The Sustainable Development Goals and climate change action are often separated, potentially increasing physical risks to assets.

Action on one risk might cause problems for the other, if they are not better integrated. Sustainability and climate change action together can best manage risk overall.

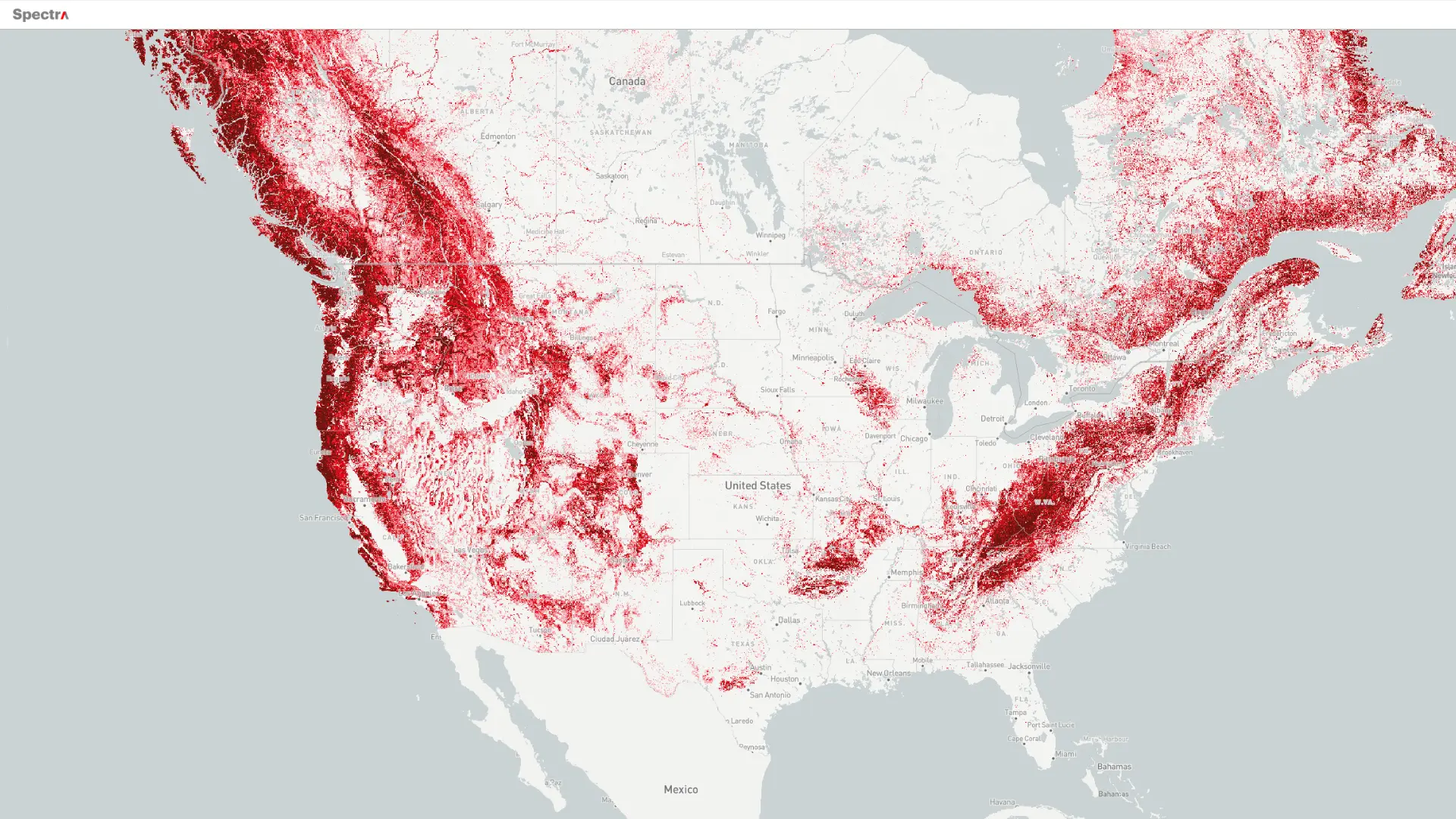

Imagine focusing only on climate change in the US.

Coastal buildings in low-lying areas of Miami and New York City might seem to be assets worthwhile divesting from. Then, go where? Perhaps west, since higher elevations of San Francisco and Los Angeles would be safer from sea-level rise. Any buildings there need to be checked for seismic safety.

And how close are these purchases to forests that burn? Or possibly in the path of mudslides accompanying downpours?

Even on the US east coast, in addition to fires and slides, earthquakes remain a major concern. Boston has been rocked by damaging tremors at least five times since Europeans arrived there while Charleston was heavily damaged in 1886. On that day, reports of damage even came in from New York City – which also felt the 2011 tremor centred in Virginia.

A priority on avoiding climate change risks can expose you to other risks.

A narrow focus on a single climate change risk might also lead to tunnel vision, neglecting others.

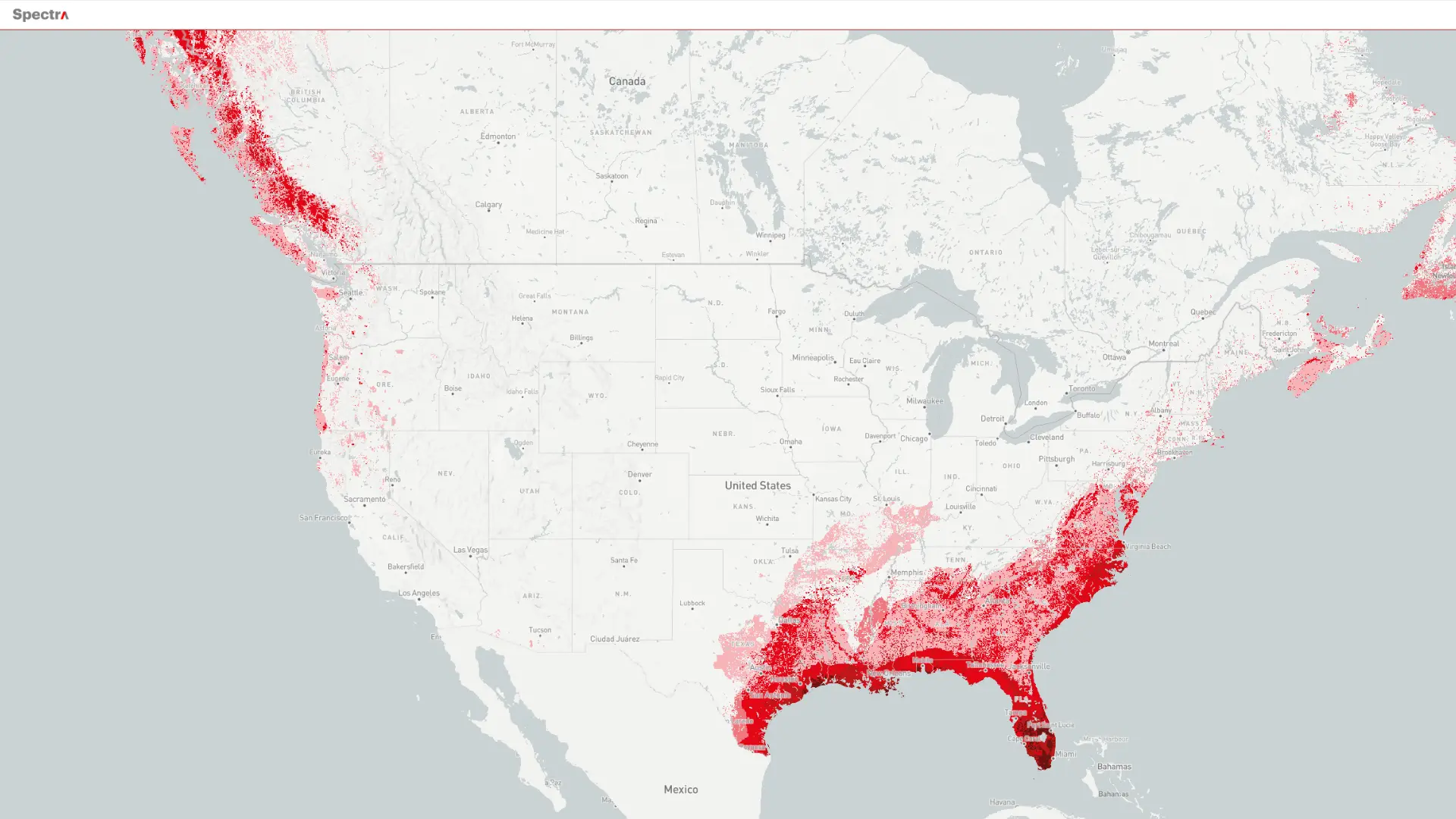

Perhaps you get out of low-lying coastlines around the US in order to limit risk to sea-level rise and storm surge due to increasing hurricane strength. Have you really managed your risks well if you end up in locations prone to hotter temperatures or more river flooding?

Risks beyond climate change

Or perhaps you end up in locations with other physical risks.

Asbestos fibres in buildings remain a liability concern across Australia. Last year in the UK, hundreds of schools were partly or fully closed immediately when the government suddenly publicised dangers of Reinforced Autoclaved Aerated Concrete (RAAC).

This concrete at its current age was long-known to be prone to collapse – and failures were happening. What is the responsibility of an asset manager to ensure that a building is designed or modified to reduce risks from an active shooter or terrorist bomb?

Out of all these physical risks, only climate change offers its own Sustainable Development Goal.

Goal 13 "Take urgent action to combat climate change and its impacts" has a little footnote giving responsibility for addressing climate change to the United Nations Framework Convention on Climate Change.

No other Goal diverts to another United Nations organisation, despite plenty of opportunities to do so. Preventing disasters is led by the United Nations of Office for Disaster Risk Reduction. Health is the remit of the World Health Organization. Neither demanded special mention in the Goals.

Nor does any other environmental change, hazard, or physical risk – from volcanic eruptions to El Niño – have its own Sustainable Development Goal. Even more confusing, Goal 13 on climate change explicitly addresses disasters, implying that all disasters can be linked to climate change – a false scientific statement.

But is this really a problem?

While those working on climate change might see themselves as separate, the real issue is dealing with physical risks in a fragmented way. It makes us wonder if managing these risks separately is truly effective or efficient.

Data for adapting to all risks

Emphasising climate change might distracts us away from other difficulties.

We lose sight of other Sustainable Development Goals, such as Goal 5 "Achieve gender equality and empower all women and girls" and Goal 3 "Ensure healthy lives and promote well-being for all at all ages".

Investing in resilient assets to tackle climate change risks, as urged by Goal 13 of the UN Climate Convention, is important. But, we shouldn't forget our duties to meet other Goals.

What responsibility do asset managers also have to invest in schools that girls can attend (for Goal 5) or in hospitals open to everyone (for Goal 3)?

Ultimately, this responsibility might be none or it might be extensive.

Every asset manager needs to examine the full range of risks to which they are exposed and how to adapt to those risks, collecting data on them all, without being distracted by a single topic.

Even considering the weather, it changes for many reasons other than human-caused climate change. Neglecting some weather changes as well as other environmental hazards could come back to haunt any asset manager. As could presuming that wider risks, such as from all pollutants and from social expectations including equity and safety, are lower priority than climate change.

Solid, accurate data on physical risks can help to place climate change appropriately within all risks.

Rather than assuming that a coastal property must be at immediate risk from sea-level risk, knowing the timeframe contributes to prioritising which physical risks to adapt to.

If the models show that heat is an imminent major problem, then adaptation measures are needed now. Determining the balance of physical risks offers pathways to the logistics of divesting from some assets in order to acquire others.

Succeeding in adaptation and more

In 1954, Hurricane Hazel ripped through Ontario, killing over 80 people around the province. Around a third of the deaths occurred along a single Toronto street, Raymore Drive, that had been built in the floodplain.

In the catastrophe’s aftermath, within much wider changes to how the area in and near Toronto was governed, rivers were turned into green spaces.

The floodplains were permitted to be floodplains, without inhabited structures and with cycling and walking paths for recreation and commuting. Generations of Torontonians have grown up with environmental education in the middle of their expanding city, enjoying deer meandering around at dawn and the spring flowers blooming on the river banks.

When a hurricane passes by, as with Hurricane Sandy in 2012, the rivers transform into raging torrents, spreading muddy water across paths and toppling trees due to significantly increased runoff as farmland transitions into suburbs. But rarely a disaster.

Without people living in the ravines, the floods do not become flood disasters. Then, Toronto’s green areas absorb air pollution, preventing healthcare costs and infrastructure damage. They also encourage positive physical and mental health, leading to one municipal motto of 'a city within a park'.

While location matters and the potential for disaster remains across Toronto, multiple Sustainable Development Development Goals are tackled simultaneously – thanks to initiatives implemented decades before the Goals were conceived.

Acting on a single set of risks in the short-term does not properly stress test the risks to which your assets expose you. Conversely, it can cause problems for other risks.

To best manage risk overall, use climate risk data as a subset of sustainability actions. Asset managers must compare, account for, and document all risks across their assets.

Integrating Climate Risk with your investment cycle

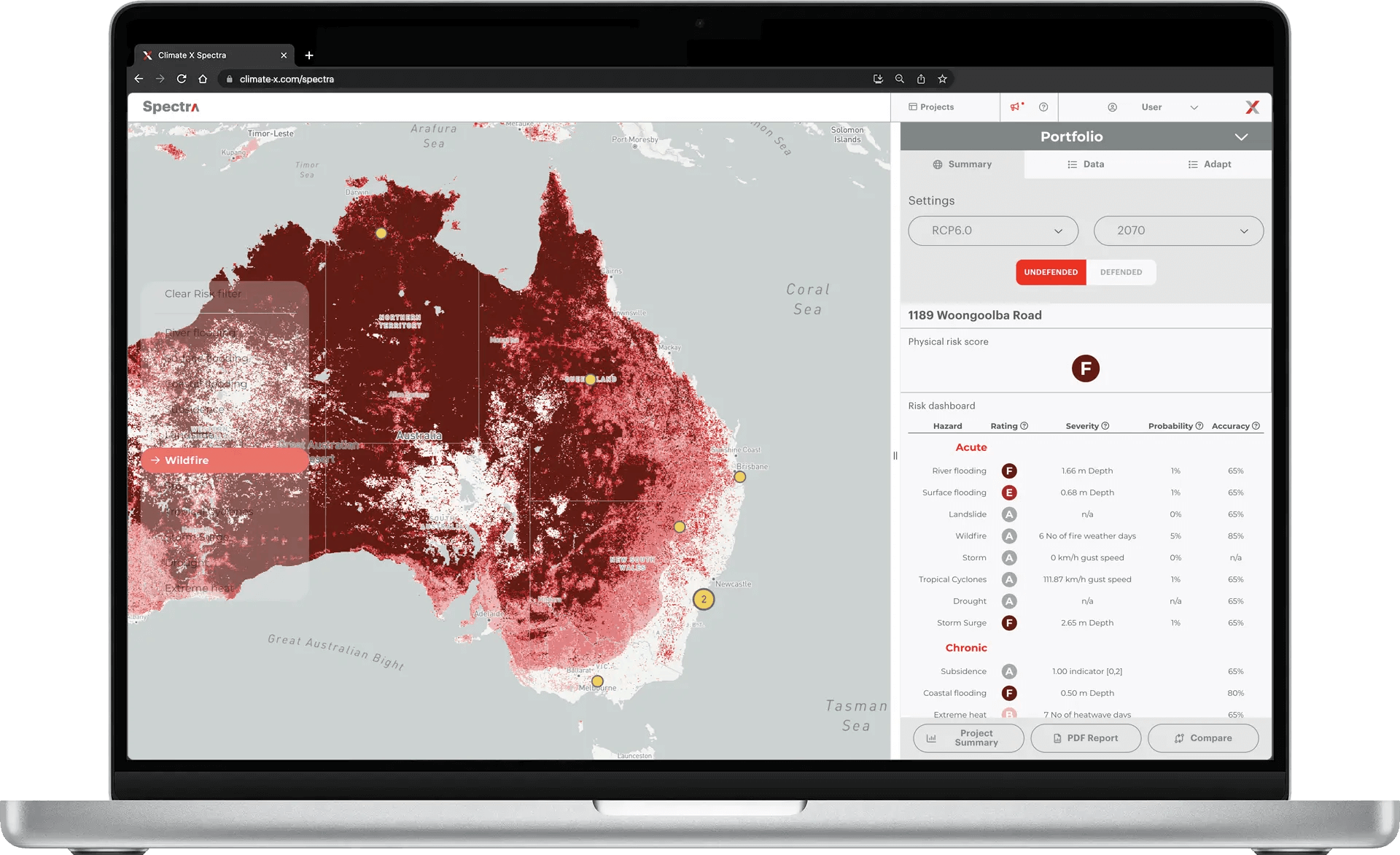

Climate X is the world’s only fully integrated climate risk platform, helping asset managers to price, manage and build resilience to climate change impacts on the built environment.

Identify risks from extreme weather in your portfolio, quantify asset-level financial losses and plan climate adaptation measures - all within few clicks with our SaaS platform, accessible via web application or API.