Despite a dramatic rise in the frequency, intensity and economic cost of extreme weather events, the United States has been slow to require large companies and banks to assess and disclose their exposure to these climate-related risks at a Federal level.

Now, lawmakers in California have taken the initiative to propose two climate disclosure requirements for companies operating in the Golden state.

Rising disaster costs prompt California climate risk law

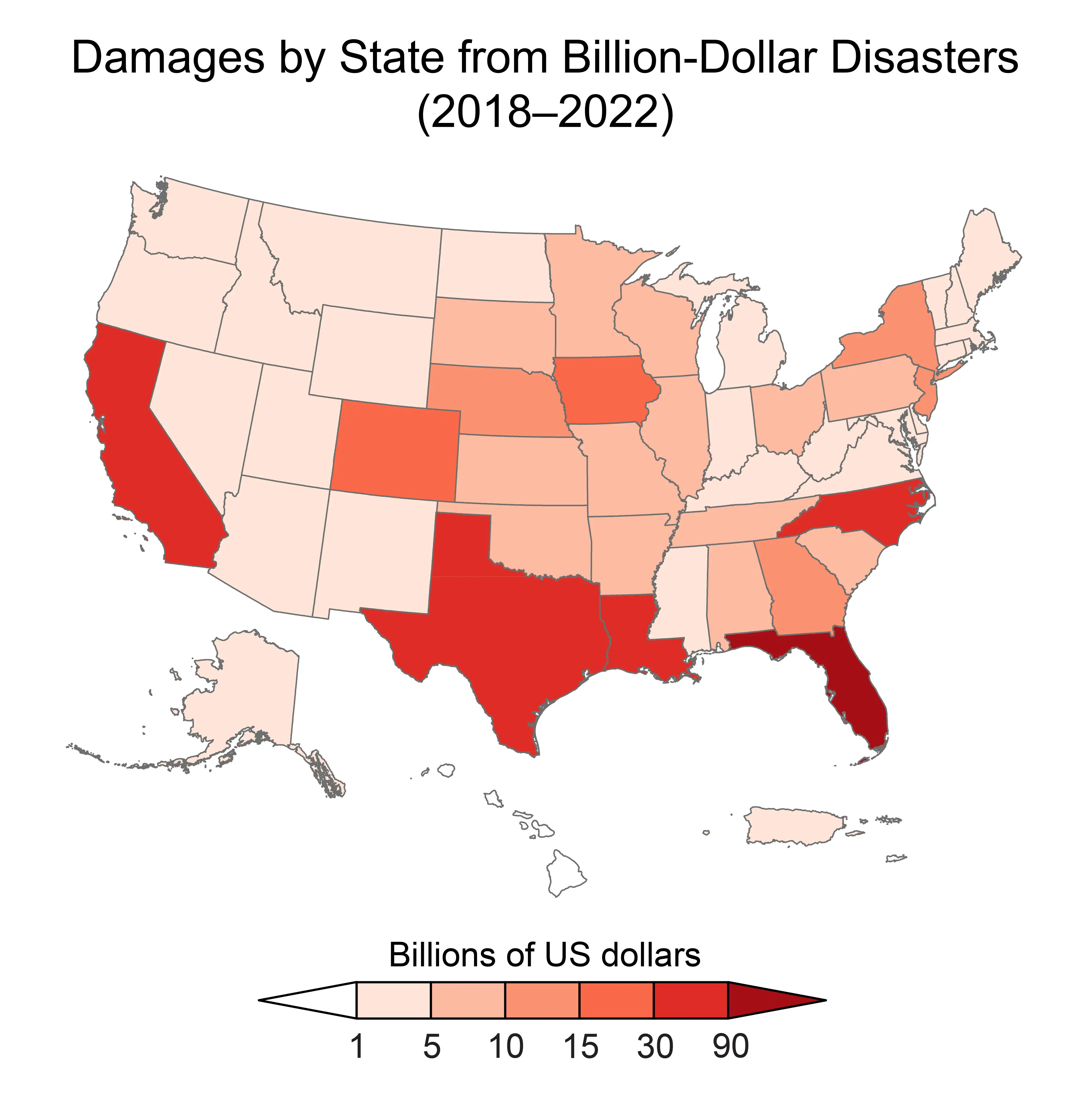

The inflation-adjusted costs associated with tropical cyclones, droughts, flooding, wildfires and other weather-related disasters has increased from USD$21.4 billion per year during the 1980's to USD$112.6 billion per year over the past decade rising to USD$178.8 billion in 2022.

In spite of the economic damage, U.S. Securities and Exchange Commission (SEC) proposals for national mandatory climate-related financial disclosures have been repeatedly delayed and are now not expected to be published until April, 2024.

Frustrated by slow progress while facing an unprecedented increase in droughts, wildfires and flooding, California legislators have moved ahead to introduce two climate disclosure requirements for companies and banks doing business in the state.

The Climate Corporate Data Accountability Act (SB 253) will require the disclosure of both direct (Scope 1 and 2) and indirect (Scope 3) greenhouse gas emissions, while the Climate-Related Financial Risk Act (SB 261) will require the assessment and reporting of climate-related financial risks.

Both acts were signed into law by California Governor Gavin Newsom in October 2023 and reports covering the preceding year would be required from January 1, 2026.

Applies to all large U.S. companies 'doing business' in California

SB 261 requires companies to report their climate-related financial risks, defined as both immediate and long term material risks to "corporate operations, provision of goods and services, supply chains, employee health and safety, capital and financial investments, institutional investments, financial standing of loan recipients and borrowers, shareholder value, consumer demand, and financial markets and economic health."

Aligned with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, the law applies to any U.S. corporation, partnership or limited liability company with over USD$500mn in total annual revenues and that does business in California.

The definition of "doing business" in California is not specified, but the phrase is already in use by the state's tax authorities to refer to companies with Californian sales of just USD$690,144. With this in mind, the nonprofit climate capital group Ceres estimates that SB 261 would apply to over 10,000 companies, including most of America's largest banks.

SEC disclosure rule delayed again

While U.S. companies come to grips with California’s SB 261 the SEC has confirmed that its proposed climate-related financial disclosure rule has been delayed yet again, with the new target date for publication now April, 2024.

A draft of the rule, applicable to all U.S. publicly traded companies, would require the assessment and reporting of "the actual or potential negative impacts of climate-related conditions and events on a registrant’s consolidated financial statements, business operations, or value chains, as a whole."

This would cover climate threats to both "upstream" activities (such as those of suppliers) and "downstream" activities (such as those of distributors, users and investments).

The draft proposal envisages a phased implementation, with reporting requirements delayed for smaller companies. Assuming the rules are implemented in 2024 this would mean that large companies would be required to report beginning January 1st, 2026 for fiscal year 2025. Other companies would get a year's extension, with smaller companies getting a two year extension.

Support from large US banks

Although the SEC proposals have encountered substantial political opposition, contributing to their delay, many investors and large banks have welcomed the focus on the growing climate risks to which they are exposed. "We support the SEC's efforts to develop decision-useful, consistent, and comparable climate-related financial risk disclosures," said Wells Fargo's Chief Accounting Officer Muneera Carr in the bank's submission to the SEC's public consultation process on the new rules.

Citigroup's Chief Accounting Officer Johnbull Okpara also expressed strong support in his bank's submission to the process. "Citi supports the overall goal to provide consistent, comparable and reliable decision-useful climate disclosures," he said.

We believe that standardized, uniform, comparable & reliable disclosures focused on climate-related risks and opportunities would help various stakeholders, including investors & asset managers, to make decisions on where they wish to deploy and allocate capital."

Citigroup's Chief Accounting Officer, Johnbull Okpara on SEC climate disclosure proposal

Bank of America CEO Brian Moynihan has also made clear his support for climate-related financial disclosures.

Speaking at the World Economic Forum's annual meeting in Davos earlier this year he said that universal reporting standards will pressure big companies and their suppliers to commit to goals that help both society and profits. “This annualized disclosure has to show year-by-year progress,” he said. “It now binds the company … By having it disclosed on a periodic basis and making it part of the official record, so to speak, you can’t walk away from it.”

U.S. National Climate Assessment warns of growing risk

The importance of both California's SB 261 and the SEC's upcoming climate-related financial disclosure requirements were highlighted by the 5th U.S. National Climate Assessment, published last month.(11)

The assessment, a U.S. federal government initiative focused on the science of climate change and its impact on the United States, warned that "many of the extreme events and harmful impacts that people are already experiencing will worsen as warming increases and new risks emerge".

The U.S. now experiences a billion-dollar weather-related disaster every three weeks on average, the report found, compared to once every four months during the 1980s.

Based on the latest scientific evidence, the comprehensive assessment outlines how the effects of climate change are already having a severe impact on the US.

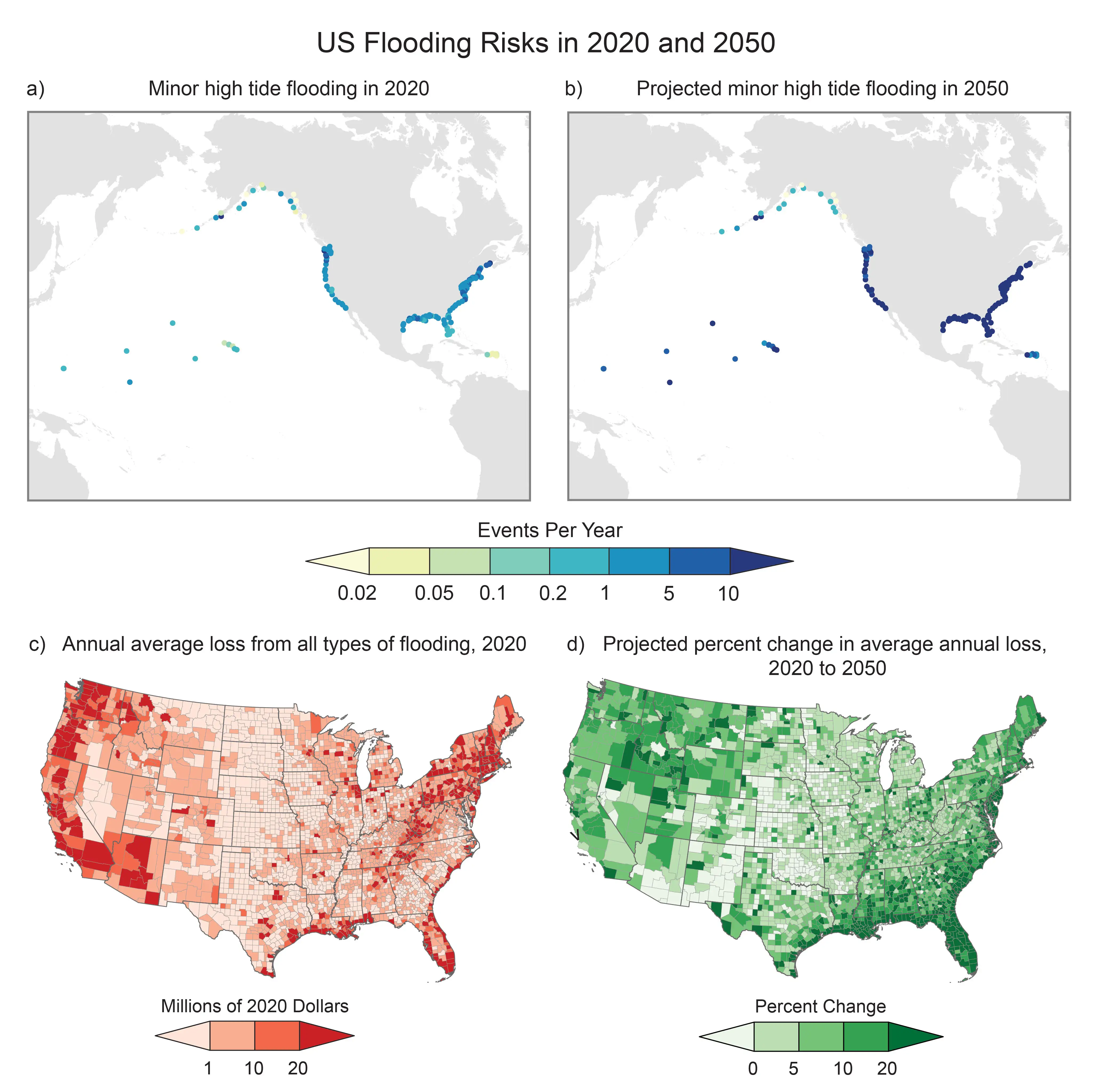

Infrastructure and services are increasingly damaged and disrupted by extreme weather and sea level rise, and homes and property are increasingly at risk. Drought, extreme heat, heavy rain and more frequent storm damage are expected to increase disruptions to food systems, while ecosystems are undergoing "transformational changes."

Heavy rain and longer dry spells are reducing water supply and access, especially in the Southeast. These and other impacts are expected to increase in the near term.

"The impacts of future changes are projected to be more significant and apparent across the US economy," the report warns. "With every additional increment of global warming, costly damages are expected to accelerate."

International climate impacts can disrupt trade, amplify costs along global supply chains and affect domestic markets, it says, and damages from additional warming "pose significant risks to the US economy at multiple scales and can compound to dampen economic growth."

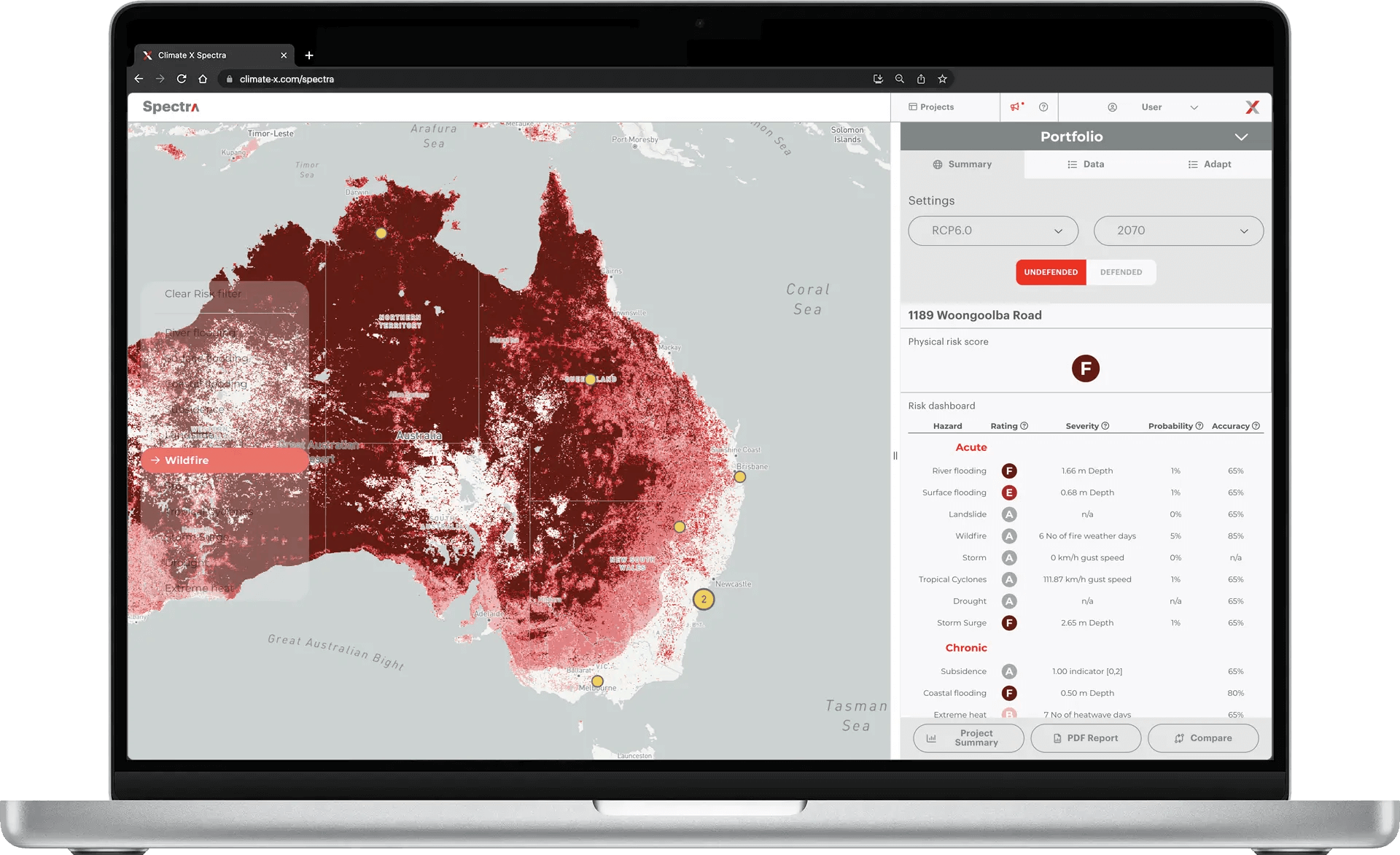

While these risks can be mitigated by a host of adaptive measures, reducing exposure depends on knowing exactly where the risks lie and how they might impact any particular asset, business, bank or investment.

California's SB 261 and the SEC's new disclosure requirements will require companies and banks to make these climate risk assessments and report them, making the growing impacts of climate change visible to investors, customers, regulators and other stakeholders.

Sources

- California Legislature (2023) SB-253 Corporations: boards of directors: underrepresented communities

- California Legislature (2023) SB-261 Climate Corporate Accountability Act

- Ceres (2023) California's First-in-Nation Climate Disclosure Legislation Sets New National Standard

- Franchise Tax Board - California (2023) Doing Business in California

- NOAA National Centers for Environmental Information (NCEI) (2023) U.S. Billion-Dollar Weather and Climate Disasters

- Office of Information and Regulatory Affairs (OIRA) (2023) Climate-Related Risk Disclosure

- Securities and Exchange Commission (SEC) (2022) Wells Fargo Comments on File Number S7-10-22

- Securities and Exchange Commission (SEC) (2022) Citigroup Comments on File Number S7-10-22

- Securities and Exchange Commission (SEC) (2022) The Enhancement and Standardization of Climate-Related Disclosures for Investors

- The Wall Street Journal (2023) Bank of America CEO Says ESG Movement Is Here to Stay

- U.S. Global Change Research Program (2023) National Climate Assessment 2023