Earth’s climate has permanently and naturally altered throughout history. But the climate is changing rapidly, driven by human activities emitting GHG emissions into the atmosphere. With an increasing awareness of climate-related risks, businesses need to rise to the challenge of climate risk... but is the pace of change too fast for entities?

Unprecedented climate change is here to stay, and observed climate variability in every region across the world represents an intensifying threat to companies with a growing need to manage climate risks against the powerful and pervasive physical risks of climate change. With more carbon than natural processes can remove at an annual rate emitted into the atmosphere, the invigoration of unpredictable wide-ranging impacts on our global society is increasing. As climate change continues to become more frequent and severe, a wide range of stakeholders, including governments, businesses, and individuals, needs to rise to the challenge of reducing greenhouse gas emissions and adapting to the changing climate.

Disasters and Losses

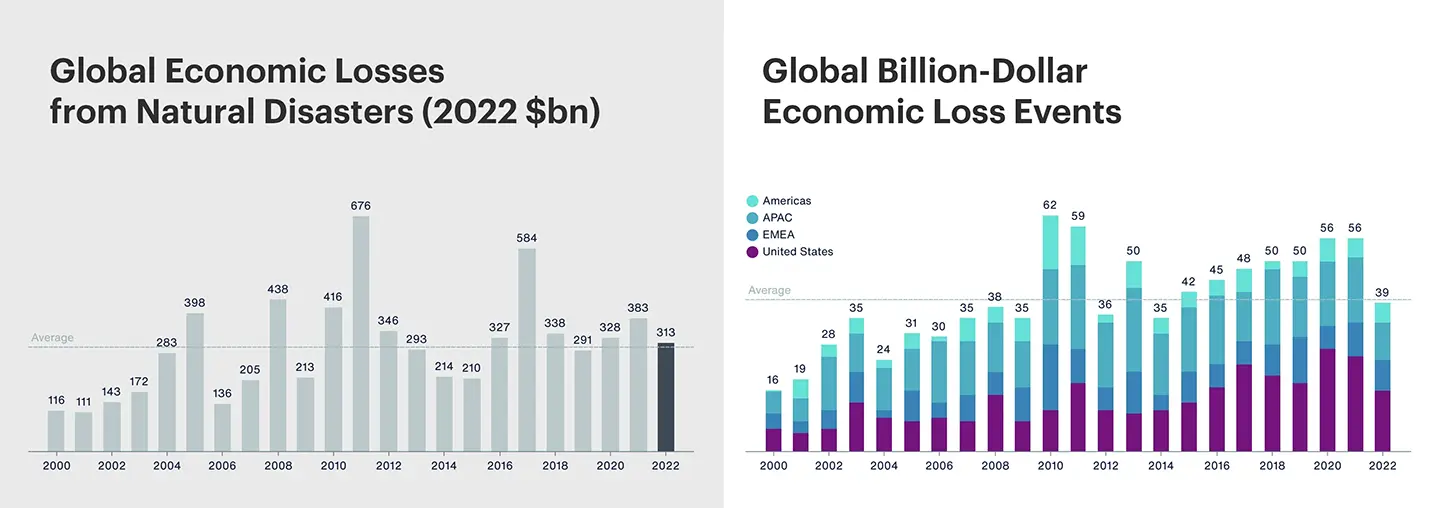

Climate disasters have increased by a factor of five over the last 50-year period. Between 1970 - 2019, there were more than 11,000 reported disasters globally, with $202 million in damages each day, amounting to $3.64 trillion in losses. Most recently, economic losses from natural catastrophes were at a staggering $313 billion in 2022, close to the 21st-century average of $301 billion highlighted below in Figure 1. Wildfires in Europe and record-breaking hurricanes in the U.S. are a few examples of climate-related disasters that affected nearly all facets of businesses across many industries.

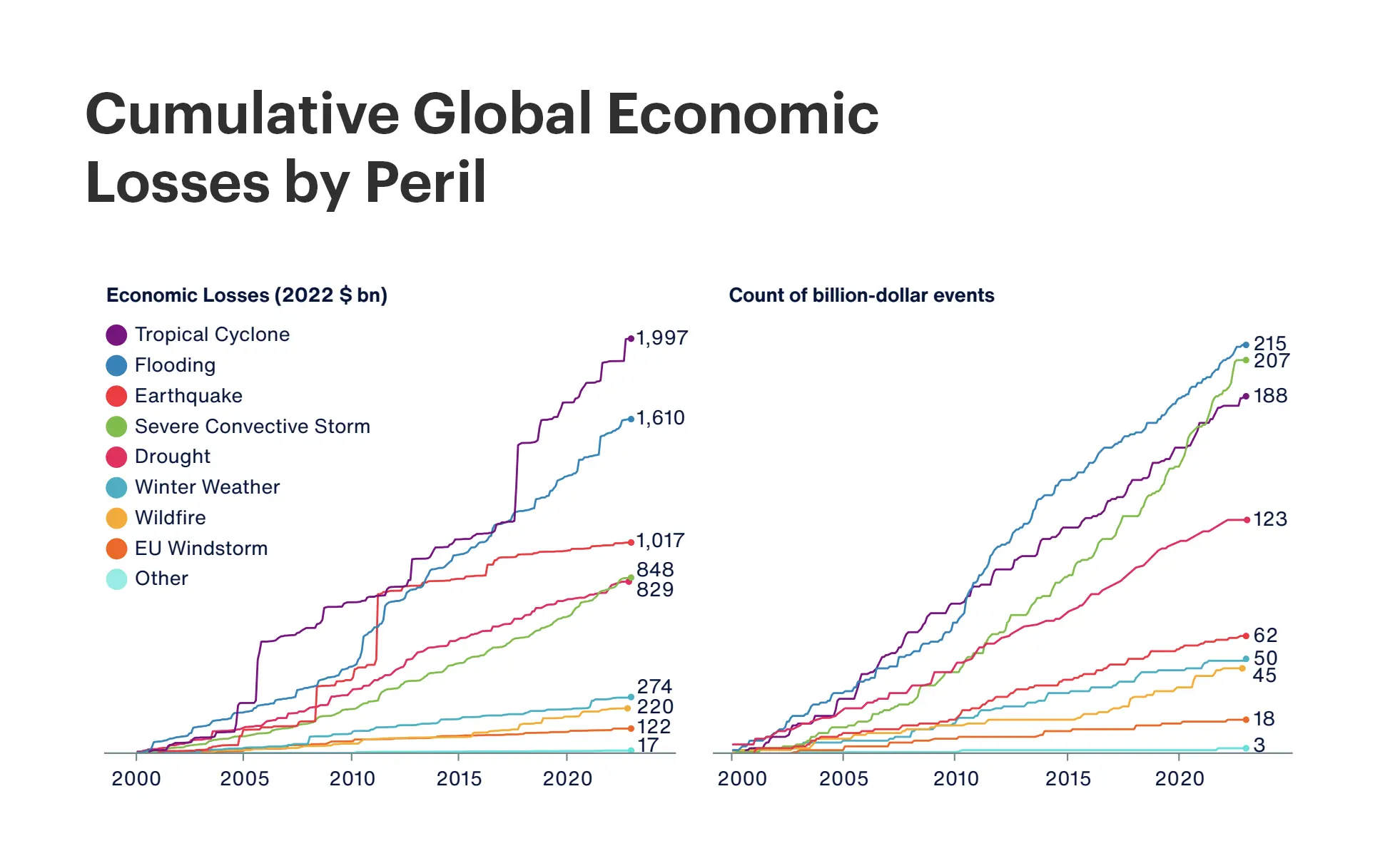

Alongside temperature increases, the probability of extreme events such as heatwaves, intense drought, heavy rainfalls, floods, and tropical cyclones has risen. As a result, tropical cyclones have remained the costliest peril on a cumulative basis since the start of the 21st century. Driven by extreme loss years, Figure 2 below showcases almost $2 trillion in aggregated losses.

Raw Regulation

Commercial and regulatory pressures are increasingly expected to have a deepened rippled effect across markets globally. To ensure a company's resilience to climate change, policymakers, regulators, central banks, and supervisors increasingly integrate climate risks into reporting climate-related risks. Aware of climate change's negative implications, policymakers are implementing dramatic reforms that align with climate change goals. Regulatory and supervisory bodies such as the Financial Stability Board (FSB) of the Task Force on Climate-related Financial Disclosures (TCFD) are a leading source of investor-led guidance to address the lack of climate reporting and help avoid another financial crisis caused by climate change.

Alongside this, central banks within the financial sector are formalising stress tests, including the Fed in 2023 and other central banks such as the Bank of England in 2021 with its 2021 Biennial Exploratory Scenario (BES) and European Central Bank (ECB) in 2022. In addition, climate-related risk disclosures encourage financial actors to report the impact of climate change on their businesses, including their operations, risks, balance sheets, and future profitability. These disclosures are established because systematic, comparable, and understandable disclosures promote better climate-related decision-making and risk management. For the financial sector, climate change-related regulatory risks can affect banks' abilities to conduct commercial activities but also allow them to protect themselves. Thus, understanding the financial sector's response to regulatory risks is increasingly important. Overcoming these challenges relies on introducing regulations to align short-term profit-maximising decisions of firms. A direct consequence is that firms face regulatory risks related to climate change with adequate climate-related risk management processes consistent with their risk appetite, risk profile and operating environment.

The Learning Curve

As climate change progresses, entities have been learning the hard way. Yet, they need to increasingly pay increasing to climate-related hazards to effectively respond to the risks with actions, especially when facing tightening regulations to turn climate physical risks into a competitive advantage. Thus, managing climate-related risks has become imperative for some organisations throughout the current climate transition.

- Design of Operations: Some institutes are making their CROs accountable for climate change, and others are dividing responsibilities amongst their business units.

- The Need for Resources: 73% of leaders are investing time and resources into evaluating and considering the impact of climate change on their risk portfolios. Industry leaders' knowledge of climate risks is expanding to meet this need, especially in the financial sector.

- Financial Reporting: The importance placed upon disclosures and the potential to encourage firms to adopt more climate-friendly strategies.

- Enhanced Structures: Regulatory frameworks must adopt a standardised template or disclosure structure that all reporting entities can follow, with policymakers needing consistency.

Companies must be prepared for the costs of managing climate risk, which come in many forms, ranging from relocating operations to reducing asset exposure or modifying operations to improve energy efficiency.

Paradigm Change: Challenges Ahead

Advanced and adapted risk tools are increasingly necessary for entities to identify climate risks with the importance of bridging data gaps. This is showcased by the need for data for developing strategic plans to fuel resilience against climate risk by analysing future events through scenario analyses. Depending on the nature of the assets, scenario analysis may be applied differently. In any case, climate scenarios are becoming more widely utilised, showcased by the FED, to measure climate risk with the need for the mother all challenges is the reliability and availability of granular data.

Despite climate risk modelling of physical risks taking centre stage for companies to assess their risk profiles across many dimensions, risk managers need a tailored approach to ensure they are fit for purpose. Climate models have improved in recent decades, mostly through improved parameterisation of unresolved processes and spatial resolution enhancement. Digital twins are one climate model solution approach that can be compared to a digital twin of the Earth. Nonetheless, there are vast challenges in building accurate physical climate models. Computationally expensive and requires specific knowledge of the area that needs to be overcome by organisations

To invigorate a clearer lens for assessing climate risk, digital tools based on data and different simulation methods, especially with the advent of new technologies, such as high-performance computing (HPC) combined with data-intensive analytics of big data, enables climate risk identification across the world. HPCs, such as Destination Earth and Twin supercomputers of the NOAA, offer great opportunities to understand and assess climate risks in the complexity of spatial planning with the increase in data volumes and the speed at which data is generated and processed in real-time. More specifically, improvement of prediction capabilities to maximise opportunity when assessing climate risk, the performance of highly accurate and dynamic Earth system simulations and the utilisation of distributed HPCs by handling data at an extreme scale.

Despite the enormous potential for data collection, analytics and simulation in near real-time for addressing complex climate challenges when unlocked with digital modelling of HPC systems, most supercomputers cannot meet the demand for big data analytics due to high costs and expertise.

Hence, organisations need to focus on climate data with the following emphasis:

- Expansion of Data Sets: All entities seeking to measure climate risks must invest and attain access to data to support deeper and more demanding climate risk analysis for regulation purposes.

- Standardised Methods: Common frameworks for stakeholders to assess risks, such as alignment with Task Force on Climate-Related Financial Disclosures (TCFD) recommendations.

- Technological Gamechangers: As highlighted earlier with HPC, new technology is needed to gather, manage and translate ever-expanding data into meaningful risk predictions.

Ultimately, data is the bedrock of effective climate risk action to assess exposures of specific assets to deal with the increasing speed of climate risk. While new data and analytics solutions are required to deal with ever-expanding data sets and more frequent climate events, the industry remains limited by the costs of a lack of expertise. Spectra, our climate risk platform, is an ideal antidote to this problem, being able to analyse data to enable asset managers, real estate developers and construction companies to analyse the impact of future climate-related physical risks at both individual site/asset and portfolio levels.

Sources

- Alizadeh, O. Advances and challenges in climate modeling. Climatic Change 170, 18 (2022).

https://doi.org/10.1007/s10584-021-03298-4 - Aon (2023) Weather, Climate and Catastrophe Insight.

https://www.aon.com/getmedia/f34ec133-3175-406c-9e0b-25cea768c5cf/20230125-weather-climate-catastrophe-insight.pdf - Aon (2022) Making Better Decisions in Uncertain Times: Aon’s 2022 Executive Risk Survey.

https://www.aon.com/insights/reports/2022/c-suite-executive-risk-survey-better-decisions - Aon (2022) Aon Collaborates With The University Of California System To Enhance Wildfire Modeling By Leveraging The Latest Climate Science.

https://aon.mediaroom.com/news-releases?item=138166 - Financial Stability Institute (FSI) (2022) The regulatory response to climate risks: some challenges.

https://www.bis.org/fsi/fsibriefs16.pdf - European Commission (2023) Destination Earth.

https://digital-strategy.ec.europa.eu/en/policies/destination-earth - The Federal Reserve (2023) Pilot Climate Scenario Analysis (CSA) Exercise: Participant Instructions.

https://www.federalreserve.gov/publications/climate-scenario-analysis-exercise-instructions.htm - HLRS (2022) The European Centre of Excellence for Engineering Applications.

https://www.hlrs.de/projects/detail/excellerat - IPCC (2021) Climate change widespread, rapid, and intensifying – IPCC.

https://www.ipcc.ch/2021/08/09/ar6-wg1-20210809-pr/ - National Oceanic and Atmospheric Administration (2022) Increase in atmospheric methane set another record during 2021.

https://www.noaa.gov/news-release/increase-in-atmospheric-methane-set-another-record-during-2021 - National Oceanic and Atmospheric Administration (2022) U.S. supercomputers for weather and climate forecasts get major bump.

https://www.noaa.gov/news-release/us-supercomputers-for-weather-and-climate-forecasts-get-major-bump - Task Force on Climate-related Financial Disclosures (2022) 2022 Status Report.

https://assets.bbhub.io/company/sites/60/2022/10/2022-TCFD-Status-Report.pdf#page=101 - World Meteorological Organization (WMO) (2021) WMO Atlas of Mortality and Economic Losses from Weather, Climate and Water Extremes (1970–2019).

https://library.wmo.int/index.php?lvl=notice_display&id=21930#.Y9WsquzMJqu - World Meteorological Organization (WMO) (2021) Weather-related disasters increase over past 50 years, causing more damage but fewer deaths.

https://public.wmo.int/en/media/press-release/weather-related-disasters-increase-over-past-50-years-causing-more-damage-fewer - Zanders (2022) ‘The data challenge makes climate risk a very interesting but very complex scope of work’.

https://zandersgroup.com/en/latest-insights/the-data-challenge-makes-climate-risk-a-very-interesting-but-very-complex-scope-of-work/