Commercial Real Estate

Assess and quantify climate change-related threats to your real estate portfolio

Climate risk is one of the biggest challenges facing the real estate sector today. While the awareness of climate change has been documented since the 1970s, understanding the physical risks was a challenge - until now.

Confidently identify vulnerabilities by measuring the projected impact of extreme weather events on your entire commercial and residential real estate portfolio. Protect existing and future investments by building climate resilience with our award-winning platform, Spectra.

Climate Risk Data

for Real Estate

Assess climate risks at speed for faster data-driven decisions to map existing and future risks, and model climate-adjusted VaR (cVaR) forecasts.

Assess Physical Risks

Across Asset Portfolios

Undertake portfolio screenings and run due diligence assessments in seconds on individual locations as part of deal originations.

Quantify Asset Costs

& Financial Impacts

Identify existing and projected exposure to key risk types and quantify real-world costs across any asset type, including commercial & residential asset valuation impacts.

Enhanced Regulatory

Compliance

Benefit from advanced physical modelling techniques to align with the latest BoE/ECB/US SEC regulatory frameworks (TCFD, CCREM, GRESB).

Want to dive straight into Spectra?

of physics

data points

of infrastructure

mapped assets

of coastline

perils

Regulatory Compliant

Climate Reporting

If you're a real estate manager or investor, you can now build resilience into your existing & future portfolios by quantifying the impact of climate risk decades in advance - with up to 99% accuracy.

Turn data into actionable insights to make faster, smarter, informed decisions

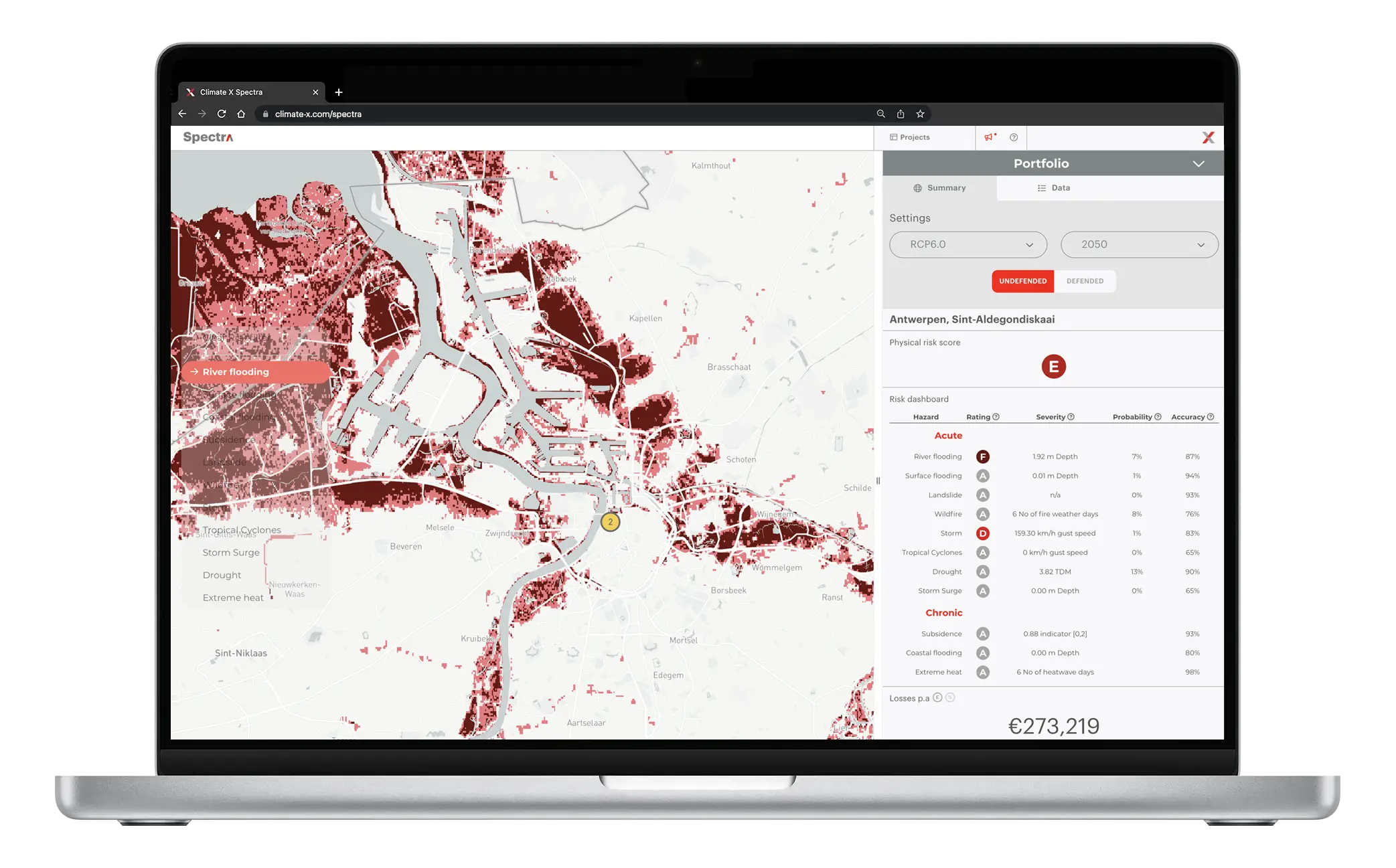

Spectra delivers extensive reporting tailored for the real estate industry in as little as two clicks with our online self-service platform or the ability to plug straight into the digital core via our customisable API to easily integrate data with your existing systems to power dashboards and widgets.

- Built for Annual Reports, GRESB, CRREM, SFDR, EU Taxonomy, Article 8/9, TCFD and other statements.

- Create comprehensive Asset & Portfolio-level Reports in seconds as a PDF.

- Compare climate risk exposures between real estate portfolios to implement robust risk management procedures and make strategic decisions that drive long-term value.

- Compare your investment performance at a regional level.

- Plug-and-play integrations with PowerBI Enterprise, Qlik View, Tableau, etc.

Trillions of data points with global coverage down to as little as 10m

Enhance the protection of your global investment exposures to NGFS-aligned physical risks with our state-of-the-art platform.

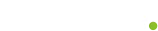

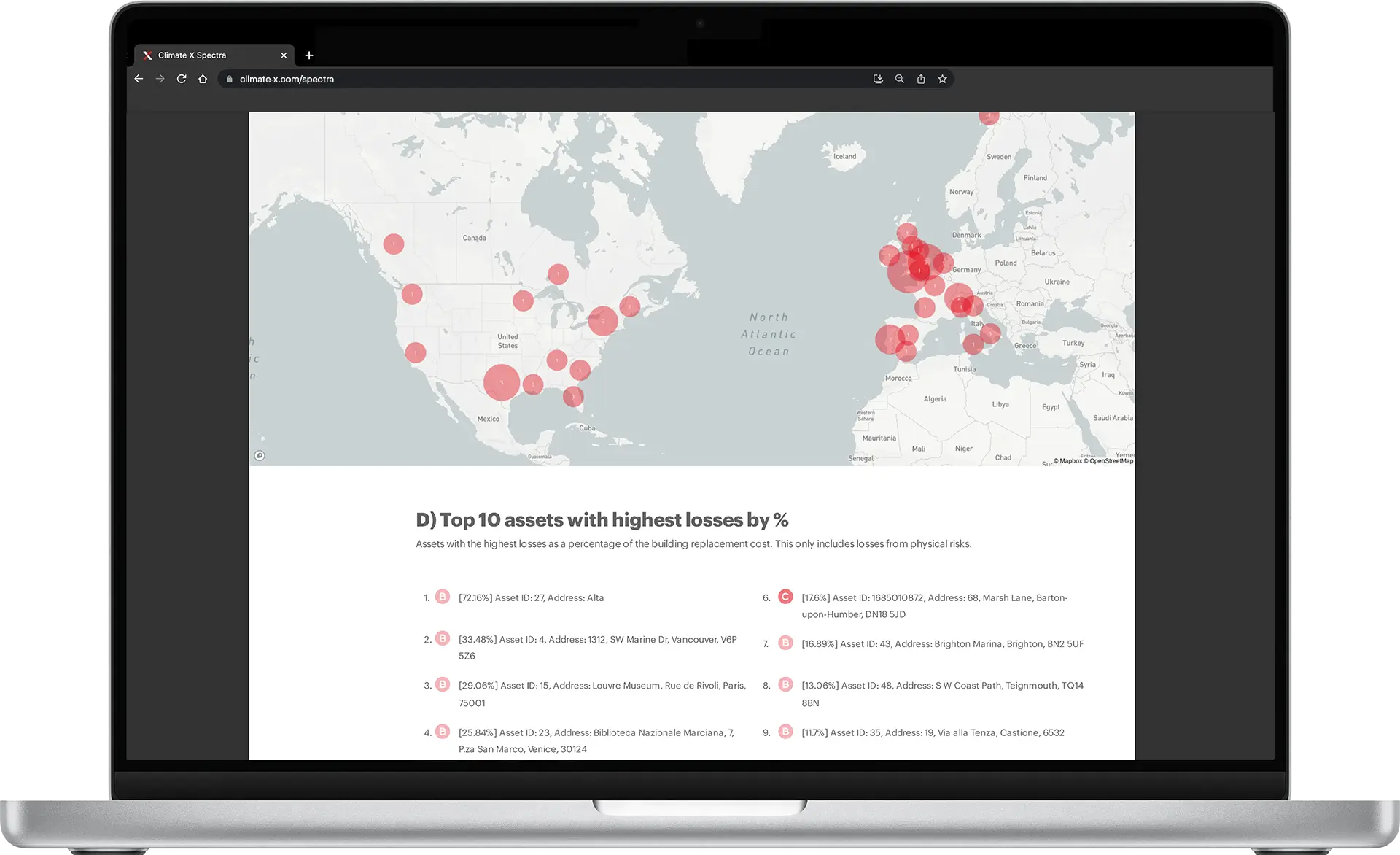

17 Physical Risks: Including river flooding, coastal flooding/sea level rise, surface flooding, subsidence, landslide/coastal erosion, wildfire, heat stress, storms, hurricanes, and drought/water stress.

Multiple RCPs, 80-year span: RCP 2.6, 4.5, 6.0, & 8.5 (EA/LA) + SSPs, in as little as 5-year intervals from 2020-2100.

Output:

- Portfolio physical risk score and risk volume distribution.

- Hazard-specific risk rating, including accuracy (up to 99%), probability and severity.

- Physical risk annual losses in monetary value and percentage.

Quantify financial losses and exposures, all the way to the year 2100

The real estate industry faces substantial transition risks as it strives to align with net-zero targets while being presented with opportunities to generate new sources of value through the climate transition.

Spectra calculates Europe-wide Energy Performance Certificate (EPC) ratings for over 300 million buildings worldwide.

Settings available: Defineable EPC target year for EPC C

Output:

- Physical Damage, combining hazard, exposure and vulnerability, built on industry frameworks.

- Scenario-linked transition costs, including EPC mapping (UK & EU) - even for assets without existing ratings.

- Company-wide risk, factoring decline in labour productivity and infrastructure disruption.

Backed by academia, trusted by industry

Leveraging climate risk data that you can trust is essential - we go beyond mere data aggregation by providing granular and actionable data for climate resilience.

- Built in-house by a value-led, diverse and world-class team of climate scientists.

- Peer-reviewed by industry experts

- Fully validated models

- Detailed and consistent methodology for all hazards/perils.

- Models achieving up to 99% accuracy.

- Detailed and comprehensive documentation & knowledgebase + support framework explaining the science and the data we project.

A future-proofed platform

Governments and Central Banks worldwide are urgently deploying policy, legislation and regulation forcing climate-risk assessments across the global economy.

As the regulatory landscape continues to rapidly evolve to address climate risk, significant reforms are being implemented to ensure that industries are directly aligned with net-zero goals.

We follow the latest developments to make sure you’re always one step ahead, offering granular climate data for effective regulatory compliance and alignment with the evolving landscape:

- TCFD & EU Taxonomy

- NGFS aligned pathways

- GRESB / CRREM / Article 8/9

- Stress testing/scenario analysis requirements.

Reporting

Turn data into actionable insights to make faster, smarter, informed decisions

Spectra delivers extensive reporting tailored for the real estate industry in as little as two clicks with our online self-service platform or the ability to plug straight into the digital core via our customisable API to easily integrate data with your existing systems to power dashboards and widgets.

- Perfect for Annual Reports, GRESB, CRREM, SFDR, EU Taxonomy, Article 8/9, TCFD and other statements.

- Create comprehensive Asset & Portfolio-level Reports in seconds as a PDF.

- Compare climate risk exposures between real estate portfolios to implement robust risk management procedures and make strategic decisions that drive long-term value.

- Compare your investment performance at a regional level.

- Plug and play integrations with PowerBI Enterprise, Qlik View, Tableau, etc.

Physical Risks

Trillions of data points with global coverage down to as little as 10m

Enhance the protection of your global investment exposures to NGFS-aligned physical risks with our state-of-the-art platform.

17 Physical Risks including: river flooding, coastal flooding/sea level rise, surface flooding, subsidence, landslide/coastal erosion, wildfire, heat stress, storms, hurricanes, and drought/water stress.

Multiple RCPs, 80-year span: RCP 2.6, 4.5, 6.0, & 8.5 (EA/LA) + SSPs, in as little as 5 year intervals from 2020-2100.

Output:

- Portfolio physical risk score and risk volume distribution

- Hazard-specific risk rating including accuracy (up to 99%), probability and severity

- Physical risk annual losses in monetary value and percentage

Transitional Risks

Quantify financial losses and exposures, all the way to the year 2100

The real estate industry faces substantial transition risks as it strives to align with net-zero targets while being presented with opportunities to generate new sources of value through the climate transition.

Spectra calculates Energy Performance Certificate (EPC) ratings for over 300 million buildings worldwide.

Settings available: EPC target year for EPC C.

Output:

- Physical Damage, combining hazard, exposure and vulnerability, built on industry frameworks.

- Scenario-linked transition costs, including EPC mapping -even for assets without existing ratings.

- Company-wide risk, factoring decline in labour productivity and infrastructure disruption.

Quality of Data

Backed by academia, trusted by industry

Leveraging climate risk data, you can trust is essential - we go beyond mere data aggregation by providing granular and actionable data for climate resilience.

- Built in-house by a value-led, diverse and world-class team of climate scientists.

- Peer-reviewed by industry experts.

- Fully validated models.

- Detailed and consistent methodology for all hazards/perils.

- Models achieving up to 99% accuracy.

- Detailed and comprehensive documentation & knowledgebase + support .framework explaining the science and the data we project.

Regulatory Compliance

A future-proofed platform

Governments and Central Banks worldwide are urgently deploying policy, legislation and regulation forcing climate-risk assessments across the global economy.

As the regulatory landscape continues to rapidly evolve to address climate risk, significant reforms are being implemented to ensure that industries are directly aligned with net-zero goals.

We follow the latest developments to make sure you’re always one step ahead, offering granular climate data for effective regulatory compliance and alignment with the evolving landscape:

- TCFD & EU Taxonomy

- NGFS aligned pathways

- GRESB / CRREM / Article 8/9

- Stress testing/scenario analysis requirements.

Our latest articles

A selection of some of our latest articles covering industry, policy and climate science.