are considered, aiming for global consistency in climate reporting by 2026.

Introduction: Proposal for disclosure requirements on climate risk to banks

Consisting of 45 central banks and banking regulators from 28 jurisdictions, the Basel Committee on Banking Supervision (BCBS) is the primary international standard setter for the prudential regulation of banks and is mandated to strengthen the regulation, supervision and practices of banks worldwide in order to ensure global financial stability.

The BCBS is now examining ways in which mandatory climate risk disclosure can be added to its global banking supervision standards.

In a consultation paper published on November 29, 2023 the committee outlined how climate risk could be incorporated into Pillar 3 of the Basel framework, which covers disclosures. Under the proposals, banks would be required to publish detailed information about the impacts of climate change on their business to help regulators and investors assess how these risks are being managed.

The new proposals form part of its "holistic approach" to addressing climate-related financial risks, which includes work across all three pillars of regulation, supervision and disclosure.

Warnings of climate risks to bank stability

"Climate-related financial risks impact banks’ credit, market, liquidity, operational and other risks based on the physical locations of banks’ operations and through the counterparties and other stakeholders with whom they interact or invest in" the BCBS warns.

A 2021 research report published by the committee explored these risks, identifying increases in the intensity and frequency of heatwaves, extreme precipitation, floods, wildfires and storms as both current and potential threats, along with sea level rise and a host of transition risks associated with climate policy and the societal move towards sustainability.

The report also found that the economic and financial impacts of these risks can vary substantially according to geography, sector and financial system development.

Climate change is not a single catastrophic event happening, it’s really many things happening more intensely and more often."

Evan Sekeris, Head of Non-Financial Risk at Japanese bank MUFG Americas

Responding to the BCBS proposals he stressed the multi-faceted impacts of climate change. "It's not a risk in the sense that we talk about operational risk or credit risk, it’s not a risk type, but an event that impacts firms through multiple risk types".

Qualitative and quantitative disclosure requirements

In response to these risks, the BCBS consultation paper outlines a series of qualitative and quantitative disclosure requirements relating to climate change.

The proposals for qualitative requirements are largely based on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and include details on banks' climate-related governance, strategy and risk management processes and procedures.

Banks would also be required to report on the concentration of their exposure to particular industries, economic sectors and geographical regions facing specific climate-related risks.

The BCBS is also suggesting a range of potential quantitative disclosure requirements, with the consultation paper offering indicative examples. Quantitative metrics that are under consideration include:

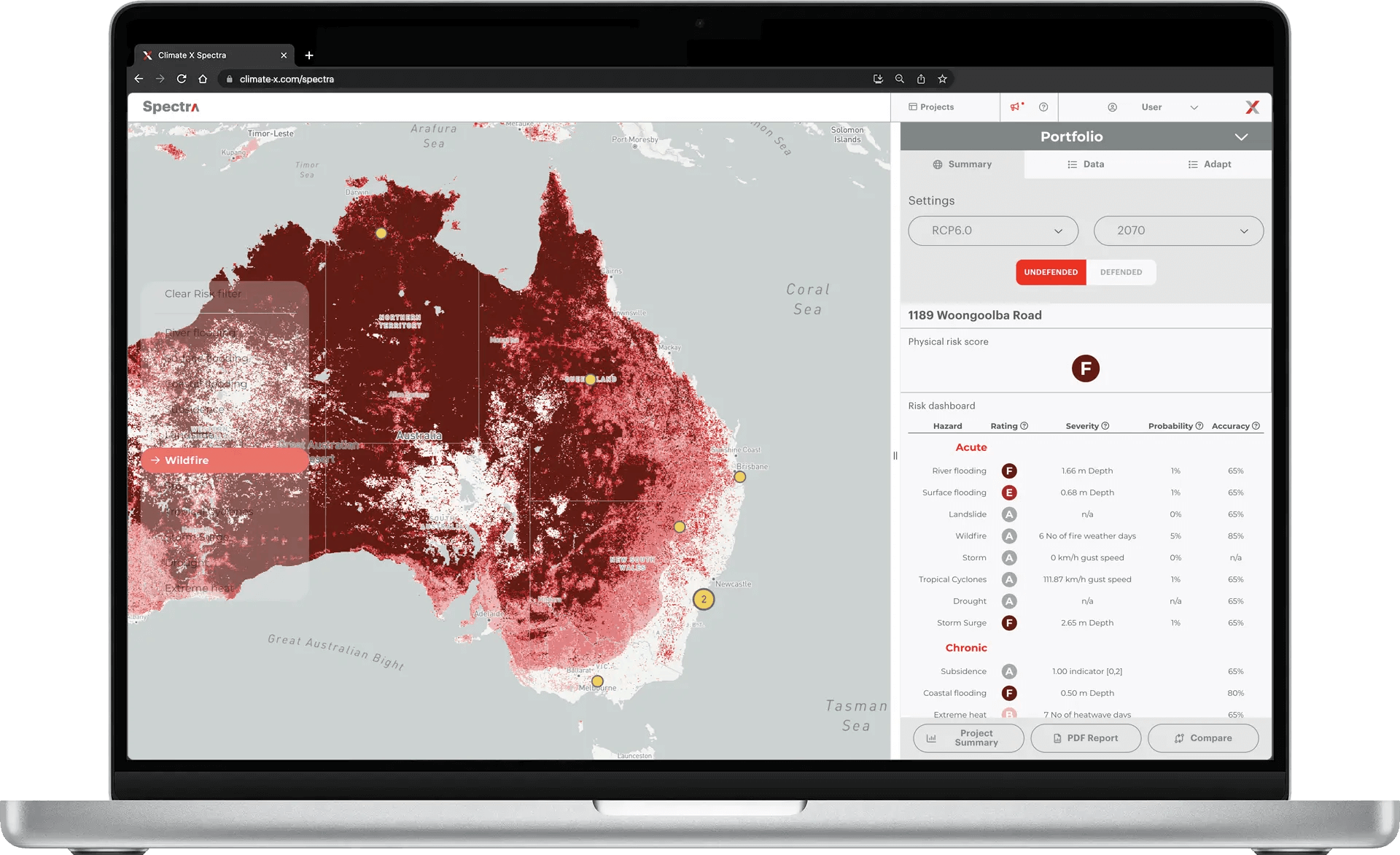

- Exposures subject to physical risk by geographical area or locations

- Exposure by sector according to standardised categories of economic activity

- Exposures by credit quality based on sectoral and geographical location

- The maturity profile of exposures subject to climate-related risks over varying time frames, including the longer term

- Financed emissions covering the greenhouse gases (GHGs) associated with loans and investments

Proposal to real estate energy efficiency

Additional quantitative disclosure requirements would not be mandated under the Basel framework but would instead be subject to jurisdictional discretion.

These jurisdictional requirements include the provision of data on the energy efficiency of real estate collateral at a portfolio level, intended to allow both investors and regulators to assess the extent to which the value of that collateral might be negatively affected by increased costs associated with high emissions or by retrofitting requirements.

"This in turn may assist market participants in assessing the risk profile and returns of a bank’s mortgage-backed real estate portfolio in the context of jurisdictional energy efficiency regulations," the BCBS says.

The consultation paper references a 2023 United Nations report that found nearly 20% of global GHG emissions and up to 36% of European emissions related to real estate properties.

It also includes an illustrative template showing how the energy efficiency of real estate exposures in the mortgage portfolio might be disclosed.

The template requirement covers both residential and commercial properties, along with an accompanying narrative covering jurisdictional legal requirements, information sources and changes over the reporting period.

Coordination with other standards

The BCBS makes clear that the proposed climate risk disclosure requirements are intended to complement the work of other standard setters, and to provide a common disclosure baseline for internationally active banks.

"The Committee has been closely monitoring the development of global frameworks to improve the consistency, comparability and reliability of climate disclosures," it says. "It has also been coordinating with other international bodies and standard setters, including the International Sustainability Standards Board (ISSB)".

The ISSB's S2 Climate-related Disclosure standards already include sector-specific guidance for commercial and investment banks and other related financial services.

However this guidance is more general than the standards proposed by the BCBS, and is far less focused on climate risks specific to the banking industry.

Conclusion: Potential implementation for January, 2026

The BCBS paper concludes with a list of 56 questions for parties contributing to the consultation exercise.

The consultation is open for submissions until the end of February, 2024 with a revised or final version of the disclosure requirements expected by the end of the year.

The BCBS is also seeking comments on the feasibility of a potential implementation date of 1 January 2026, along with any transitional arrangements that might be considered necessary.

Sources

- BCBS (2021), Climate-related financial risks - a survey on current initiatives

- BCBS (2023), Consultative Document - Pillar 3 disclosure requirements - Climate-related financial risks

- BCBS (2024), Comments on Basel Committee documents open for consultation

- IFRS (2023), IFRS S2 Climate-related Disclosures

- Risk.net (2023), Basel climate guidance leaves op risk managers in the dark

- UNEP FI (2023), Real Estate Sector Risks Briefing