The European Central Bank's Approach to Climate Risk Management

Understanding the ECB Climate Risk policy, requirements and best practices.

Climate and environmental risks are prompting central banks to require their integration into financial institutions' risk management strategies for financial stability.

The European Central Bank is at the forefront of this movement, emphasizing the importance of understanding climate risk policy for compliance and risk professionals in the banking industry.

The ECB has developed specific climate risk guidelines and disclosure requirements. These guidelines are part of the broader ECB climate risk management strategy, ensuring that climate risk in the banking sector is adequately addressed and integrated into banks' risk management frameworks.

Download our free whitepaper to dive deep into ECB climate & environmental risks guidelines or keep reading below for an overview of main challenges and solutions.

Realising the urgency: Why delaying Climate Risk compliance can impact your bottom line

The warming planet has emerged as a key risk to global financial institutes, due to the increased frequency & severity of extreme weather events as well as shifting societal norms and transitioning to a low-carbon economy.

These are respectively referred as physical risks and transition risks.

To safeguard the stability of the financial system, the European Central Bank (ECB) has set climate risk guidance to help banks and financial institutions assess the risks climate change poses to their business.

Credit, market, and operational risks, along with collateral valuation and concentration risk, can all be exacerbated by climate change, heightening the inherent risks in the banking business.

Emerging Obstacles in Climate Risk Compliance

Financial institutions are making efforts to rise up to the challenge, led by Risk, Compliance and ESG teams.

However, because climate risk is a new domain, there's a general lack of clear benchmarks or examples of best practices. Plus, climate science is highly technical and complex, requiring specialised resources that may not be readily available in your organisation.

The urgency of compliance and budget constraints compound these challenges, making the management of climate risks especially daunting for banking professionals in the industry.

Overcoming these challenges with the right solution

Analysing climate risks requires a combination of tools, services and processes to translate scientific climate evidence into the language of financial risk management.

As per ECB's 2020 guidelines, these metrics should then be integrated into your business strategy and risk management, hence enabling full regulatory compliance.

Most institutes work with outside providers to obtain skills, information and outputs required to meet regulatory expectations, climate risk management expectations and climate stress/scenario tests.

Choosing the Right Climate Risk Assessment Tool

To overcome physical climate risks, seek a Climate Risk Assessment tool that provides:

High-quality Data:

- Comprehensive risk ratings supported by metrics such as severity and probability, ideally also including financial impacts.

- Granular resolution depending on the hazard.

- Transparent methodology you can access and review.

Time Horizons, Hazard and Geographical Coverage:

- Short, medium and long-term horizons.

- A range of climate scenarios (RCPs/SSPs) to leverage in your stress tests.

- A wide range of hazards available and physically modelled where possible.

Disclosure-useful elements, such as:

- Portfolio and/or asset overview to use and share enterprise-wide.

- Possibility to integrate with existing frameworks.

- Regional benchmarking.

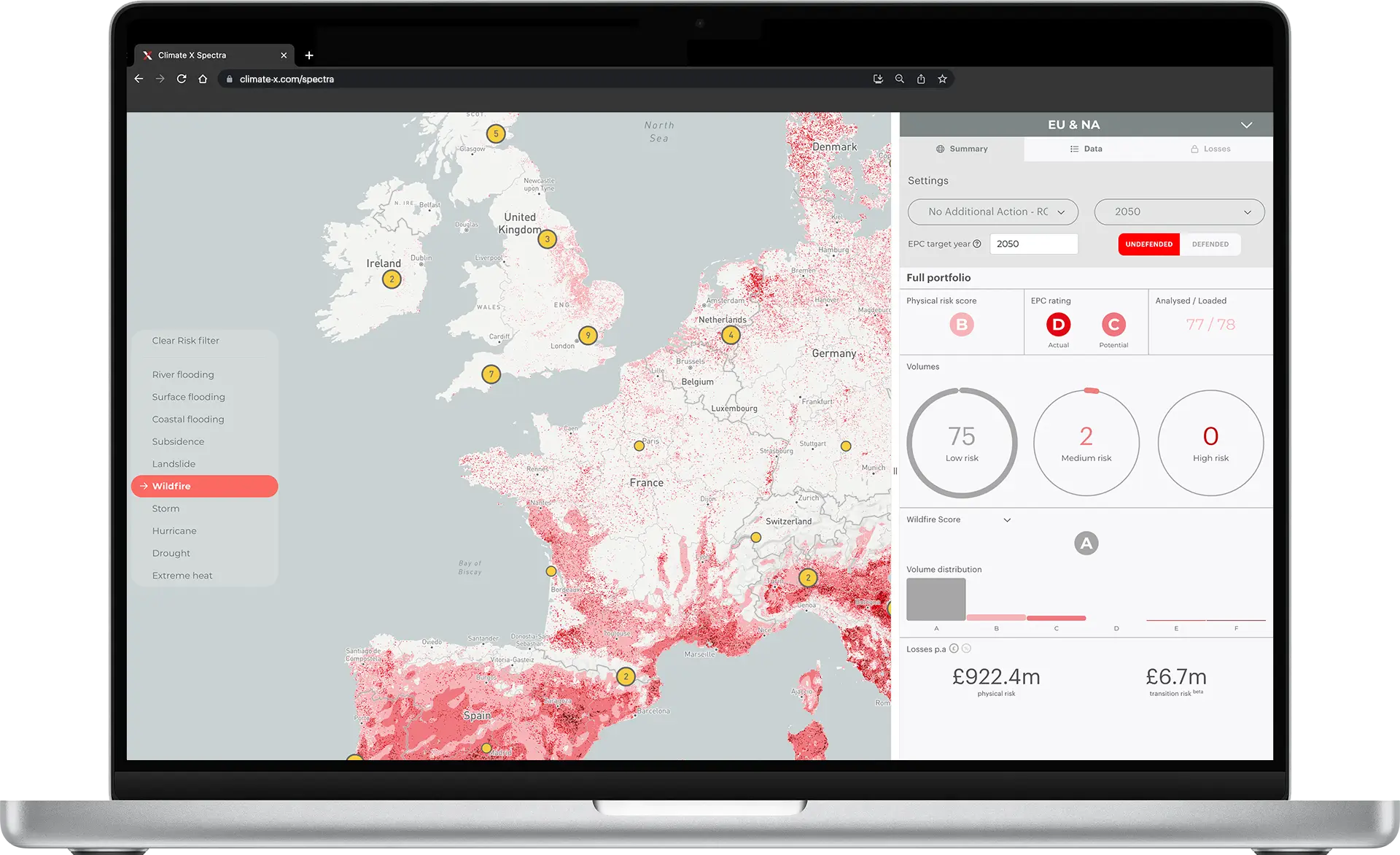

Spectra, an enterprise-wide Physical Climate Risk SaaS Platform

Spectra is the only fully integrated physical risk software solution, delivering asset-level reports, risk ratings and financial loss data for over 1.5 billion assets worldwide in as little as three clicks.

Developed in-house by a team of PhD-holding climate scientists, Spectra provides physical risk data that supports your risk assessment, stress testing and reporting. Our data enables effective integration of physical risks into your risk management & business strategy, aiding with regulatory compliance.

Our expert team boasts decades of experience in the financial sector, covering risk management, regulatory change and stress testing. If you're looking for a climate risk data provider to support you in your climate risk journey, speak to us.

Frequently Asked Questions

ECB Climate Risk Policy

The European Central Bank Guide on climate-related and environmental risks outlines how the ECB expects its supervised banks to manage and disclose C&E (climate-related and environmental) risks under current prudential rules.

The guide aims to enhance banks' awareness of and preparedness for managing climate-related and environmental risks.

It outlines 13 key supervisory expectations, covering:

- The impact of climate-related and environmental risks on the business environment (1) and its implementation into business strategy (2,3) and risk appetite framework (4).

- Governance (5) and internal reporting (6).

- Integration of C&E into existing risk management (7), including credit risk (8), business continuity, reputational and/or liability risks (9) and market risk (10).

- Stress Testing (11).

- Liquidity risk and buffer calibration (12).

- External Reporting and Regulatory Disclosure (13).

Each primary expectation is accompanied by detailed sub-expectations designed to delineate the requirements and assist supervised banks in fully understanding their responsibilities.

Additional Resources

Download our free Whitepapers

European Central Bank: Supervisory Review and Evaluation Process

Banks have to end of 2024 to comply with ECB the expectations. Those that fail to do so are subject to enforcement measures, including daily fines of up to 5% of average daily revenue.

The ECB’s primary method for evaluating banks’ compliance is the supervisory review and evaluation process (SREP) – the supervisor’s annual “health check” of entities within its jurisdiction.

From Data to Strategy: Embracing IFRS S2 Across Banking Functions

A comprehensive guide to integrating ISSB reporting in your financial institution.

Get actionable steps, key roles for implementation and insights into how ISSB aligns with other regional regulatory alignment - such as CSRD.

Perfect for CROs, CFOs, Sustainability and Compliance Officers and banking professionals in global banks.

Operations Manual: Climate Risk for Banking

Perfect for Risk, Compliance and ESG Analysts approaching climate physical and transition risks + Directors looking for a comprehensive overview of regulatory requirements by different institutions.

Operations Manual: Climate Risk for Real Estate / Asset Managers

Perfect to understand how climate risk affects asset valuation, Climate Value at Risk, as well as ISSB/TCFD regulations.

Get an overview of how to identify, assess and manage the financial risks associated with climate change.

Created for professionals in the US, EU, UK, Germany and France in the real estate/asset management industry.

Our Articles

Thought leadership from industry leaders.