- As the ECB makes climate risk a supervisory priority for 2024 to 2026, a new study shows that 90% of Eurozone banks are misaligned with EU Climate Law and face substantial exposure to the resulting risk of credit losses.

- Comparing bank lending with creditor production projections based on the IEA's 2050 Pathway, the analysis found the most affected banks could potentially face impacts on solvency.

Banks misaligned with European Climate Law

A new European Central Bank (ECB) study has further highlighted the exposure of eurozone banks to climate-related financial risks, adding to concerns that the European banking industry is failing to effectively respond to climate change and the transition to a sustainable economy.

Released last Tuesday, January 23rd 2024, the exercise assessed the alignment of the banking sector with the European Climate Law requiring the European Union (EU) to reach carbon neutrality by 2050.

Among the 95 major institutions analysed, it found that 90% are misaligned with EU objectives, a result that the ECB called "staggering".

Potential impact on solvency

Using the Paris Agreement Capital Transition Assessment (PACTA) methodology, the study assessed transition risks for fifteen different technologies in six key sectors, together accounting for about 70% of CO2 emissions.

Production projections for corporate borrowers in these sectors were compared with targets set under the International Energy Agency’s (IEA's) 'Net Zero Emissions by 2050' decarbonisation pathway with a forward-looking horizon of five years.

Under this pathway, the competitiveness of corporations would be reduced, the study found, leading to a higher probability of default and potential credit losses for the banks that lend to them.

It identified "substantial exposures" to misaligned counterparties, with non-EU corporations less aligned than those located in Europe. The exposure of banks to misaligned counterparties could also increase by more than 50% if existing credit lines to these corporations are fully utilised.

Some of the most misaligned credit portfolios have a relatively high exposure compared with their CET1 (most liquid) capital, the analysis shows, suggesting a potential impact on solvency for the banks concerned.

Transition vs physical risk tradeoffs

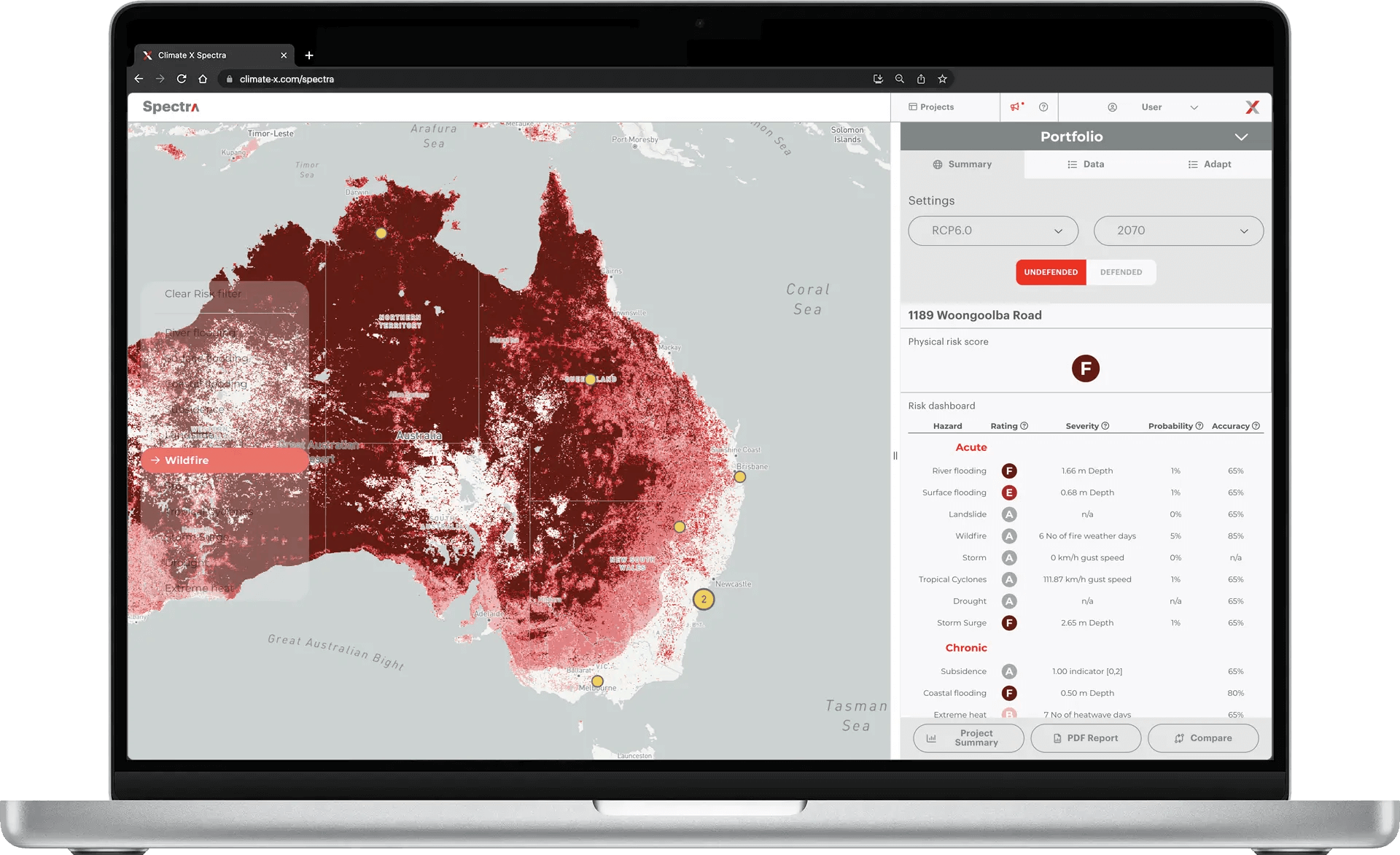

Although focusing on the transition risk from climate mitigation policy, the ECB study also has implications for physical climate risk due to the tradeoff between the two risk types.

While government and regulator policies leading to orderly and successful decarbonisation will increase the transition risk to corporations and the banks that lend to them, those policies will also reduce the physical risks from flooding, drought, wildfires, sea level rise and other climate impacts. Conversely, failure to reduce carbon emissions will lower transition risk but will also increase physical risk.

The exposure to transition risk highlighted in the study also has implications for the overall climate risk profile of banks.

As the ECB and other financial regulators increase pressure to mitigate climate risk to the financial sector, banks will have to balance their exposure to both physical and transition risk. Higher exposure to climate transition risk, such as that illustrated in the ECB study, will therefore require greater mitigation of physical climate risk.

Climate risk data

The European Banking Authority (EBA) has identified data availability and the estimation of losses as the two main challenges facing banks when assessing climate and other environmental risks and incorporating them into regulatory requirements.

In an October 2023 report the regulator said that "availability of relevant, high-quality and granular data... remains a challenge to risk classification and risk analysis" and warned that many ESG ratings or scores suffer from "poor quality, a limited and varying scope, and a lack of transparency on underlying methodologies".

In response to these deficiencies it has called for the development of environmental risk monitoring metrics at exposure, counterparty and portfolio level and for banks to take remedial action to close gaps they are facing in terms of climate and environmental data and methodologies.

ECB prioritises climate risk supervision

The ECB is growing increasingly frustrated at the failure of supervised banks to address climate risk and has already threatened 20 banks with significant financial penalties for continued non-compliance with climate risk management expectations.

In a speech introducing the enforcement measures, ECB vice-president of banking supervision Frank Elderson made clear that a failure to adequately manage climate and environmental risks is no longer compatible with sound risk management.

The failure to manage climate and environmental risks increasingly calls into question the fitness and propriety of those in charge of establishing and steering banks' practices. This is a situation we can not and will not accept"

Frank Elderson, European Central Bank Executive Board Member

ECB banking supervisors have followed through on Elderson's warning, making the management of climate-related and environmental risks one of their three supervisory priorities for 2024-2026 and identifying material exposures to both physical and transition climate risk as a "prioritised vulnerability" to the EU banking sector and financial system.

Referencing the record-breaking heatwaves, wildfires and floods recently experienced in Europe and other regions of the world, the central bank warned that "delayed climate action is expected to further increase physical and transition risks and, potentially, the related losses to banks".

ECB will use "full toolkit" to ensure bank compliance

EU Banks are expected to meet all supervisory expectations specified in the 2020 ECB Guide on climate-related and environmental risks by the end of 2024, including the full integration of climate risks into their Internal Capital Adequacy Assessment Process (ICAAP) and stress testing.

Some supervised banks still show "severe weaknesses” in meeting supervisory expectations for a full assessment of the climate impacts on their activities - the ECB said - while the quality of the disclosed information remains low.

This is a situation that EU banking regulators are clearly unwilling to tolerate.

"Going forward, ECB Banking Supervision will continue to use its full toolkit to ensure banks comply with these expectations," the ECB warned, including "supervisory escalation" such as periodic penalty payments or bank-specific capital add-ons.

Sources

- European Banking Authority (2023), "Report on the Role of Environmental and Social Risks in the Prudential Framework"

- European Central Bank (2024), "Banking Sector Alignment Report"

- European Central Bank (2023), "Speech by ECB President"

- European Central Bank (2023), "Supervisory Priorities"

- European Central Bank (2020), "Press Release"

- European Climate Law, "EU Action on Climate"

- International Energy Agency (IEA) (2021), "Net Zero by 2050"