The European Banking Authority (EBA) has recommended adding climate and other environmental risks to the Pillar 1 framework, proposing that their contribution to market, credit and operational risks be factored into bank capital and leverage ratio requirements.

Among other measures, the proposals would require banks to incorporate environmental risks into internal stress testing programmes, consider environmental risks in the valuation of property collateral, and identify whether environmental and social risks might trigger operational losses.

"The main priority remains for institutions to develop techniques to identify how and to what extent environmental and social risks translate into financial risks," the EBA said in a report published on October 12, 2023.

"For environmental risks, in particular, this implies institutions being able to identify whether a realised loss is linked to environmental factors and the extent to which the market prices environmental risks, as well as to incorporate environmental factors into their own assessments."

Background

The EBA was required to consider the prudential regulation of environmental risk by both the EU Capital Requirements Regulation and Investment Firms Regulation.

In fulfilment of this mandate, it published a discussion paper in May 2022 exploring whether and how environmental risks might be incorporated into Pillar 1.

The current proposals are based on feedback received from a consultation process based on that paper, as well as on input from the European Commission's High-Level Expert Group on Sustainable Finance and the European Systemic Risk Board. They form part of the EBA’s broader sustainability-related work as outlined in its December, 2022 Roadmap on Sustainable Finance.

Proposal for 13 Actions over the Three Years

The EBA report includes a total of 32 policy recommendations of which 13 are short-term actions to be taken over the next three years as part of the implementation of the revised Capital Requirements Regulation and Capital Requirements Directive (CRR3/CRD6).

Specifically, the EBA is proposing to require that climate and environmental risks be incorporated into:

- The valuation of immovable property collateral.

- External credit assessments by credit rating agencies.

- Due diligence assessments

- Assessment of potential operational risk losses.

- Supervisory reporting metrics

- Stress testing programmes under the Fundamental Review of the Trading Book (the capital rules governing banks’ wholesale trading activities).

Proposals for Scenario Analysis and Revisions to IRB Formula

In the medium-to-long term, the EBA suggests 19 revisions to the Pillar 1 framework to incorporate environmental and social risks.

These include:

- Requiring the use of scenario analysis to enhance the forward-looking elements of the prudential framework.

- Adding climate and environmental risk to the Internal Ratings Based (IRB) supervisory formula and corresponding standardised approach for credit risk.

- Introducing climate and environment-related concentration risk metrics to the Pillar 1 framework.

- Examining the role of transition plans as part of the development of further risk-based enhancements to the Pillar 1 framework.

The EBA also promises to "continue strengthening the integration of environmental and social risks across all pillars of the regulatory framework" to ensure that the banking sector remains resilient during the transition towards a more sustainable economy.

Emphasis on High Quality and Transparent Data

Data availability and the estimation of losses are the two main challenges that should be considered when assessing ESG risks and incorporating them into regulatory metrics, the EBA emphasises.

Availability of relevant, high-quality and granular data remains a challenge to risk classification and risk analysis"

EBA Report "On the role of Environmental and Social Risks in the Prudential Framework", October 2023

The report also warns that many ESG ratings or scores suffer from "poor quality, a limited and varying scope, and lack of transparency on underlying methodologies".

For example, the effect of flooding, wildfire and other acute climate impacts depend on the unique characteristics of the location in which an asset is situated. One building may flood while a nearby building at a higher elevation may be spared. Realistic climate risk assessments must therefore account for these granular and location-specific factors, hence their importance to prudential risk management and regulators.

The quality of data used can vary widely as well, depending on how and when that data is collected. Some data sources use extrapolation techniques that may miss highly localised characteristics of an individual asset’s location whose importance we highlighted above.

For regulators, investors and other interested parties to accurately assess asset-level risk it is therefore crucial that the approach, sources and methodologies used to develop asset-level data are fully transparent, allowing users to determine its quality.

The Solution

Although the performance of European banks in meeting ECB climate-related expectations remains low, help is available in the form of easily accessible, high quality, granular and transparent climate data.

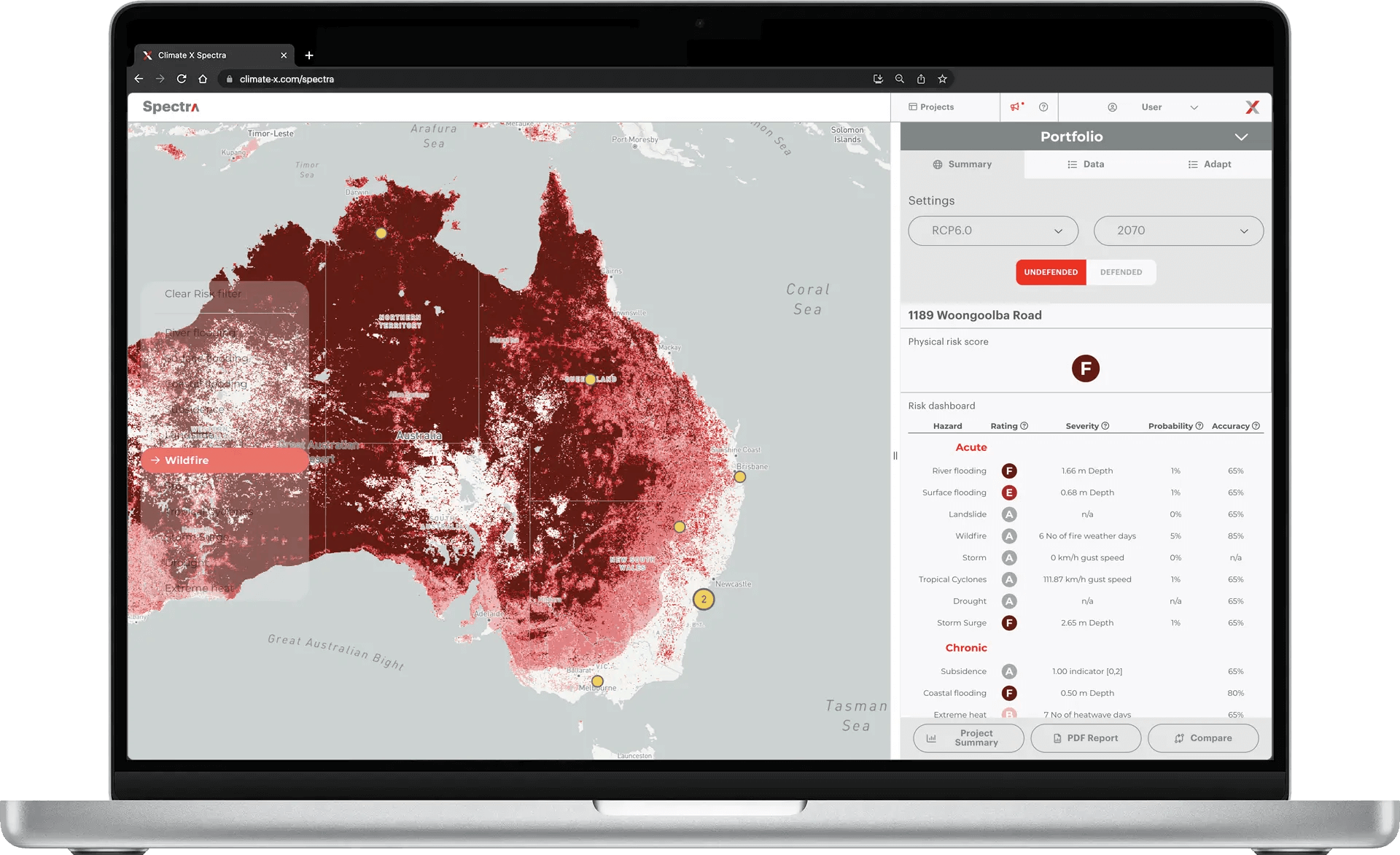

Climate X's enterprise-wide solution, Spectra, supports your capital adequacy decisions with location-specific climate risk data and loss estimates complete with methodology and sources. We produce both asset and portfolio-level outputs and support API integrations with softwares such as PowerBI Enterprise, Qlik View and Tableau.

Spectra has been developed by a team of climate and data scientists from the MIT, University of Oxford, Harvard University and more, and has been vetted by world-renowned academics and research institutes.

Our models are backtested and validated by comparison with real-world data, and our data is updated regularly. We share all source documentation, limitations, methodologies and estimates of regional accuracy with our customers to ensure complete transparency.

Our customers in the banking industry use our enterprise-wide risk solution to extract climate risk data across different asset classes/functions, everything from RCR resi mortgages, corporate, CRE, to operations.

Growing Concern About Bank Exposure to Climate Risk

As the impacts of climate change accelerate in both frequency and intensity, the EBA’s proposals for the incorporation of these risks into Pillar 1 requirements reflects growing concern about the exposure of banks and of the wider financial system.

A 2022 European Central Bank climate risk stress test of 41 significant European banks found that all were exposed to the materialisation of acute physical climate risks to varying degrees.

Drought, heat events and floods were the major physical climate threats identified, with bank exposures closely linked to the geographical location of their lending activities.

In some cases the materialisation of such risks could lead to "non-negligible losses", the exercise found. It also "clearly illustrated that further work is needed on the part of many institutions to gather and manage data with climate-relevant breakdowns."

EBA Proposals Part of Global Moves on Climate Risk to Banking

Although the EBA is the world's first banking authority to propose the incorporation of environmental risks into its Pillar 1 requirements, work in this area is also underway at an international level through the Basel Committee on Banking Supervision (BCBS).

The BCBS published two analytical reports on climate-related financial risks in 2021, followed by a series of principles for the effective management and supervision of climate-related financial risks in 2022.

It is currently investigating the extent to which climate-related financial risks can be incorporated into the existing Basel framework and has already released a series of FAQs on how such risks may be captured in existing Pillar 1 standards.

The BCBS has also begun a public consultation on a Pillar 3 disclosure framework for climate-related financial risks, part of its mandate to strengthen the regulation, supervision and practices of banks worldwide in order to ensure global financial stability.

In a statement announcing the consultation the Committee said that the initiative formed part of its "holistic approach" to addressing climate-related financial risks to the global banking system.

The consultation will remain open until the end of February, 2024 with a revised or final proposal expected in the second half of the year.

Sources

- European Banking Authority (EBA) Press Release (2023): "EBA recommends enhancements to Pillar 1 framework to capture environmental and social risks".

- European Banking Authority (EBA) Report (2023): "Report on the role of environmental and social risks in the prudential framework".

- European Banking Authority (EBA) Discussion Paper (2022): "EBA launches discussion on the role of environmental risks in the prudential framework".

- European Banking Authority (EBA) Roadmap on Sustainable Finance (2022): "EBA publishes its roadmap on sustainable finance".

- European Banking Authority (EBA) Report on the Management and Supervision of ESG Risks for Credit Institutions and Investment Firms (2021): "EBA publishes its report on the management and supervision of ESG risks for credit institutions and investment firms".

- European Central Bank (ECB) Climate Risk Stress Test (2022): "Climate risk stress test".

- Bank for International Settlements (BIS), Basel Committee on Banking Supervision (BCBS) Analytical Reports (2021): "Press Release: analytical reports on climate-related financial risks".

- Basel Committee on Banking Supervision (BCBS)(2022) "Principles for the Effective Management and Supervision of Climate-Related Financial Risks".

- Basel Committee on Banking Supervision (BCBS)(2022) "Frequently Asked Questions on Climate-Related Financial Risks".

- Basel Committee on Banking Supervision (BCBS)(2022) "Basel Committee Disclosure Framework Consultation for Climate-Related Financial Risk"