Financial institutions are not providing well-substantiated climate disclosures. Investors and regulators, as well as supervisors and customers, are demanding increased transparency from banks when it comes to their climate and environmental disclosures, on points such as their material exposure to climate-related risks and the methodologies they use to assess their vulnerability.

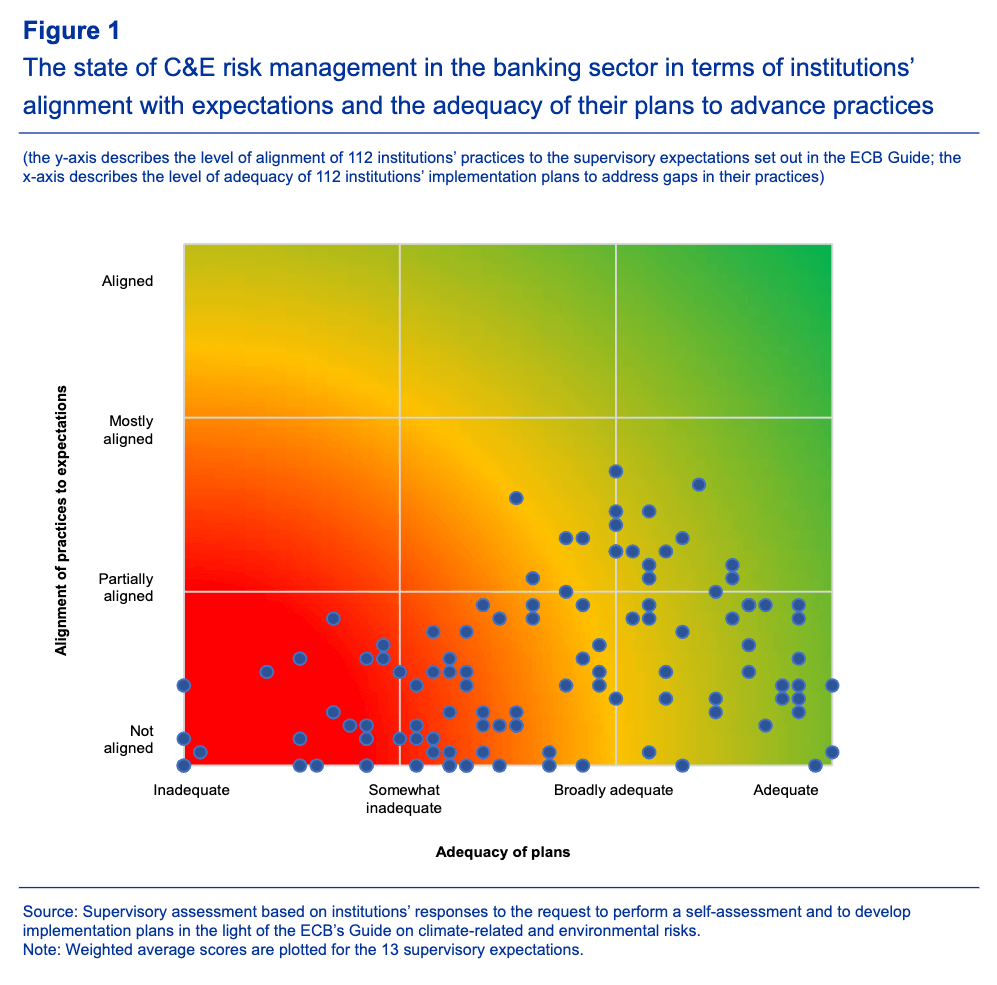

The European Central Bank (ECB) has shared the results from its 2021 supervisory assessment which was regarded as "an unprecedented stocktake of European banks' preparedness to adequately manage and disclose their exposure to climate-related and environmental risks."

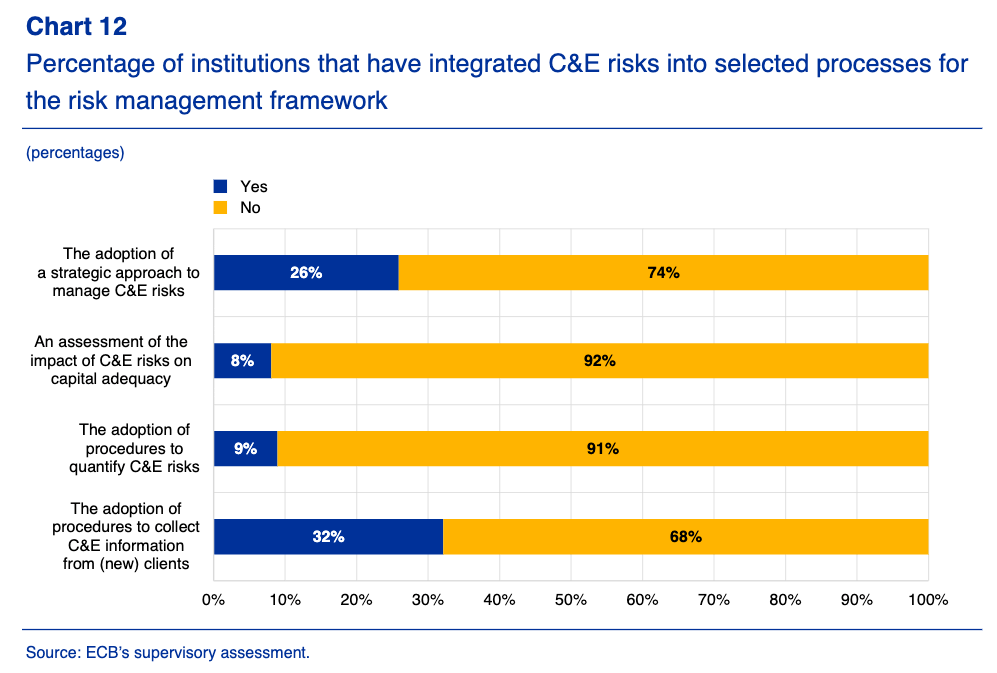

It highlights that in the banking sector, 45% of institutions significantly lack both transparency and adequate metrics when conducting their risk assessments and evaluation.

The ECB views climate-related and environmental risks (C&E risks) as key risk drivers for the banking sector – already making credit, market, and operational risks greater, C&E risks are predicted to increase their impact across sectors and countries in the future.

The key gaps identified by the 2021 ECB assessment on banks' climate-related and environmental risks

- Around 75% of the institutions do not disclose whether climate-related and environmental risks have a material impact on their risk profile.

- 57% of the institutions in the sample still do not describe the potential strategic impact of either transition or physical risk.

- None of the institutions are close to fully aligning their practices with the supervisory expectations. This means that only 20% of the banks in the assessment disclose their methodologies, definitions, and criteria for all of the figures, metrics, and targets reported as material, whereas the supervisory expectations outlined by the ECB require the full disclosure of such information.

Furthermore, KPMG, an international accounting organisation, reports that 85% of financial organisations believe their Board and management need some or considerable improvement in their ability to deal with climate risk.

Transparency and adequacy

The analysis showed that none of the banks disclosed all the basic information on climate-related and environmental risks that would align with the ECB's expectations. The list of expectations, which can be found here, describes how institutions should approach climate-related and environmental risks. They provide a guiding baseline that financial organisations should follow to increase the transparency of their disclosures.

For example, Expectation 13 states that "institutions are expected to disclose meaningful information on climate-related and environmental risks that they deem to be material", thus promoting better and more substantial reporting on climate-related risks. It is advocating for the inclusion of details on methodologies, resources, and all potential material risks relevant to the respective business.

The ECB report shows that while some banks are already using stress testing in their risk management, the quality of the scenario analysis itself has not been assessed. So far, financial institutions have only had to make a reference to whether they are using certain tools when measuring their climate risk exposure rather than disclose if their methodologies are useful and substantial enough to result in adequate reports.

Regulation

Regulations and government policies are key drivers of systemic change. The "European Commission's Strategy for Financing the Transition to a Sustainable Economy" shares that regulations need to include cooperation between public and private finance and be implemented in a timeframe that aligns with international climate goals of reducing emissions. Otherwise, an untimely adoption of proper regulations can lead to disruptive readjustments in the future, with complications for financial stability.

Financial institutions should work closely with policymakers to develop regulations that will drive a deeper understanding of climate and environmental risks, which can, in turn, help outline certain investment opportunities for them:

Through the assessment of climate and wider ESG risks for investors and their mitigation, [financial bodies] can reach the ultimate goal of portfolio alignment with the Paris Agreement."

Science Based Targets: Private Equity Sector SBT Guidance

Risk management

How can banks and other financial institutions implement meaningful and accurate risk management processes in their strategies?

Scenario analysis and stress testing are really useful tools for risk identification and assessment of climate-related risks. What seems to have not had much time under the spotlight, however, is the fact that a detailed understanding of risk is crucial, as without it there can be no effective action. Financial bodies need to be fully aware of all physical and transitional risks climate change and extreme weather can have on their portfolios and picking the right sources to do so is a hard but vital element of risk management. The implementation of systems that allow businesses to have a complete overview of their risks is a key step in the portfolio alignment process.

The good news is that businesses are realising the importance of risk analysis and are actively looking to undertake the appropriate assessment to align their strategies to relevant regulations and evaluate the risks climate change poses to their assets, as per the FCA's report.

KPMG also report an increase in the percentage of institutions that describe their process of identifying and managing climate-related risks:

75% Financial Services responders that identified climate-related risks with the potential to have strategic or financial business impact."

KPMG: Climate-related and environmental risks

However, climate risk management is a new practice for many firms and can present certain distinctive challenges such as access to required reliable data and lack of accurate modelling and resourcing. This means that many institutions may not have the best tools at hand to conduct proper climate scenario analysis and integrate accurate and complete stress testing into their risk management.

Physical climate risk analysis requires relevant and specific climate and asset-level or portfolio-level data and information. While there is a significant amount of climate data openly available, navigating the vast number of sources and types of data can be challenging and may require complex processing systems. This has been another pain point for many businesses, as gathering aggregate data is a complicated process that can produce unreliable results and, therefore incomplete risk analysis.

This was the starting point of Climate X's story: while looking for reliable data to help them to build accurate and specific reports in the banking industry, Lukky Ahmed and Kamil Kluza couldn't find acceptable, transparent, and explainable data. "Climate X Spectra has been designed by a team of climate scientists, engineers, and finance experts to smoothen the path for governments and businesses worldwide to use data they understand and trust to make multi-generational climate-informed decisions," said Lukky Ahmed, co-founder and CEO at Climate X.

Both the ECB's assessment and KPMG's study show that even though many financial institutions are aligning their strategies with ESG goals, a large number are not considering the long-term implications climate change can have on their businesses. Many organisations are already in line with the steps for near-future risk mitigation, such as considering and reviewing current climate and ESG (Environmental, Social, and Governance) data, integrating it into their stress tests, and reporting on key risks. However, there is more they can be doing to ensure a smoother transition to full regulatory compliance and substantial risk assessment of their business operations. In the mid to long-term, businesses should be thinking about how to improve and expand their stress testing methods, extend them to make sure they cover all relevant possible climate risk types and expand and align their KPIs with the desired outcomes of their risk assessments.

Central banks can be a catalyst in encouraging other financial institutions to review their portfolios and tailor them to include the principles of sustainable management. An example here could be the Banque de France. They were the first European central bank to adopt a Responsible Investment Charter in 2018 for its own funds' portfolios. The charter refers to the precise commitments through which the bank intends to make its work on a sustainable model for economic growth. In this case, it means that Banque de France's financial operations are currently aligned with a 2°C strategy, with the plan to get this lowered in line with a 1.5°C strategy.

As it has become evident, one of the main struggles financial organisations are currently facing is finding reliable and accurate data to rely on and conduct their risk assessments with. It is a long and meticulous process that can take a lot of effort to follow through, but here at Climate X, we can help you navigate your climate risk journey.

Next steps

Start your journey today, and book a demo to see Climate X Spectra in action.