Listed companies in Hong Kong and Singapore will be required to assess and report their climate risks in line with International Sustainability Standards Board (ISSB) standards as part of new climate and sustainability disclosure rules being implemented in both jurisdictions.

- The Stock Exchange of Hong Kong will require all issuers to make climate-related disclosures as part of their ESG reports from 2025, with the reporting period to begin on January 1, 2024.

- Singapore's Accounting and Corporate Regulatory Authority (ACRA) is implementing a similar rule, with issuers expected to report climate risks and other information from April 2025.

- Both regulations are explicitly aligned with the ISSB climate standards.

Global support for ISSB standards

Announced at Glasgow's COP26 in 2021, the ISSB was set up by the International Financial Reporting Standards (IFRS) board, the body responsible for global accounting standards that are applied in 168 jurisdictions across the world.

Following an extensive consultation process, it published the final version of its standards in June, 2023. They consist of IFRS S1 (requiring disclosure of general sustainability-related financial information), and IFRS S2 (requiring the assessment and disclosure of climate-related financial information, including climate risk).

The ISSB standards, largely based on the Taskforce on Climate-related Financial disclosures (TCFD) architecture, are intended to provide a consistent global baseline for sustainability-related financial disclosures. Although implemented locally, alignment with the standards offers comparable data for investors, lenders, regulators and other stakeholders concerned about their potential exposure to growing and diverse climate risks.

They are supported by the G7, the G20, the Financial Stability Board, the International Organization of Securities Commissions, Finance Ministers and Central Bank Governors from over 40 jurisdictions, and many other financial regulators and authorities.

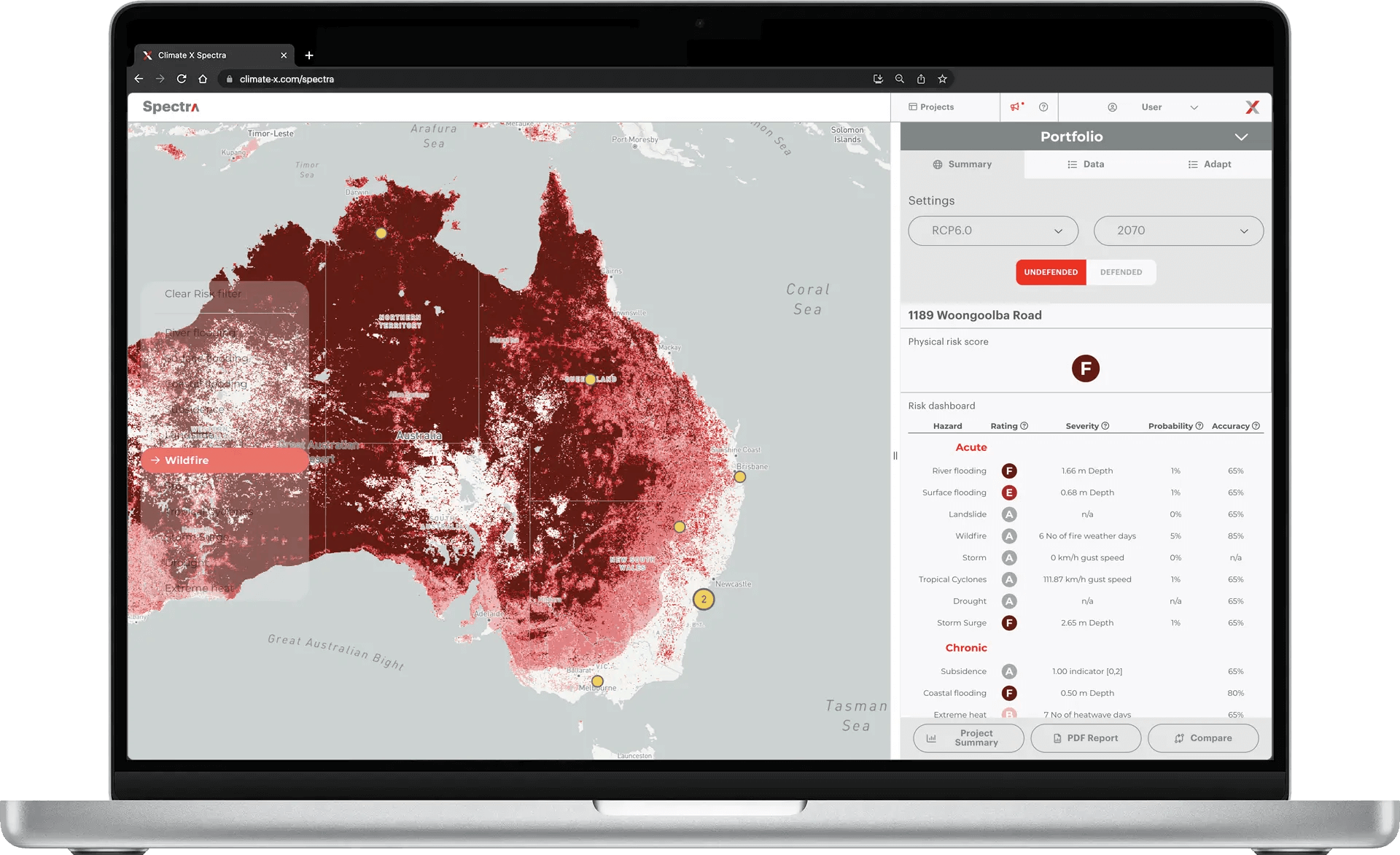

Under the IFRS S2 standard companies must assess and disclose their climate-related physical and transition risks over several time horizons. They are also required to disclose the processes used to identify, assess and monitor climate-related risks, including information about climate risk assessment, scenario analysis, data sources and monitoring. Companies are also required to disclose how processes for identifying and assessing climate-related risks are integrated into their overall risk management process.

China and Japan on path to mandatory ISSB disclosures

Hong Kong and Singapore are not the only Asian markets moving towards mandatory climate-related financial disclosures aligned with ISSB standards.

The Ministry of Finance of the People’s Republic of China (PRC) was involved in the development of the standards and is represented on an ISSB advisory forum, while Beijing hosts one of two ISSB offices in Asia. The ISSB standards are therefore likely to be integrated into the PRC’s 'Guidance for Enterprise ESG Disclosure', first issued last year. The Chinese environmental disclosure guidance is currently voluntary, but the China Securities Regulatory Commission has said that mandatory disclosure is the "next step" for regulators.

Meanwhile in Tokyo, location of the second Asian ISSB office, the Financial Accounting Standards Foundation of Japan is expected to release its draft standards for ISSB-aligned disclosures by the end of March, 2024.

These standards will be the subject of a public consultation process before a final version is adopted in 2025. Regulators in South Korea, Malaysia and the Philippines are also discussing and evaluating the implementation of ISSB-aligned disclosure standards, while the Institutes of Chartered Accountants in both India and Indonesia have expressed strong support.

Singapore banks already face climate risk disclosure expectations

While Hong Kong and Singapore's new climate disclosure rules are the first mandatory implementations of IFRS S1 and IFRS S2 in Asia, they are not the countries' first disclosure regulations.

The Monetary Authority of Singapore (the country's central bank and financial regulator) has required that banks identify climate and other environmental risks since the publication of its environmental risk management expectations and guidelines in 2020.

Under those guidelines banks must assess their climate-related risks and potential impacts at both the customer and portfolio levels. Hong Kong also has an existing climate-related disclosure regime for listed companies, albeit on a "comply or explain" basis and not explicitly aligned with the ISSB.

ISSB focusing on world wide adoption

Considering that the ISSB was only formed two years ago, the rapid movement from announcement to standards development and now to the beginning of implementation has been remarkable.

The extent of global support for the ISSB standards among corporate and financial regulators and authorities is also unprecedented, and it is clear that these standards will become mandated in more and more countries as investors and regulators seek internationally consistent and comparable data on climate risks and other environmental issues.

To assist in this process, the ISSB is preparing an 'adoption guide' to help jurisdictions incorporate IFRS S1 and IFRS S2 into national law and regulation.

The goal is comparability and consistency of sustainability-related disclosures for capital markets globally."

SSB Co-Chairs Erkki Liikanen and Emmanuel Faber

In the statement announcing the measure: "Our roadmap to adoption is focused on ensuring this is delivered through widespread adoption of both IFRS S1 and IFRS S2. The growing prevalence of the effects of sustainability-related risks and opportunities around the world are a reminder to us all of why we cannot delay".

Sources

- Bamboo Works (2022), "Navigating China’s New ESG Disclosure Guidelines"

- Bloomberg, Sheryl Tian Tong Lee (2023) "Hong Kong Stock Exchange to Tighten Climate Disclosure Rules"

- Hong Kong Exchanges and Clearing Limited (2023), "Exchange Publishes Consultation Paper on Enhancement of Climate Disclosure under its ESG Framework".

- IFRS (2023), About the International Sustainability Standards Board

- IFRS (2023), Cover note: Adoption Guide overview

- Latham & Watkins LLP (2023), "Asia Regulatory Update Newsletter December 2023".

- Monetary Authority of Singapore (2020), Guidelines on Environmental Risk Management for Banks

- Standards Board of Japan (SSBJ)(2023), Public Consultation Process