TL;DR

- Despite a strong GDP contribution in 2022, France's real estate market declined 14.1% due to rising interest rates, stricter credit conditions, and new regulatory requirements.

- Climate change poses significant regional risks, affecting property values and market stability.

- French real estate must adapt by incorporating climate data and adhering to new regulations like coastal erosion risk disclosure to navigate future environmental and thrive.

The highest GDP output of 10.8% in 2022 was the real estate industry. Yet, the French real estate market has fallen by 14.1% since the first half of 2022.

The intense and rapid increase in interest rates explains the market reversal. Across France, interest rates have risen from 1.5% to 3% in one year. In turn, the National Real Estate Federation (Fnaim) has noted a sharp slowdown in transactions expecting a 5% drop in the average price of house prices.

Banks have tightened their criteria for granting credit, and constraints to sellers (namely energy audit and Energy Performance Diagnosis obligations) have made it more difficult, which has limited the number of potential buyers in the real estate market.

Among the current requirements is a down payment of around 20% of the purchase price, a significant barrier for first-time buyers. Furthermore, building permits for new construction for housing have dropped by 26.7%.

The price of new constructions has also soared: for an equivalent area, the price of a house in Talmont-Saint-Hilaire, in Vendée, for example, has jumped from €135,000 to €165,000 in one year. Buildings are subject to inflation due to the soaring cost of materials, expenses, and regulatory constraints to be topped off with extreme increases in energy costs. According to the French building federation, 100,000 jobs will be threatened by the end of 2024.

Coinciding with the implications of climate change on France, the risks geographically differ significantly depending on their exposure to specific risks such as rising sea levels, increasing temperatures, and heightened drought. Specifically, France's north-western and western coasts will face the forefront of sea level rise (coastal flooding), while the south, east, and major cities will be more susceptible to temperature increases.

The city of Lyon represents a clear case study of the French real estate industry's vulnerability to how climate change presents a significant threat to the industry - including mortgage lenders, insurers, bank portfolios and the broader financial system.

In a city that expects its population to grow with 300,000 new inhabitants by 2030, its urbanisation will continue to accelerate. On top of this growth, Lyon’s real estate industry has been pressured by prices falling by 3.3% since the beginning of 2023.

Furthermore, new home costs have increased by 6% on average, to €5,580 in the Lyon metropolitan area, between March 2022 and 2023. For a city that sits upon the intersection of the Rhone and Saone rivers in Eastern France, Lyon is highly vulnerable to the symptoms of climate change, including droughts, flooding and heatwaves that much like the rest of France, could worsen over the already vulnerable sector.

The real estate industry faces challenges, including climate risks and providing housing, business premises and public facilities in a rising population. How prepared is the industry for climate risk?

Blazing France

Climate projections indicate that temperatures in France will continue to rise throughout the 21st century, with an expected average increase between 0.6°C and 1.3°C.

France faces more frequent and intense climate hazards, including heatwaves that correspond for longer periods over consecutive days, multiplying by 8 over the past 35 years. Since 1947, there have been 46 heatwaves, but 22 of them have occurred since 2010, with the last official heatwave taking place in August 2023. This frequency is expected to double by 2050.

For the real estate industry, increasing temperatures induce deep concerns about wildfires and building materials' impact on industry players.

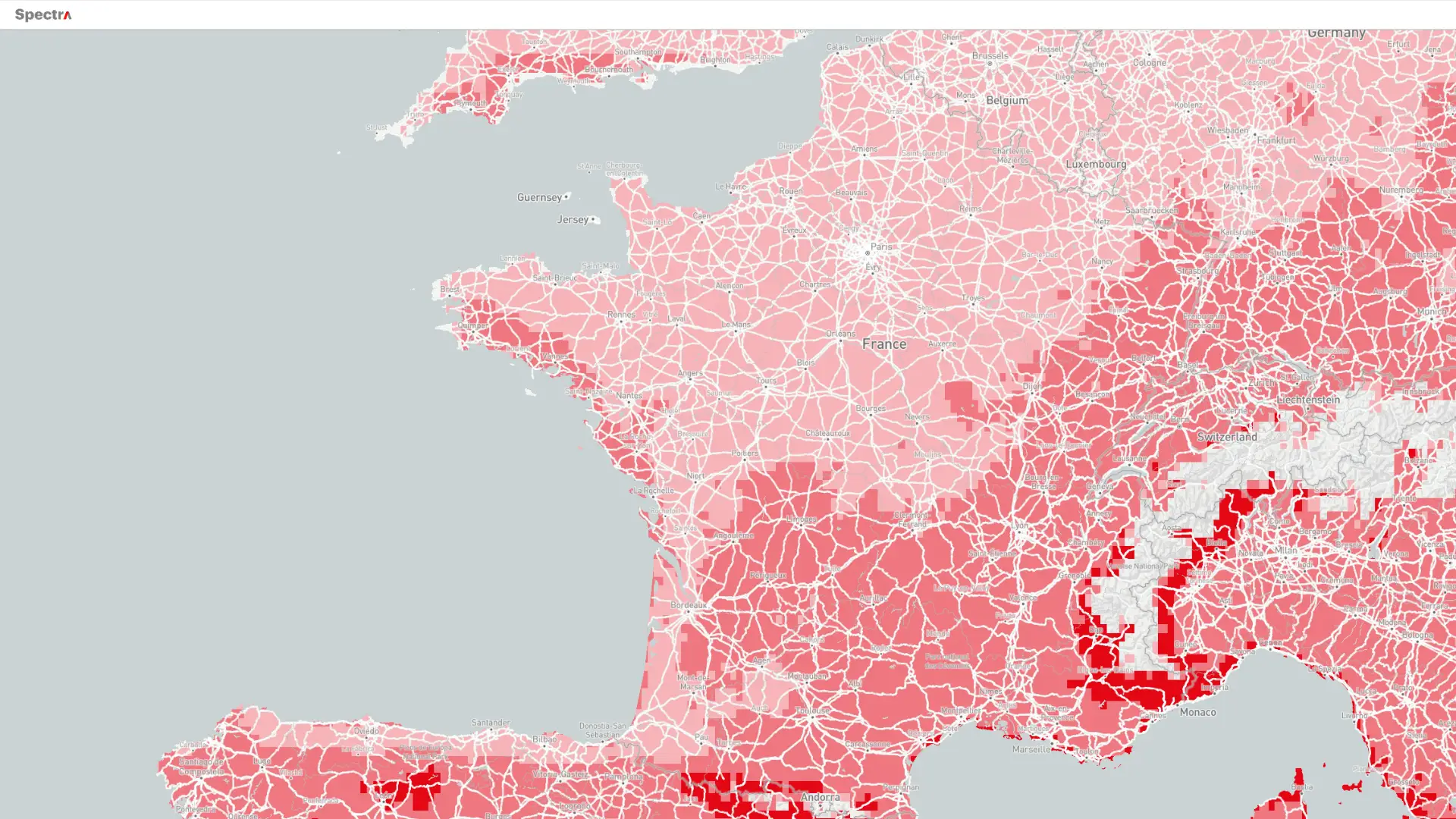

Covéa reported that France's drought-related claims are expected to increase by more than 60% by 2050. The risk of drought, which for the built environment takes the form of the insurance risk of shrinking and swelling clays, is a phenomenon that weakens the soil on which buildings are built when this soil experiences episodes of drought.

This phenomenon, linked to variations in the soil volume, leads to differential settling, causing damage to buildings. Since 2016, the recurrence of intense drought episodes and the damage caused has increased. Between 1989 and 2020, the costs related to the effects of drought amounted to almost €15.2 billion.

Torrential Trials

The constantly rising sea levels along France's extensive 5,500 km coastline are increasingly posing challenges for coastal residents. Adrien Privat, an official at the French coast protection agency Conservatoire du Littoral, warns that approximately 50,000 residences will likely need to be relocated by the end of the century.

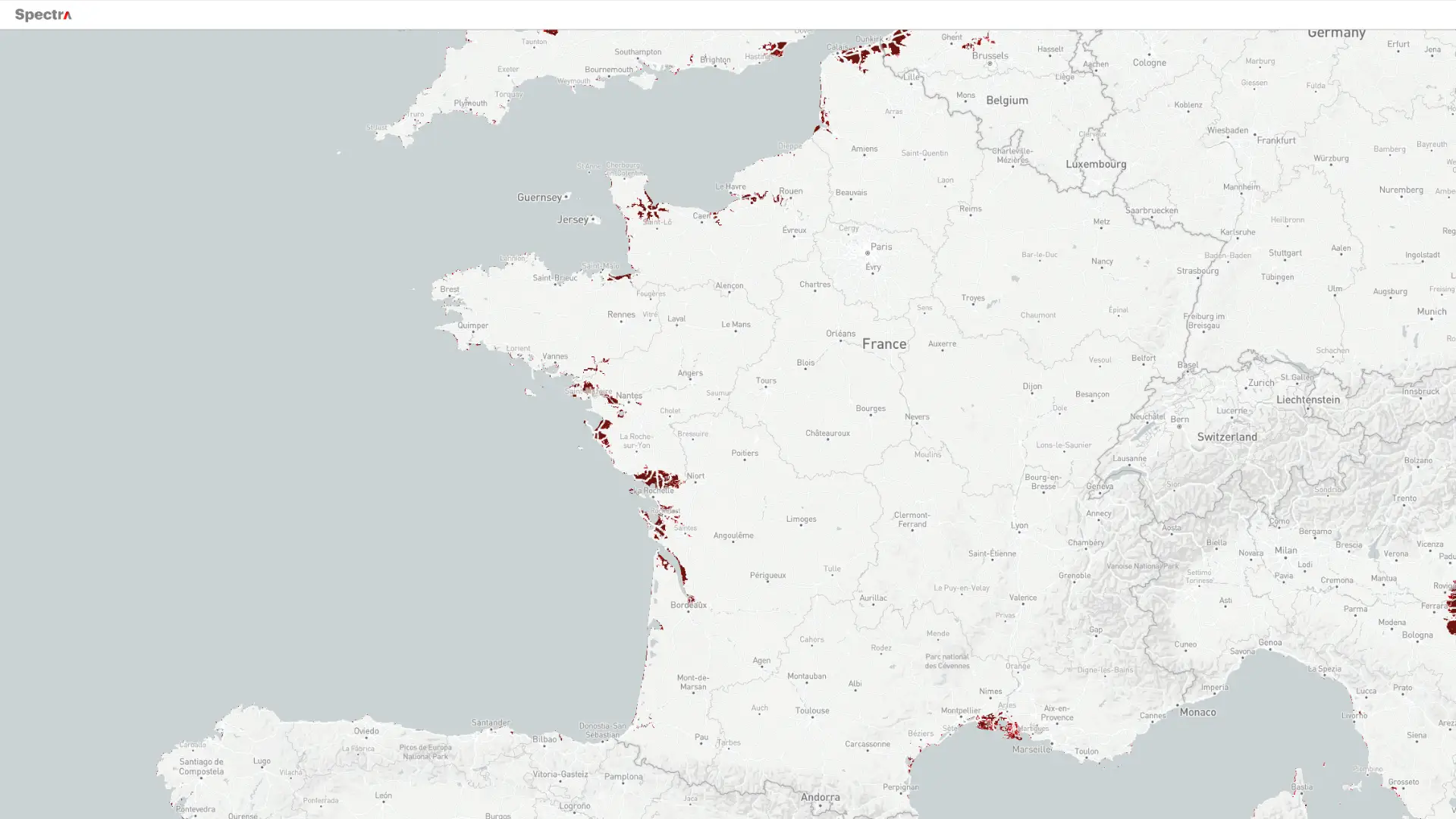

The entire French coastline is under threat, particularly sandy coastlines as opposed to rocky ones. Between 2016 and 2021, around 15,000 real estate transactions involved properties that are expected to become prone to flooding before 2050.

The total value of these properties at the time of purchase was estimated at €5 billion, without factoring in the exposure to climate risks. Notably, areas such as the mouth of the Seine and the Atlantic coast are the most vulnerable, including cities like Le Havre, where the value of at-risk properties by 2050 could exceed €1 billion, along with Bordeaux, Deauville, and Caen.

This situation poses a significant challenge for France, as the combined factors of population growth and rising sea levels are projected to increase the population residing in the coastal 1/100-year flood zone from 1.6 million in 2000 to 2.33 million by 2060.

Remarkably, France currently lacks a national standard for flood protection levels. Levees in the country typically safeguard agricultural areas against events that occur once every 5 to 10 years, while populated areas are protected against events that happen once every 20 to 100 years.

Although the state is legally responsible for implementing a flood risk management strategy in compliance with the EU Floods Directive, the task of information gathering and practical execution of the L-RPP (Local Flood Risk Prevention Plan) is frequently delegated to local authorities and stakeholders who operate with limited budgets.

One significant consequence that property owners will face is the implementation of a new law regarding the information on coastal erosion risks.

This law mandates that tenants and purchasers must be informed about the risks of coastal erosion within a century as soon as the property advertisement is published.

Additionally, property owners will need to make financial provisions for the costs of destruction and restoration. In turn, this complicates the real estate market within coastal regions of France.

This law, part of the Climate Law, aims to enhance buyers' and tenants' understanding of the risks associated with the properties they are interested in, considering the anticipated developments resulting from climate change.

Consequently, there is a genuine risk for recently acquired properties that were purchased without knowledge of the risks they face. Once these risks become known, the affected properties may experience a decline in value within the real estate market.

It is crucial for all players in the real estate industry and their clients to understand and account for their own risks and those to the company’s assets within their risk management practices.

For Bpifrance, the issue of the climate is existential. We need to go door-to-door to convince people to act and deploy action plans for all our customers."

Nicolas Dufourcq, CEO of Bpifrance.

Thus, access to granular climate data is a substantial step towards understanding climate risks to meet new laws and compliance at localised levels across France.

Existing Coverage

Unlike many insurance markets, France's CATastrophes NATurelles (CatNat) system has covered subsidence-related building losses since 1989 as a standard policy feature.

After a period of moderate losses with occasional spikes, subsidence claims have surged since 2016, with inflation-adjusted annual losses consistently exceeding €600 million. The average annual loss during this time was €840 million, approximately 50% of the total CatNat premiums collected.

As climate change intensifies, the demand for CatNat coverage is expected to rise significantly. Awareness among municipalities and individual policyholders about recovering subsidence losses is also growing.

Notably, 62% of French municipalities have not sought a CatNat declaration for subsidence since 2003 (grey area below), resulting in no compensation for policyholders in these areas despite potential eligibility.

Moreover, the French government is currently discussing a reform of the CatNat scheme.

Coverage of rehousing costs, an extension of the damage reporting period for policyholders from 18 to 24 months, and appointing local representatives to assist communities in the CatNat declaration process are foreseen as part of the reform.

Subsidence victims will be better informed, and assuming climatic conditions remain equally dry, losses might substantially exacerbate in the coming years. Mitigation by replacing or strengthening weak buildings alone can hardly compensate for increasing claim costs in the mid-term, as only 1% of the building stock is renewed each year.

Fundamentally, the CatNat scheme must increase transparency, especially in how affected municipalities disclose information. Without this improvement, as climate hazards escalate, there will be a need to revise insurance terms and pricing. This adjustment is crucial to prevent unsustainable pressure on the NatCat scheme.

Access to the Right Data

The French real estate industry faces challenges and risks, including financial downturns and climate change impacts. The market has experienced a decline due to increased interest rates and more stringent credit criteria, affecting transactions and property prices.

Climate risks, such as rising sea levels, droughts, and increasing temperatures further compound these challenges by reducing property values, damaging assets and shifting customers' preferences.

Climate data plays a crucial role in understanding and mitigating these risks.

Granular climate information enables industry players to assess the vulnerability of properties and make informed decisions for industry players. Implementing new laws on coastal erosion risks highlights the importance of providing buyers and tenants with climate-related information, as ignoring these risks can lead to substantial property devaluation.

Furthermore, access to climate data is essential for the real estate industry to comply with regulations, assess property values accurately, and develop appropriate risk management strategies.

Thus, the real estate industry must prioritise the acquisition and utilisation of climate data to effectively navigate the challenges posed by climate change, safeguard investments, and ensure the long-term resilience of the sector.

Assessing Climate Risks and Mitigating with Adaptation

Banks and real estate firms such as Standard Chartered, CBRE, and Virgin Money leverage our unique climate risk workflow solution, integrating Spectra’s physical risk assessments to identify risks and utilizing Adapt to uncover high-ROI adaptation measures and CapEx opportunities for mitigation planning.

Learn more today to start building resilience in your business.

Sources

- Bpi France (2023) Bpifrance, banque du climat.

- Covea (2022) Covea White Paper.

- Euronews (2023) In pictures: France demolishes beach apartments and relocates residents due to rising sea levels.

- EY (2023) Panorama de l’immobilier et de la ville – 7ème édition – 2023.

- France Info (2023) La baisse des prix de l'immobilier s'accélère à Lyon.

- International Water Association (2023) Building a Sustainable Future.

- La Tribune (2023) Immobilier: les prix vont chuter de 5% en 2023, un « choc brutal », selon la Fnaim.

- Le Monde (2023) Le marché immobilier tourne au ralenti, les prix commencent à baisser en France.

- Magnolia (2023) Crise de l’immobilier 2023: les chiffres choc.

- MeteoFrance (2023) Le climat futur en France.

- MeteoFrance (2023) Vagues de chaleur et changement climatique.

- PAP (2023) Où les prix immobiliers vont-ils baisser en 2023?

- The PLOS ONE Staff (2015) Correction: Future Coastal Population Growth and Exposure to Sea-Level Rise and Coastal Flooding - A Global Assessment. PLOS ONE 10(6): e0131375.

- Priest, S. J., C. Suykens, H. F. M. W. Van Rijswick, T. Schellenberger, S. B. Goytia, Z. W. Kundzewicz, W. J. Van Doorn-Hoekveld, J.-C. Beyers, and S. Homewood. (2016) The European Union approach to flood risk management and improving societal resilience: lessons from the implementation of the Floods Directive in six European countries. Ecology and Society 21(4):50.

- SwissRe (2023) Natural catastrophes in 2020: secondary perils in the spotlight, but don’t forget primary-peril risks.

- TFI Info (2023) Ventes de maison neuves: pourquoi la demande s'effondre en France.