European housing markets are at a turning point. The cost-of-living crisis has eroded real incomes, making borrowers more susceptible to financial distress as interest rates surge. This situation has increased the risk of a broader downturn and threatens European financial stability. Furthermore, inflation has soared between 2021 and 2022, mainly driven by the energy crisis. In response, central banks have significantly raised interest rates, leading to tighter financial conditions.

Mortgage rates have more than doubled in most European countries and tripled in Finland, Slovakia, Switzerland, and the UK in 2022. Approximately 45% of European households face a financial strain, impacting mortgage and consumer debt. Lower-income households are particularly vulnerable due to higher essential expenses. Consequently, housing markets across Europe are overvalued by 15% to 20%. The disparity between house prices and incomes has widened since 2019, with a 25% difference from the long-term trend in the price-to-income ratio 2022 Q3. Price-to-rent ratios are approximately 40% higher than historical averages, signalling potential market imbalances.

A real estate bubble is emerging, with buyers paying excessively high prices. When the bubble bursts, real estate prices typically decline. To address the looming housing downturn, authorities are implementing stricter macroprudential policies to strengthen banks.

The European housing market faces systemic risks compounded by climate change, including extreme climate events causing property damage and infrastructure destruction. These risks rapidly impact real estate prices due to rising sea levels, increased flooding, storms, and changing weather patterns. Understanding the influence of physical climate risks is vital for real estate managers to ensure long-term profitability.

Staying Above Water

Due to climate change, European river floods pose a significant threat to the region and are projected to reach unprecedented levels.

The British Isles and Central Europe are expected to experience increased flood risk throughout the 21st century, while some parts of Scandinavia and the Mediterranean may see stable or declining risk. In 2023 alone, Croatia, Italy, Latvia, Serbia, and the UK have already suffered devastating floods caused by storms and heavy rainfall.

In a scenario without climate mitigation, where global warming reaches 3°C, projected flood losses in Europe could amount to €44 billion per year by 2100. However, with effective climate mitigation measures, these losses could be reduced to €8.1 billion per year, accompanied by an 84% decrease in the population exposed to flood risk, preserving a risk level comparable to the present.

Researchers have also determined that implementing improved private precautionary measures in homes could reduce flood risk in Europe by an average of 15%, resulting in a cost-saving of €137 million during the baseline period. However, the combination of ongoing development and urbanisation in floodplains may lead to an unprecedented surge in flood risk.

The real estate industry in Germany has faced significant challenges due to flooding. According to GDV (German Insurance Association), since 2000, approximately 2.7 million new residential buildings have been constructed in the country, with over 32,000 of them located in flood-prone areas.

Between 1,000 and 2,400 new residential buildings are added to these high-risk zones every year. Presently, around 270,000 residential buildings are situated in areas highly susceptible to flooding. Recent flood events, such as the devastating floods in Rhineland-Palatinate and Baden-Württemberg in May 2023, as well as the catastrophic floods in July 2021, have caused extensive damage, affecting over 10,000 buildings and resulted in approximately 32 billion in damages.

“We saw that the kind of debris – the material transported by the flowing water – changed significantly. Along with eroded sediment and existing deadwood, anthropogenic materials – those made by people – played a crucial role” says Dr. Susanna Mohr, General Manager of the Center for Disaster Management and Risk Reduction Technology (CEDIM) at KIT.

The extent of German building construction becoming increasingly impacted by climate risks is showcased by insurers in Germany warning that new homes continue to be built in flood-risk areas in the country.

Only climate-adapted construction can reduce the economic damage caused by climate change and extreme weather events in the future"

Said Jörg Asmussen, head of the German Insurance Association (Gesamtverband der Deutschen Versicherungswirtschaft – GDV), the federation of private insurers in Germany.

Real estate prices in Germany experienced a slight decline at the end of 2022, marking the first decrease in twelve years. This drop can be attributed to reduced demand caused by increased financing costs. However, despite this decline, there continues to be a housing shortage.

The impact of the interest rate shock is hampering new construction efforts. Unfortunately, comprehensive information is lacking to determine which regions will emerge as winners or losers. Deutsche Bank acknowledges the uncertainty surrounding the influence of the climate crisis on various areas of Germany. Furthermore, it remains uncertain whether behavioural changes, construction measures, precautions, and effective crisis management will suffice to contain or prevent climate damage.

Given the expected intensification of climate risks and the corresponding increase in flooding, which rises by approximately 7% per degree of warming, housing availability and insurance premiums will diminish. Consequently, regions less prone to extreme weather events in the future may witness heightened demand, resulting in increased prices and rents. Ultimately, the housing market, already grappling with higher long-term rates, is expected to face steeper price hikes.

To mitigate the economic vulnerability associated with climate-related risks, real estate companies must adopt climate-adapted construction practices as a minimum requirement. Constructing buildings that can withstand the rapid changes caused by climate shifts is crucial.

Climate X's Spectra platform, designed for the commercial real estate industry, offers a solution. It is capable of identifying climate risk vulnerabilities by assessing the projected impacts of extreme weather events on commercial and residential real estate portfolios. By guiding real estate stakeholders towards climate risk-resilient practices, this platform plays a vital role in shaping the future of the real estate industry.

It’s Getting Hot in Here

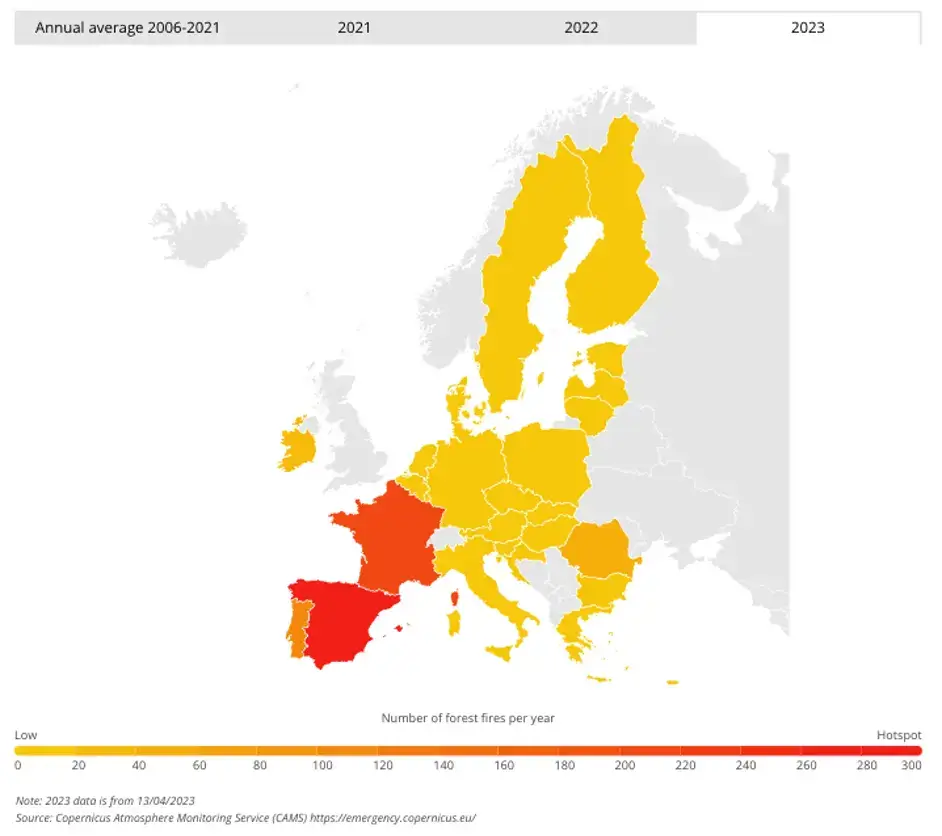

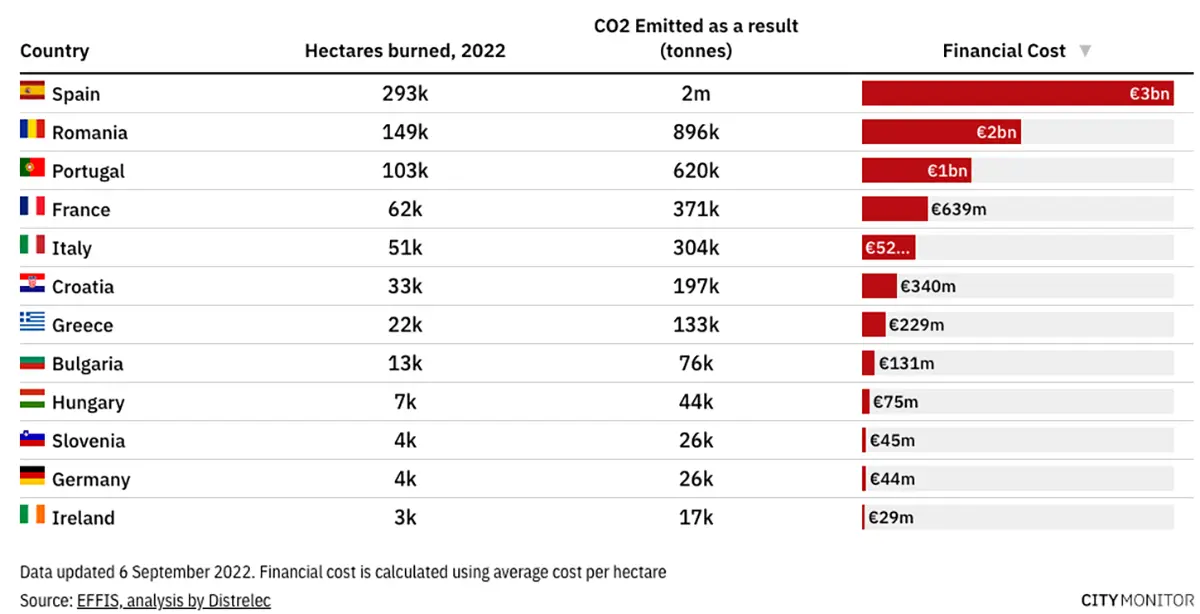

2022 was the second-worst wildfire season in the European Union since 2000 when the Copernicus’ European Forest Fire Information System (EFFIS) records began burning in 26 of the EU27 countries, burning 837.212 hectares (ha.), an area the size of Belgium and representing an 86% increase from 2021.

Although summer is wildfire season in Southern Europe, wildfires have also been observed in regions ranging from the Nordic to the Baltic countries.

These areas, relatively new to drought problems, experience small amounts of rain that dry the soil. However, the focus remains on Southern Europe, where wildfires cause substantial economic damage, averaging up to €21 billion per season.

The fire-prone regions in this part of Europe have witnessed a reduction in the annual GDP growth rate by an average of 0.11–0.18% due to recent wildfires. In some particularly severe wildfire years, the economic impact can be even more significant, with a calculated decrease in the GDP growth rate of almost 5%.

Recognising the 'cross-cutting' nature of the wildfire risk, the CCRA acknowledges its implications for people, buildings, infrastructure, and businesses, extending across the rural-urban interface. This poses a critical challenge for investors, infrastructure development, energy supplies, and especially insurers and reinsurers, given that the replacement cost for assets insured against wildfire across Europe is estimated to be around €22.6 trillion.

In light of escalating damage caused by wildfires across Europe, the European Union has taken action by announcing the expansion of its aerial firefighting fleet.

The fleet will be doubled to include 24 aircraft and 4 helicopters for the upcoming season. However, European firefighters are expressing the urgent need for additional resources, enhanced personnel training, and better protective equipment. These concerns highlight the potential unpreparedness of emergency services to handle the increasingly severe weather conditions and the heightened risk posed to real estate across the continent.

Given the recurring occurrence of wildfires in Europe, exacerbated by droughts and Spain's extreme heat, the country has become a hotspot for such disasters. Spain accounted for 35% of all burned land in European wildfires last year. Barracas has experienced the first significant wildfire this year, scorching over 4000 hectares.

We are moving from the era of big forest fires to mega forest fires in Spain"

Pablo Martin Pinto, a professor at Valladolid University, warning that such vast blazes were “here to stay”.

Specifically in the northern-eastern region of Catalonia, the central reservoirs, which provide water for some six million people, including Barcelona, are still only at 29% of capacity and water restrictions remain in place across the region. Aware of the crisis, the Council of Ministers has approved a Plan of Actions against forest fires for this year, considering adaptation.

For the wildfire risk to real estate, despite the sharp rise in interest rates and economic uncertainty, Spanish house prices rose by an average of 7.4% in 2022. Moreover, even after 2024, it is unlikely that house prices will continue to increase as rapidly as in recent years, as the leverage of falling interest rates has disappeared.

Various overvaluation indicators, such as the ECB's, suggest that overvaluation in Spain has increased less than in other countries. This indicates the Spanish property market is better positioned to withstand the cooling-down period. However, wildfires worsening velocity can put holes in the Spanish real estate market, destroying homes and skyrocketing insurance premiums for homeowners in more vulnerable areas.

Spain is a striking example of how multiple climate risks can intersect, exacerbating one another. The country's terrain has become a tinderbox susceptible to wildfires, with uncertainties surrounding future firefighting strategies. Countries facing heightened wildfire risks must prioritize this issue on their political agendas and take proactive measures to prevent wildfires rather than only addressing them during extreme heat and fire outbreaks.

Foreseeing Risks

The real estate industry is already witnessing the tangible effects of climate change, particularly with the rise of extreme heat events in Europe, and these environmental shifts will continue to shape its future.

To ensure the resilience of real estate in the face of climate change, it is crucial to prioritise business continuity and mitigate potential financial losses by understanding asset vulnerabilities.

Properties located in susceptible areas are experiencing declining market values and escalating insurance costs. Buyers and investors now consider climate change risks a significant factor when making decisions, leading to a shift in property demand towards more resilient and sustainable locations. Moreover, regulatory measures and policies addressing climate change, such as carbon pricing and energy efficiency requirements, increasingly influence property valuations and affordability.

Climate services [providing information to help end users make climate-smart decisions] play a key role in ensuring the resilience of energy systems to climate-related shocks, in planning operations, and in informing measures to increase energy efficiency."

Said WMO secretary general Prof Petteri Taalas.

Recognising the profound impact of climate change on real estate pricing is essential for industry stakeholders to adapt, implement resilience strategies, and make well-informed decisions to mitigate financial risks.

Asset owners and managers can leverage exposure data and regional adaptation efforts to enhance asset resilience and engage communities in shared resilience priorities by utilising climate risk companies like Climate X, which can significantly improve an organisation's capacity to address systemic disaster risk, identifying and converting potential risks into opportunities through Spectra, thereby safeguarding people, businesses, and the global ecosystem from the escalating threats posed by wildfires.

Sources

- Alfieri, L.; Dottori, F.; Betts, R.; Salamon, P.; Feyen, L. Multi-Model Projections of River Flood Risk in Europe under Global Warming. Climate 2018, 6, 6. https://doi.org/10.3390/cli6010006

- Dottori, F., Mentaschi, L., Bianchi, A. et al. Cost-effective adaptation strategies to rising river flood risk in Europe. Nat. Clim. Chang. 13, 196–202 (2023). https://doi.org/10.1038/s41558-022-01540-0

- Steinhausen, M., Paprotny, D., Dottori, F., Sairam, N., Mentaschi, L., Alfieri, L., Lüdtke, S., Kreibich, H., and Schröter, K. (2022) Drivers of future fluvial flood risk change for residential buildings in Europe. Global Environmental Change, 76: 102559.

- Valderrama, Laura and Gorse, Patrik and Marinkov, Marina and Topalova, Petia B., European Housing Markets at a Turning Point – Risks, Household and Bank Vulnerabilities, and Policy Options. IMF Working Paper No. 2023/076, Available at SSRN: https://ssrn.com/abstract=4410559 or http://dx.doi.org/10.5089/9798400239489.001

- Wallemacq, Pascaline & UNISDR, & CRED,. (2018). Economic Losses, Poverty and Disasters 1998-2017. 10.13140/RG.2.2.35610.08643.

- AP News (2023) Spain’s Barcelona faces drought ‘emergency’ in September. https://apnews.com/article/spain-catalonia-water-drought-climate-barcelona-39cff05f6742bf0b2b72b63d5de3b145

- AP News (2023) Spain registers hottest spring temperatures on record. https://apnews.com/article/spain-hottest-spring-weather-drought-rain-dry-3e82058f410d11909cf909d3f02483fa

- Bloomberg (2023) Europe’s Firefighters Strained as Climate Change Fans Wildfires. https://www.bloomberg.com/news/articles/2023-06-22/europe-s-firefighters-strained-as-climate-change-fans-wildfires#xj4y7vzkg

- ClimateChangePost (2023) Economic damage of wildfires in Southern Europe is up to €21 billion per season, on average. https://www.climatechangepost.com/news/2023/4/3/economic-damage-of-wildfires-in-southern-europe-is/

- EIPOA (2022) EUROPEAN INSURERS’ EXPOSURE TO PHYSICAL CLIMATE CHANGE RISK. https://www.eiopa.europa.eu/system/files/2022-05/discussion_paper_on_physical_climate_change_risks.pdf

- European Commission (2023) New analysis indicates European cities and countries with highest expected losses from future flooding. https://environment.ec.europa.eu/news/new-analysis-indicates-european-cities-and-countries-highest-expected-losses-future-flooding-2023-06-21_en

- European Commission (2023) The EU 2022 wildfire season was the second worst on record. https://joint-research-centre.ec.europa.eu/jrc-news-and-updates/eu-2022-wildfire-season-was-second-worst-record-2023-05-02_en#:~:text=Excluding%20war%2Dtorn%20Ukraine%2C%20Spain,countries%20that%20were%20most%20affected

- European Commission (2023) How the EU is preparing for the 2023 wildfire season. https://civil-protection-humanitarian-aid.ec.europa.eu/news-stories/stories/how-eu-preparing-2023-wildfire-season_en

- Green (2023) The era of ‘mega forest fires’ has begun in Spain. Is climate change to blame? https://www.euronews.com/green/2023/03/27/the-era-of-mega-forest-fires-has-begun-in-spain-is-climate-change-to-blame

- Floodlist (2023) Croatia – Flooding in Multiple Counties After Record Rain, Authorities on Alert as Rivers Rise. https://floodlist.com/europe/croatia-floods-may-2023

- Floodlist (2023) Germany – Insurers Demand a Stop to Building New Homes in Flood-Risk Areas. https://floodlist.com/europe/germany-stop-building-houses-flood-risk-areas

- Floodlist (2023) Italy – Deadly Flash Floods in Campania Region. https://floodlist.com/europe/italy-floods-campania-may-2023

- Floodlist (2023) Latvia – Augšdaugava Communities Isolated After Daugava River Floods. https://floodlist.com/europe/latvia-augsdaugava-daugava-river-floods-april-2023

- Floodlist (2023) Serbia – Floods Leave 2 Missing, Dozens Evacuated. https://floodlist.com/europe/serbia-floods-january-2023

- Floodlist (2023) UK – Evacuations After Floods in Devon and Somerset. https://floodlist.com/europe/united-kingdom/floods-devon-somerset-may-2023

- The Guardian (2023) Early wildfire in Spain’s Valencia region forces 1,500 villagers to evacuate. https://www.theguardian.com/world/2023/mar/25/wildfire-spain-valencia-evacuation-villagers-firefighters

- ING (2023) Why Spain’s housing market is set to cool this year. https://think.ing.com/articles/why-spains-housing-market-will-cool-down-this-year/

- NRWZ (2023) Immobilienmarkt 2023: „Käufer können Zinstäler und ihre bessere Verhandlungsposition nutzen”. https://www.nrwz.de/service/immobilienmarkt-2023-kaeufer-koennen-zinstaeler-und-ihre-bessere-verhandlungsposition-nutzen/401476

- PreventionWeb (2023) Climate change and land-use changes increase likelihood of flood events. https://www.preventionweb.net/news/climate-change-and-land-use-changes-increase-likelihood-flood-events

- PZ-News (2023) Starkregen sorgt für Überschwemmungen im Südwesten. https://www.pz-news.de/weltweit_artikel,-Starkregen-sorgt-fuer-Ueberschwemmungen-im-Suedwesten-_arid,1854597.html

- US News (2023) Wildfires Driven by Climate Change Are on the Rise - Spain Must Do More to Prepare, Say Experts. https://www.usnews.com/news/world/articles/2023-06-15/wildfires-driven-by-climate-change-are-on-the-rise-spain-must-do-more-to-prepare-say-experts