Data constraints in climate risk assessments make them unsuitable for effectively measuring the true degree of climate-related risks. Good data is thus key to enabling the financing flows for the energy transition and equally to managing climate risks. The Network for Greening the Financial System (NGFS) - a global grouping of central banks and financial authorities - has laid out its policy recommendations to improve the availability, quality, and comparability of climate-related data.

The urgency of climate-related risks is echoed in the rapidly emerging frameworks and regulations for their standardisation and disclosure. Obligatory disclosure makes climate risk assessment a crucial matter for companies, their investors, and insurers.

Following COP26, initiatives zeroing in on climate-related data have intensified. Policy and regulatory efforts related to the harmonisation of sustainable finance taxonomies and global disclosure standards have focused on three areas:

- The design of sustainable finance classifications and taxonomies (e.g. deployment of the EU Taxonomy);

- Corporate and investor disclosures (exhibited, e.g. by the EU Corporate Sustainability Reporting Directive, the recent proposal by the US Securities and Exchange Commission or climate-related financial disclosure legislation in the UK);

- The standardisation of sustainability information (e.g. the International Financial Reporting Standards Prototype for Climate-related Disclosures Requirements or the formation of the International Sustainability Standards Board).

Analytical tools, methodologies, benchmark indicators, and financial institutions’ commitments all highlight gaps across several dimensions of climate-related data, mainly its availability (e.g. coverage, granularity, accessibility), reliability (e.g. quality, auditability, transparency), and comparability.

Indeed, the financial and corporate sector has usually circumvented these issues by using "simplistic, top-down approaches that prioritise global coverage," for example, applying uniform global climate datasets with no regional sensitivities or having "the same damage function used for all office buildings irrespective of construction type or location," as Alberto Arribas and colleagues summed it up in their recent contribution in Nature Communications.

Central banks to the Rescue

Central banks and financial oversight authorities are also aware of the climate data-related challenges. Over a hundred of them are grouped under the Network for Greening the Financial System (NGFS) umbrella to share best practices for enhancing environment and climate risk management in the financial sector.

In July, the NGFS published its final report on bridging climate data gaps, systematically mapping them and proposing policy recommendations and solutions aimed at bridging them.

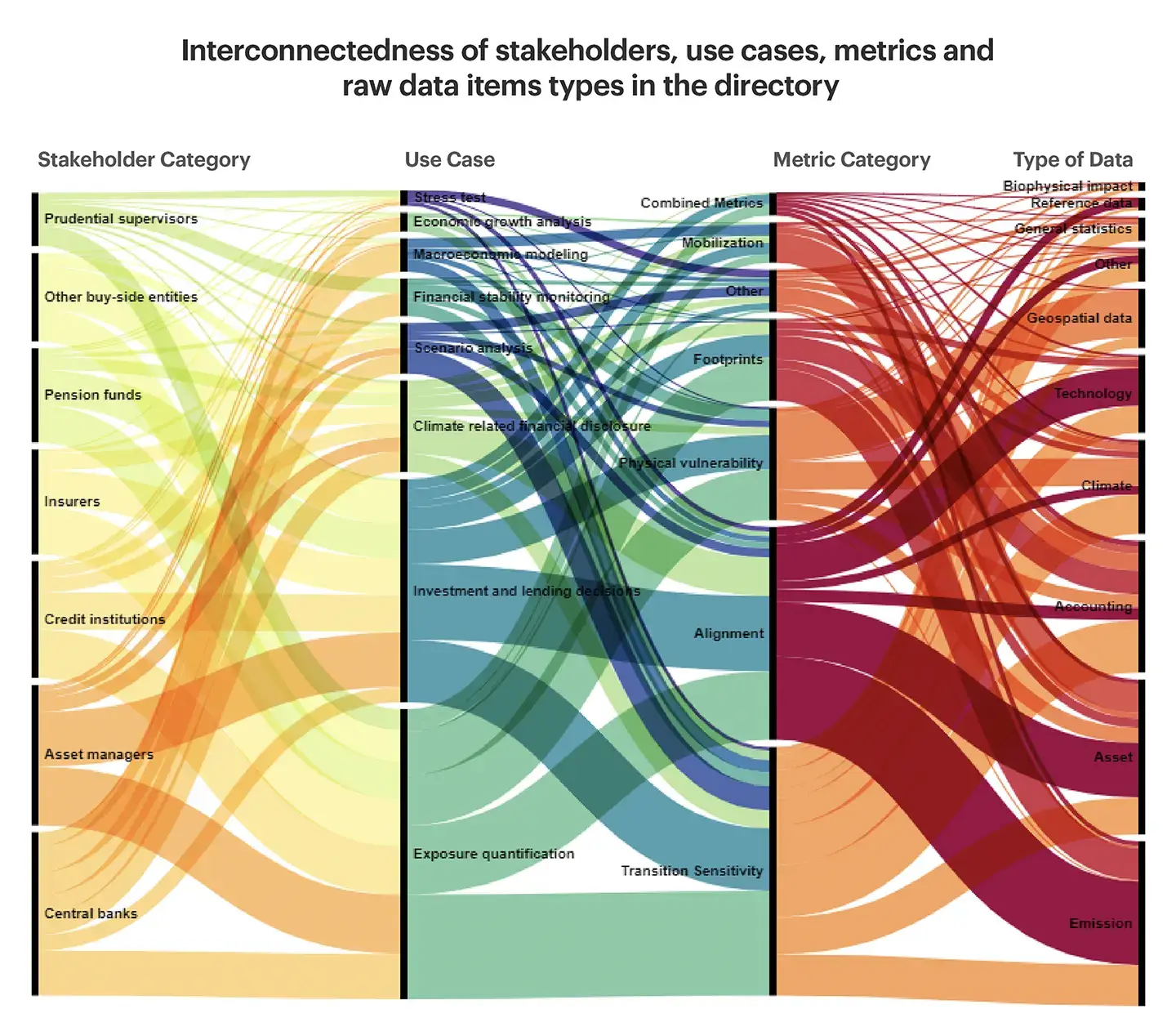

The NGFS has taken stock of available climate-related data, considering various use cases (e.g. stress tests or exposure quantification) for different stakeholder groups (e.g. insurers or asset managers). The final directory references over 300 unique metric/methodology combinations, over 1,200 raw data items and more than 700 links to data sources based on the needs of the financial sector.

Based on the analysis of the directory, the NGFS concludes that the largest gaps are concern biophysical impact, emissions, and geospatial data, thus limiting the usability of metrics related to "physical vulnerability" as well as "transition sensitivity," which are the main metric types that benefit from these three raw data inputs. Overall, the NGFS identifies nine key challenges for climate-related data (see figure below):

Against this background, the NGFS’s final report gives specific policy recommendations for improving the quality, availability, and comparability of climate-related data.

Fostering convergence towards a common and consistent set of global disclosure standards

On top of the creation of the ISSB, the NGFS believes it is vital that the availability of "decision-useful granular data on emissions" and the reliability of reported data be increased.

The body advocates for closer dialogue among standard setters, regulators and supervisors, as well as the financial industry and non-financial entities, to identify existing limitations in the quality of reporting. It also voices the need for a global-level discussion through the ISSB to develop more granular, sector-based methodologies for climate-related disclosures. Moreover, it favours increasing reporting requirements for non-financial corporations.

Increasing efforts towards mutually shared and operationalised principles for taxonomies and sustainable finance classifications

The second recommendation speaks of a need to harmonise taxonomies and sustainable finance classifications globally. While agreeing on regional ones is already a tough row to hoe (as evident from the seemingly endless negotiations on the EU taxonomy), the NGFS is hopeful that having comparable and consistent data can help achieve this objective.

The body stresses that developing use cases in collaboration with the private sector is important. Moreover, the NGFS advocates for increasing linkage between the taxonomies on the one hand and disclosure or data-related measures on the other. This would not only improve data availability but also, eventually, move us towards interoperable and more globally consistent classifications.

Developing well-defined and decision-useful metrics and methodological standards

For the NGFS, this starts with harmonising forward-looking metrics. This should be based on collecting more granular data, especially asset-level geographical data, which in turn should be audited for quality. The NGFS bets on developing partnerships with non-financial institutions, particularly those designing energy-climate scenarios, such as the IEA or the IPCC.

Better leveraging available data sources, approaches, and tools

While the NGFS directory, being a public tool, is itself an important step in this direction, the body insists on leveraging existing global platforms and standard setters, such as the International Platform on Sustainable Finance and the ISSB to enhance capacity building and knowledge-sharing in this area.

The NGFS goes on to recommend further training to assurance professionals on decisive climate-related data and indicators. Lastly, it should be about harnessing new technologies, e.g., machine learning, artificial intelligence, or improved satellite data.

Improving Climate Data Architecture

The implementation of these recommendations will help foster progress on what the NGFS calls the "three building blocks" of the climate data architecture, i.e., a common set of global disclosure standards; finding the smallest common denominator for a global taxonomy, and the development and transparent use of well-defined metrics and methodological standards.

Closing data gaps and strengthening the climate information architecture is also crucial to monitoring and "pric(ing) risks to the financial sector stemming from climate change as well as to foster(ing) private sustainable finance markets needed to fund the transition to a greener economy," says Fabio Natalucci, co-Chair of the NGFS workstream "Bridging the data gaps" and Deputy Director of the Monetary and Capital Markets Department at International Monetary Fund.

The NGFS’s Workstream on bridging the data gaps is now supposed to evolve into an internal data expert network.

Where Climate X steps in

The efforts by the NGFS show how ensuring the quality of climate-related data remains an obstacle to appreciating risks properly. And this is what you need to build resilience. Thankfully, tools exist that can help you can get ahead.

Our climate risk platform Spectra leverages the latest climate models with some of the most accurate real-world data on weather patterns and events. We can help you assess the potential climate-related threats to your assets and portfolio, so you can put your mind at ease, knowing you have done your due diligence.

Get in touch with our team and discover how you can leverage top-notch data to your advantage.

Sources

- https://www.ngfs.net/en/final-report-bridging-data-gaps

- https://www.climate-x.com/articles/industry/what-are-the-key-gaps-in-banks-and-financial-institutions-for-climate-risk-disclosures

- https://www.sec.gov/news/press-release/2022-46

- https://www.gov.uk/government/publications/climate-related-financial-disclosures-for-companies-and-limited-liability-partnerships-llps

- https://www.nature.com/articles/s41467-022-31979-w (Arribas, A., Fairgrieve, R., Dhu, T. et al. Climate risk assessment needs urgent improvement. Nat Commun 13, 4326 (2022). https://doi.org/10.1038/s41467-022-31979-w)

- https://www.ngfs.net/en/communique-de-presse/ngfs-publishes-its-final-report-bridging-data-gaps