The housing market is experiencing instability, with households feeling the impact of the banking crisis. However, in addition to these challenges, the increasing effects of climate change demand that potential homebuyers consider more than just affordability when making property investments.

While factors such as price, location, and amenities have traditionally been prioritised by homebuyers, overlooking climate risks can lead to devastating consequences in the long run. Real estate companies must educate prospective buyers about the potential climate threats a property may face, urging them to incorporate resilience and sustainability into their decision-making process, as well as understanding the evolving purchasing patterns of consumers.

Real estate companies play a vital role in raising awareness about climate risks, promoting sustainable and resilient housing options, and expanding their knowledge of changing consumer preferences regarding climate risks. But how can homebuyers effectively address the climate factor beyond affordability?

The Flip

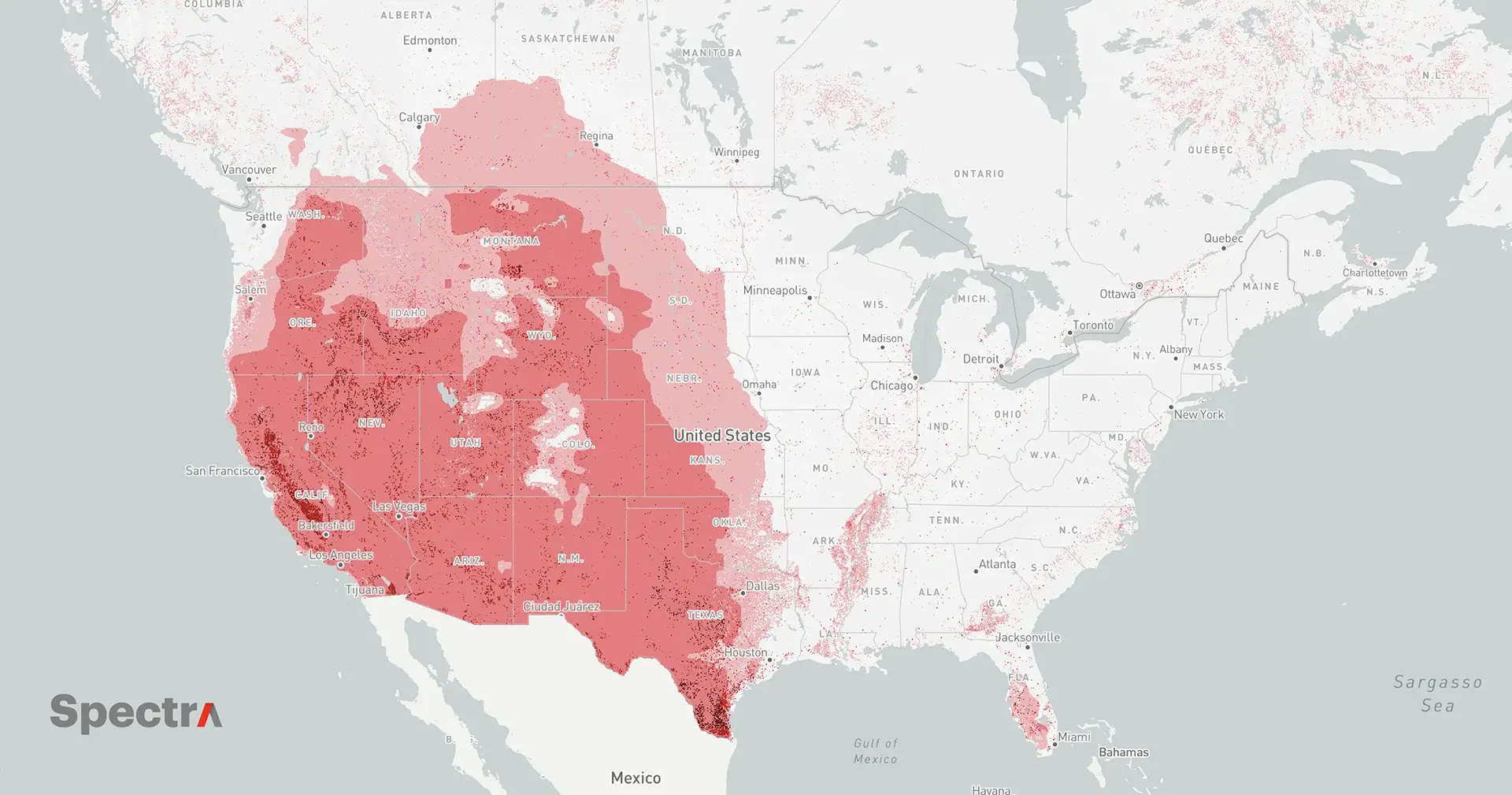

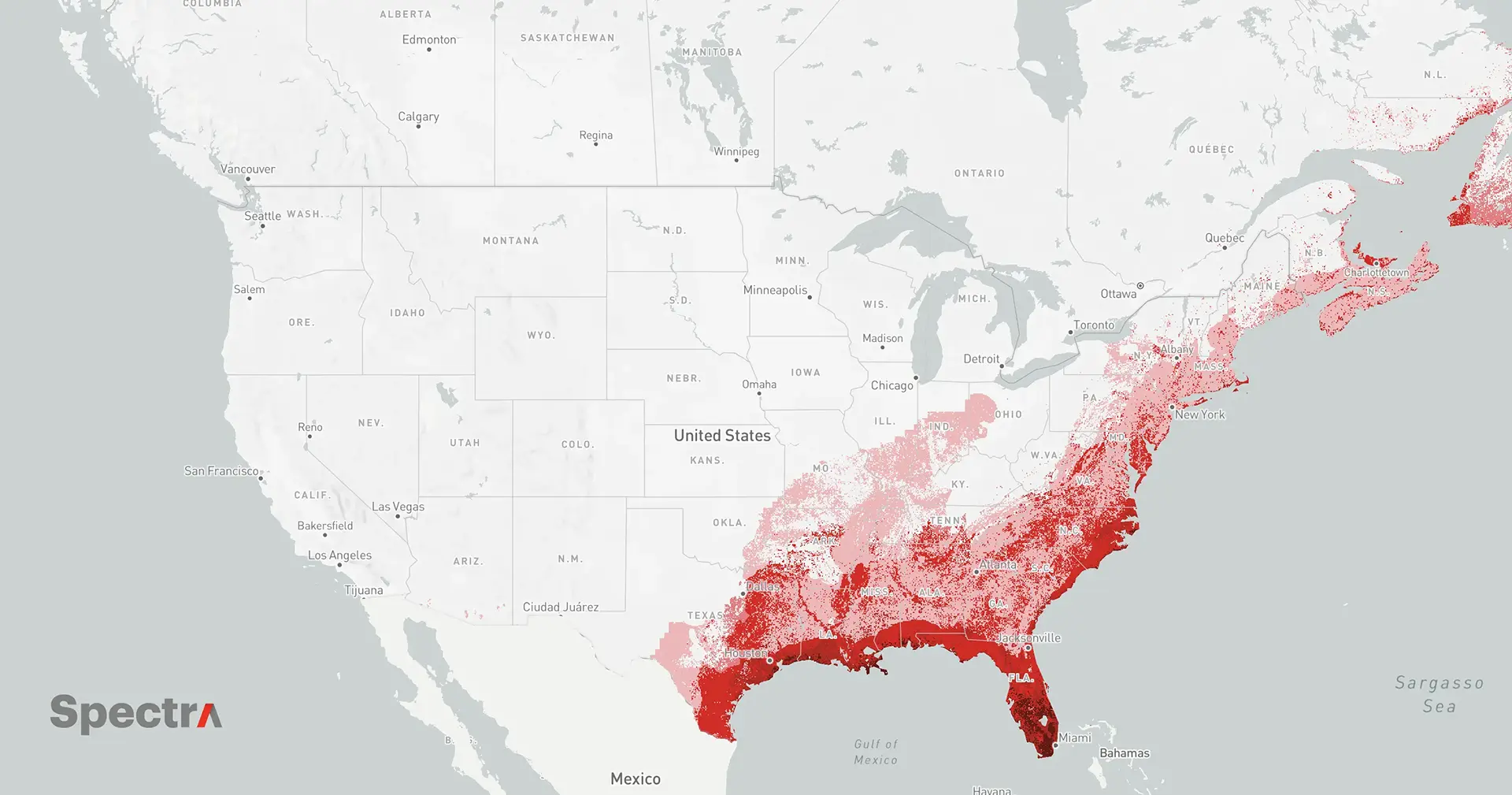

The surge in extreme physical climate hazards, such as hurricanes, floods, wildfires, and droughts, substantially threaten properties in vulnerable areas worldwide.

For instance, coastal regions face the danger of rising sea levels and intensified storm surges, which can have devastating consequences for homeowners. However, inland regions are not exempt, as they are susceptible to wildfires, floods, and droughts. Thus, purchasing property in high-risk areas for severe weather carries potentially significant financial implications for homeowners, extending beyond mere repair costs.

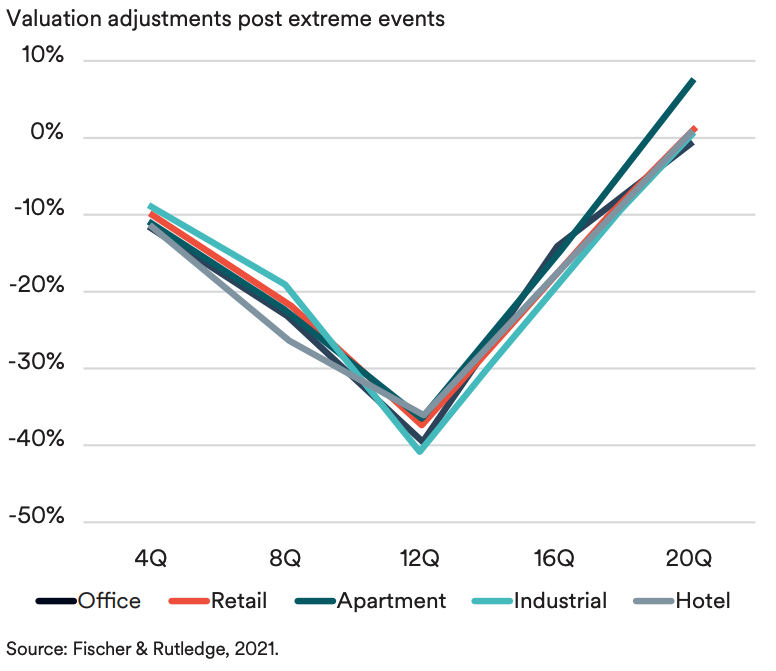

The real estate market provides indicators, which can sometimes be conflicting, regarding price movement. Property values tend to decrease following climate-related events, although such declines may be short-lived, Figure 2. But, properties affected by recurrent severe storms or wildfire events show a slower recovery in value, indicating that with the increased frequency and severity of such disruptive events, permanent or sustained declines in value are likely.

It is crucial to ascertain whether a property or location is already known to be at risk, as a more significant deviation in valuation can be observed when the risk has yet to be previously considered.

Homeowners' insurance is critical in safeguarding investments. Yet, traditional insurance models may not adequately address the damages caused by climate-related events.

Current insurance premiums are typically based on historical data for climate risks, which can result in severe underpricing of risk and inflated property valuations in areas prone to climate impacts that are expected to increase in quantity and severity. Moreover, insurance companies charge higher rates in locations vulnerable to climate hazards. Consequently, homeowners and renters end up paying more for home insurance.

The increasing withdrawal of insurers from the most at-risk areas exacerbated the situation, leading to an insurance crisis in three U.S. states—Florida, Louisiana, and California. This serves as a warning sign for countries like Canada, where concerns may not be as prominent, but the possibility of insurers abandoning at-risk zones remains a genuine concern.

Although wildfires are becoming increasingly prevalent across Canada, insurers in this country still classify them as accidents, and we have not witnessed any insurer withdrawing from insuring wildfire-prone areas."

Stated Craig Stewart, the Vice President of Climate Change and Federal Affairs at the Insurance Bureau of Canada.

Nonetheless, the growing insurance crisis fundamentally threatens to make property ownership prohibitively expensive for millions of individuals, posing a severe threat to the economically critical real estate industry.

Homebuyers who need help to afford insurance also face challenges in securing a mortgage. Additionally, climate disasters can put borrowers in a position of mortgage default or render them unable to afford reconstruction, which poses risks to banks.

All these consequences, whether driven by banks or insurance companies, can trigger panic selling and pressure housing markets as many homeowners in climate risk-prone areas attempt to sell their homes.

Ignorance Is Bliss

Homebuyers' disregard for climate risks is evident in the U.S., where numerous property buyers overlook the potential for floods and pay inflated prices. Furthermore, under the current "business-as-usual" approach, developers continue constructing buildings in flood-prone areas, leaving mortgage lenders to bear flood risks without passing them on to borrowers.

For instance, real estate magnates in coastal states like New Jersey and Florida have built thousands of houses on beachfront and barrier islands. At the same time, engineers in inland areas have drained numerous rivers and swamps to make formerly uninhabitable land suitable for construction. However, as time progresses, this mindset by both homebuyers and real estate companies will change as the physical impossibility of ignoring climate risks becomes apparent.

The existing public policy, including the inadequacy of federal flood maps, needs to identify millions of flood-vulnerable properties. Insufficient access to information and a lack of awareness regarding climate change result in homebuyers paying inflated prices without considering the insurance costs associated with climate-related risks.

Consequently, U.S. properties are overvalued by an estimated $121 billion to $237 billion, with inflated home prices prevalent in almost every county nationwide.

Beyond Just Four Walls

Location determines a property's vulnerability to climate risks.

Buyers should do their due diligence and check insurance premiums ahead of time for different areas so they understand what they're getting into. Other costs for homeowners and buyers are retrofits to withstand climate change, such as insulation for more severe winter storms and air conditioning for hotter summers.

A prominent example of home buyers needing to be conscious of climate risks is the implications of Energy Performance Certificates (EPC) ratings. Introduced in 2008, EPC ratings provide valuable building-specific emissions data, offering properties an energy efficiency rating from A (most efficient) to G (least efficient).

These ratings are crucial for homeowners, builders, and renters alike, as they help assess energy performance and set improvement goals, particularly emphasising efficient retrofitting. As regulators increasingly promote energy efficiency, properties with lower EPC ratings are becoming subject to stringent regulations or require costly renovations to meet new standards, including climate risk anticipation.

As the importance of EPC ratings grows, so does the pressure on homeowners to meet these stringent standards. The challenge is that new regulations are based on property characteristics rather than energy consumption data. This means homeowners may need help to comply with the ratings, leading to expensive retrofitting or even selling their properties.

Such circumstances can create instability in the housing market as properties with lower EPC ratings become less desirable. Understanding EPC ratings regarding climate risks ultimately empowers home buyers to make informed decisions considering environmental impact, long-term costs, resilience, and future policy changes.

To support buyers, real estate companies should guide them in understanding the nuances of insurance policies and encourage them to opt for comprehensive coverage that includes climate-related risks.

Buyers must make informed decisions about where to buy and how to mitigate risks from climate change. Real estate companies should also leverage climate data and predictive analytics to assess the long-term viability of a location.

By providing potential buyers with comprehensive information on climate-related risks, companies can empower them to make informed decisions and avoid investing in properties facing future challenges. This integrated approach ensures buyers have a holistic understanding of the climate risks associated with their chosen location and enables them to take appropriate measures to protect their investment.

The Great Balance

A paradigm shift is needed in approaching physical climate risk analysis and how the real estate sector incorporates this into financial decision-making.

The intricate web of interconnected risks and opportunities in real estate will demand insurers to reassess premiums for areas prone to risks or possessing resilience. Furthermore, property valuers must establish more robust and standardised protocols for evaluating resilient buildings and cities. This includes asset owners who must utilise sophisticated and elaborate modelling and assessment tools to thoroughly evaluate assets at every lifecycle stage, ensuring physical and financial resilience.

To support buyers' decision-making regarding climate risks, several advancements can help:

- Develop enhanced tools and models to analyse microeconomic trends, address social needs, and anticipate secondary impacts with physical risks.

- Engage with insurers and valuation professionals to understand how building and city adaptations affect asset values, financial plans, and exit cap rates.

- Improve the integration of energy and carbon impacts from future climate scenarios into current net-zero strategies, including accounting for increased cooling loads, optimising on-site renewables, and mitigating energy demand risks.

- Involve tenants and occupiers in understanding potential risks and their ability to adapt to new practices and expectations.

- Collaborate with local and regional public bodies responsible for area-wide adaptation planning to assess asset and city exposure to risks and identify growth opportunities.

- Implement comprehensive climate risk analysis and enhanced due diligence to assess the interplay between existing or necessary adaptation measures at the asset and area levels.

Buying a home represents one of the most significant lifetime investments for individuals. As the impacts of climate change continue to intensify, disregarding climate risk factors beyond affordability can have severe long-term consequences for homeowners.

Real estate companies are responsible for raising awareness about climate risks and advocating for sustainable and resilient housing solutions. Real estate firms can safeguard their clients and the environment by integrating climate data, promoting sustainable practices, and actively participating in community initiatives, creating a more sustainable future for the housing industry resilient to increasing climate risks.

Together, we can establish a resilient housing market that withstands the challenges posed by a rapidly changing climate.

Sources

- Gourevitch, J.D., Kousky, C., Liao, Y.(. et al. Unpriced climate risk and the potential consequences of overvaluation in US housing markets. Nat. Clim. Chang. 13, 250–257 (2023). https://doi.org/10.1038/s41558-023-01594-8

- Lartigue, B., Biewesch, L., Marion, F. et al. Energy performance certificates in the USA and in France—a case study of multifamily housing. Energy Efficiency 15, 26 (2022). https://doi.org/10.1007/s12053-022-10036-x

- CBC (2023) As climate changes, insurance is becoming more complex — and pricey. https://www.cbc.ca/news/canada/climate-change-insurance-fires-1.6863796

- PreventionWeb (2023) Bubble trouble: Climate change is creating a huge and growing U.S. real estate bubble. https://www.preventionweb.net/news/bubble-trouble-climate-change-creating-huge-and-growing-us-real-estate-bubble

- Schroders (2023) Climate change and cities: adapting real estate investment decisions. https://www.schroders.com/en-lu/lu/professional/insights/climate-change-and-cities-adapting-real-estate-investment-decisions/

- Scientific American (2023) Ignoring Climate Risks Has Inflated Property Values in Flood Zones. https://www.scientificamerican.com/article/ignoring-climate-risks-has-inflated-property-values-in-flood-zones/