Frequently Asked Questions

Discover all the common questions we encounter at Climate X, relating to who we are and the climate solutions we provide.

Climate Risk

Climate Risk relates to the potential impact of climate change on the global annual economic output. The warming planet is a key risk to global financial institutes, with a need to understand the direct risks climate change poses for clients and portfolios to safeguard financial businesses. Moreover, indirect impacts of climate change on the financial sector can occur through regulatory policies organisations must comply with.

Climate Risk Data

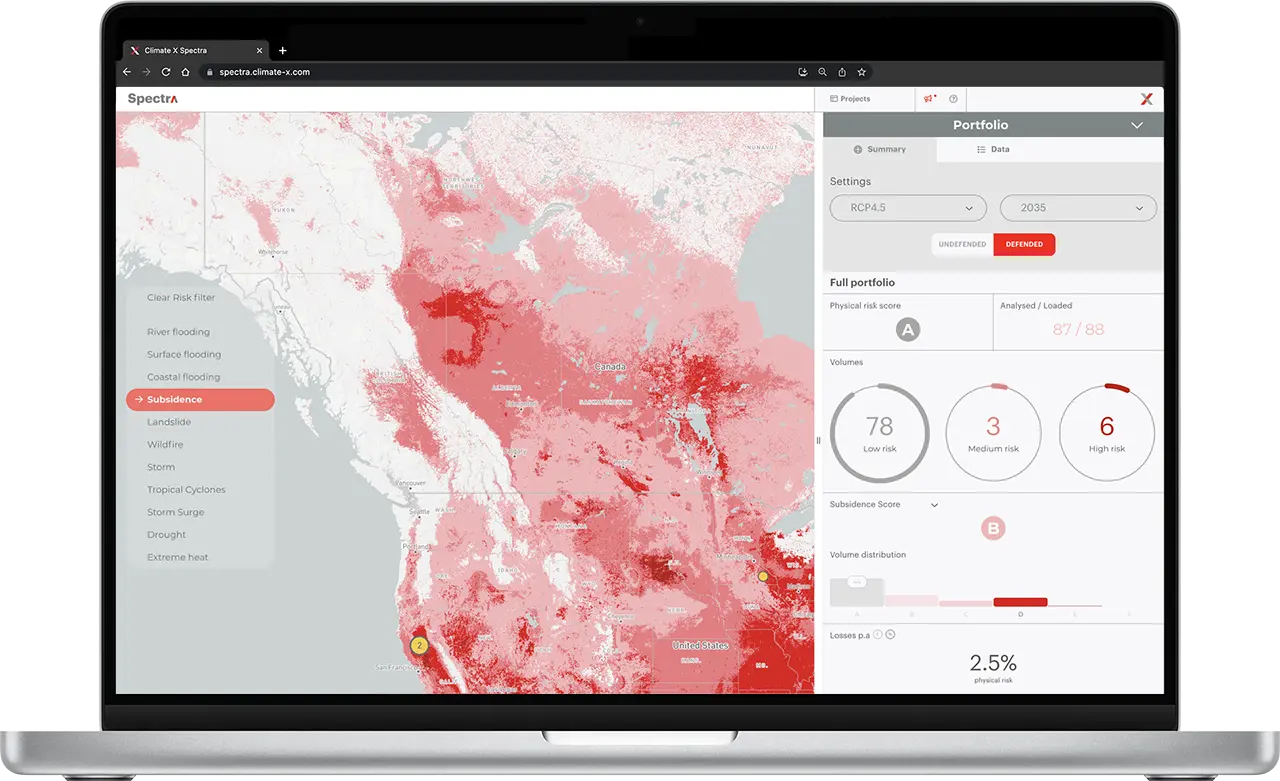

The easiest ways to access our proprietary climate risk data are:

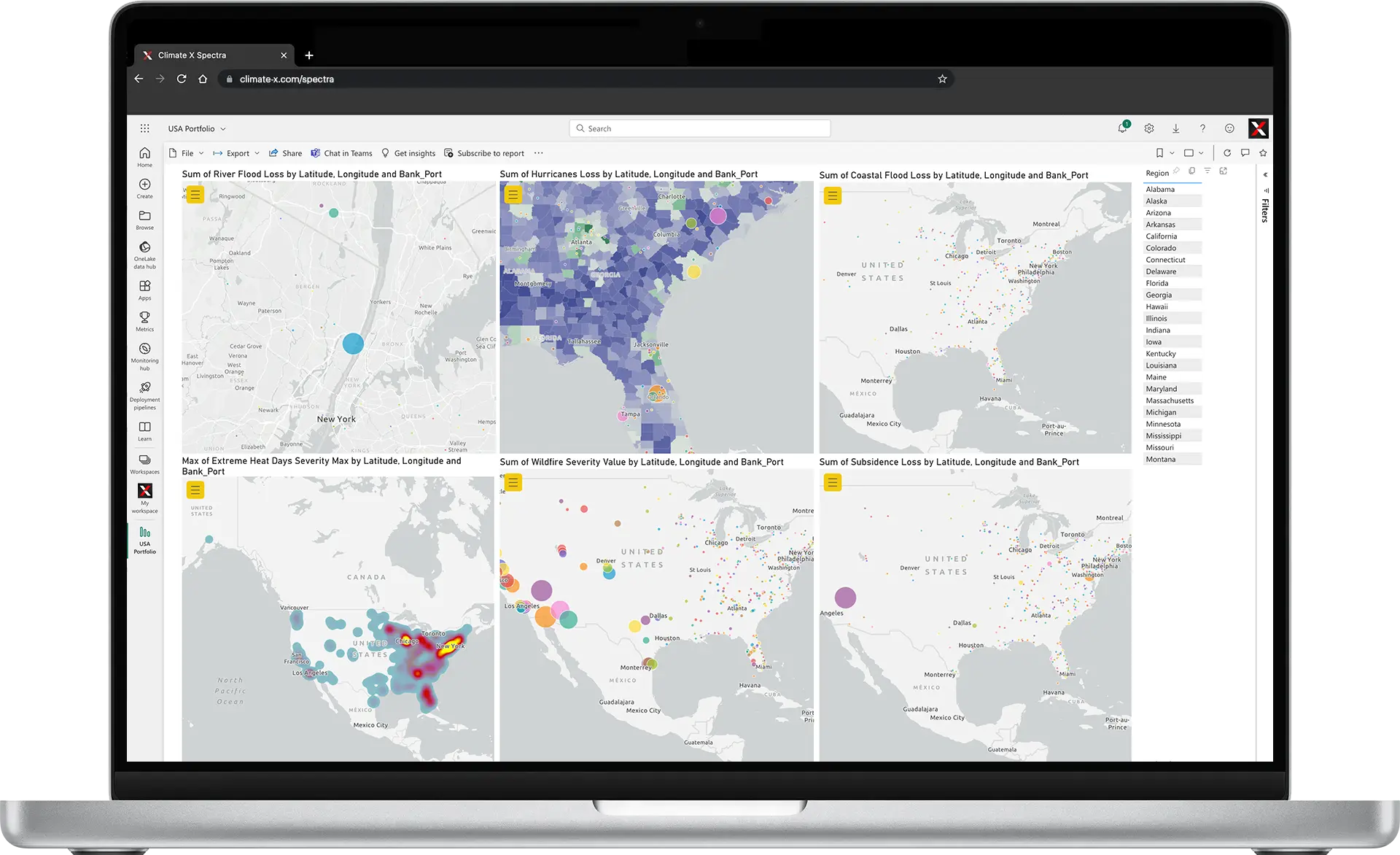

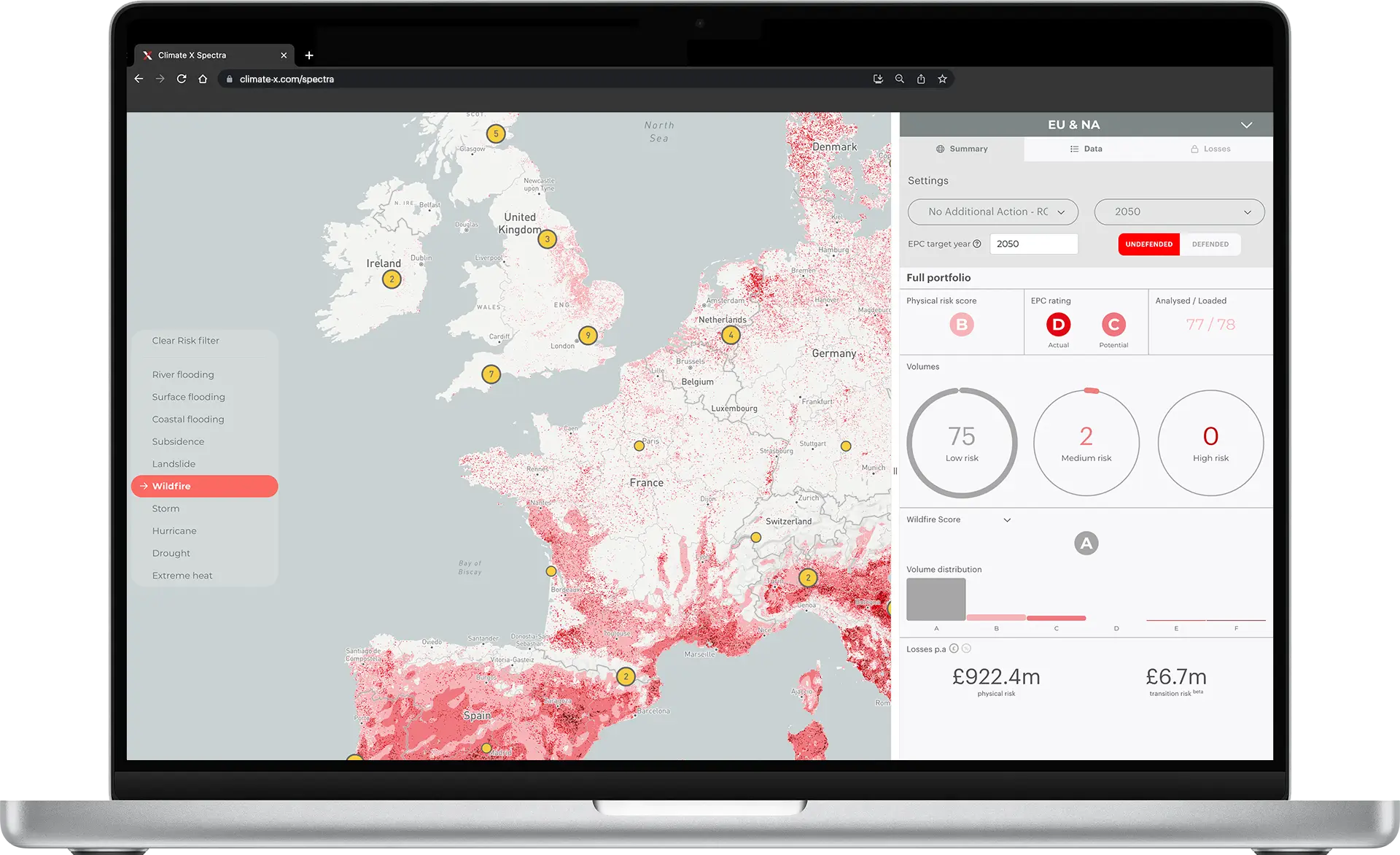

- via our online self-service platform, Spectra.

- via our customisable API to easily integrate data with your existing systems to power dashboards and widgets.

Climate Risk Reporting

Yes. With our data, you'll have a portfolio and asset-level view of climate risk across various asset classes and functions suitable for internal risk reporting. Running a risk report would take you less than five minutes and is entirely self-service.

Climate X and the team driving it

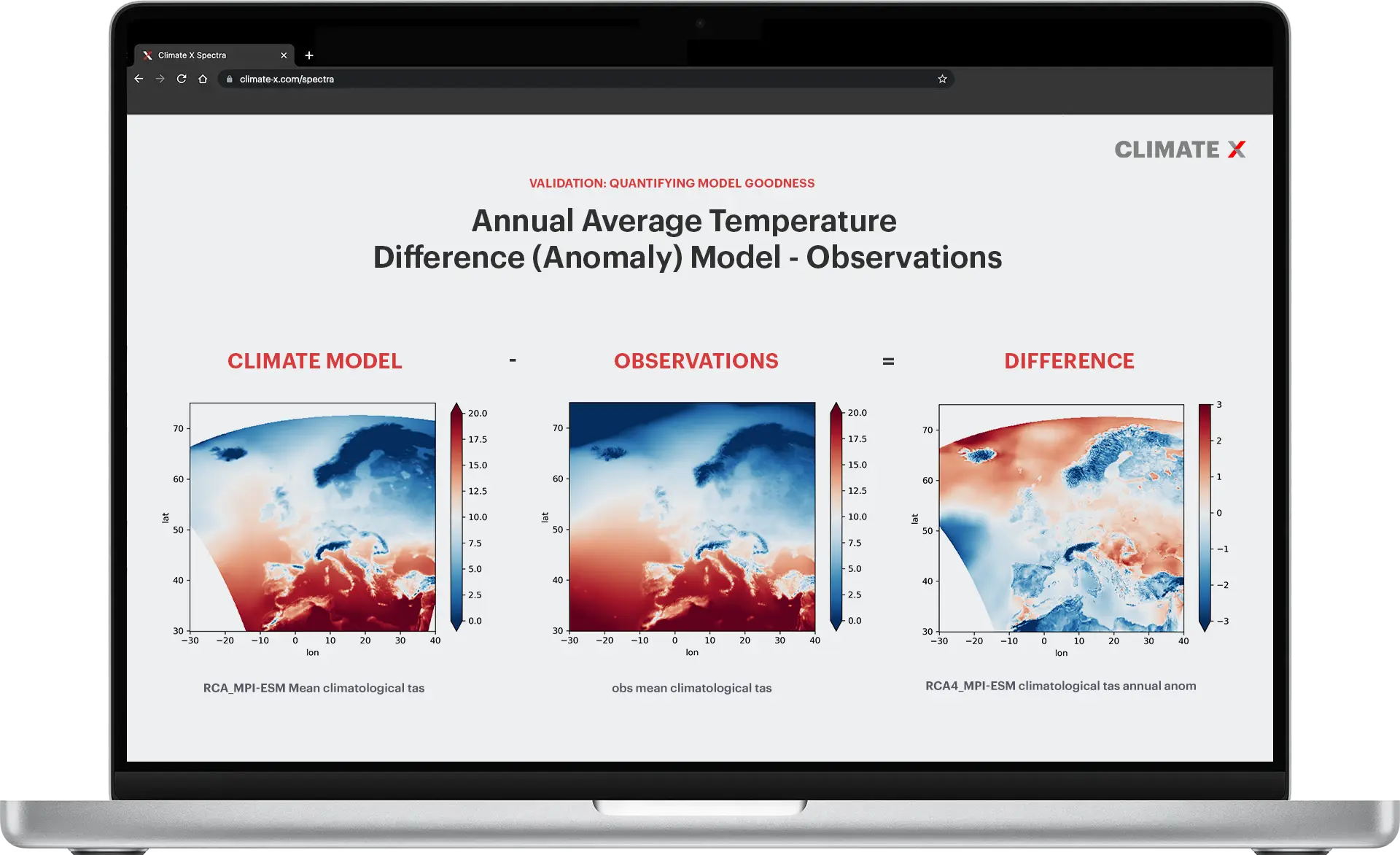

Climate X is a climate risk data and analytics provider that helps organisations become more resilient by quantifying the probability and severity of weather events at an asset level, decades before they happen.

Climate X has developed Spectra, an enterprise-wide solution serving service retail, wholesale, risk, and finance teams in the banking and real estate industry through one platform, and as one provider.

Want to dive straight into Spectra?

Our latest articles

A selection of some of our latest articles covering industry, policy and climate science.