Spectra supports major European bank in its stress testing and backbook analysis, yielding a better-informed commercial strategy.

The solution was chosen due to a number of factors, including accuracy, breadth of offering and Climate X’s deep understanding of the financial services industry combined with flexible and scalable technology. The client is now considering baking Climate X Spectra into its climate-related activities.

The European Tier 1 Bank

Full-service Tier 1 digital bank with a heritage stretching over 180 years. They enjoy a globally recognised brand and are listed on the London Stock Exchange. Their focus is primarily on retail, business banking and agriculture.

A Growing Challenge

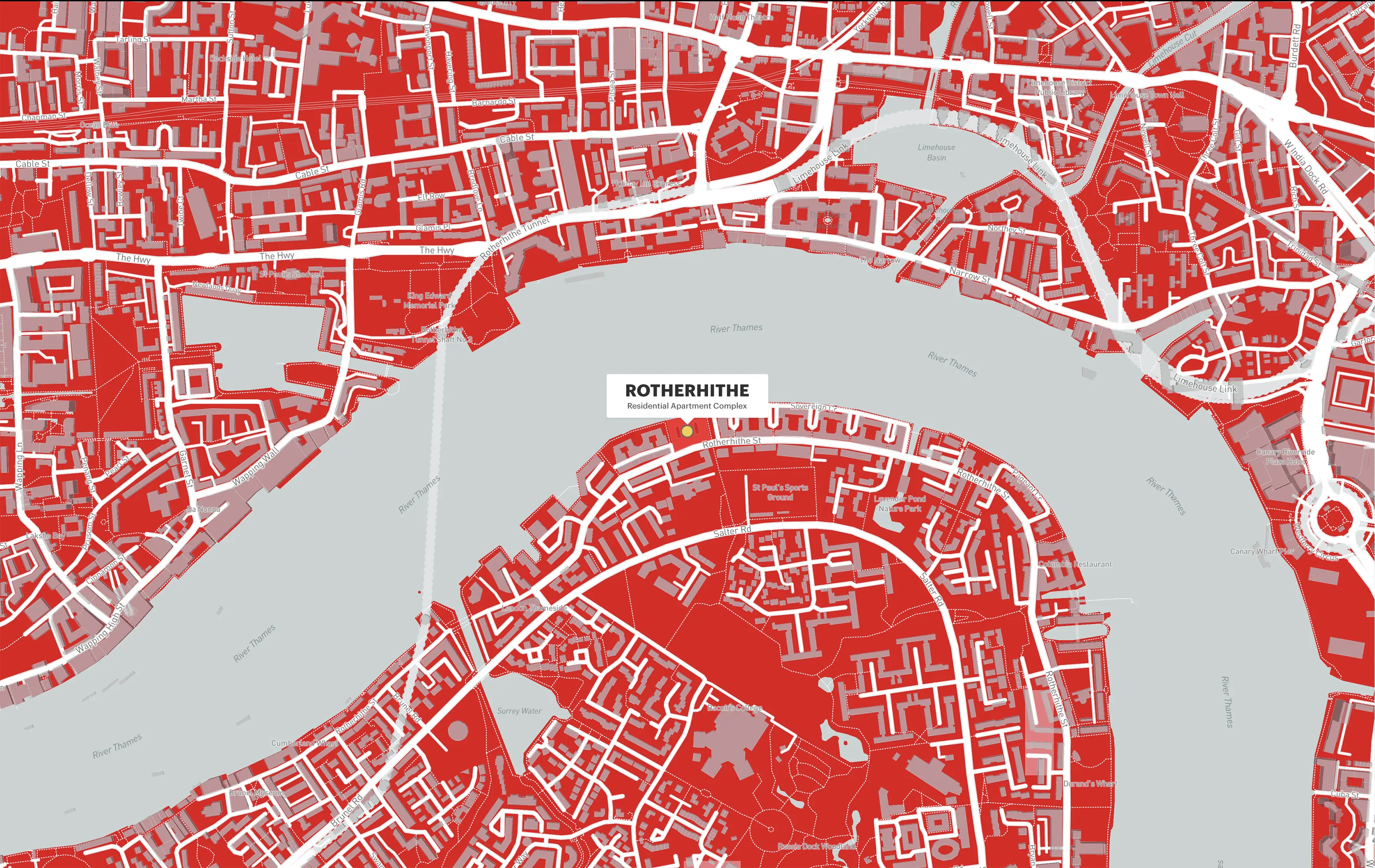

The customer approached Climate X as they searched for a provider offering high-resolution and high-accuracy climate risk data as part of their backbook commercial analysis and a regulatory stress test. Such exercises have become a new norm in Europe and APAC regions, and are extending globally, including US banks under the Federal Reserve.

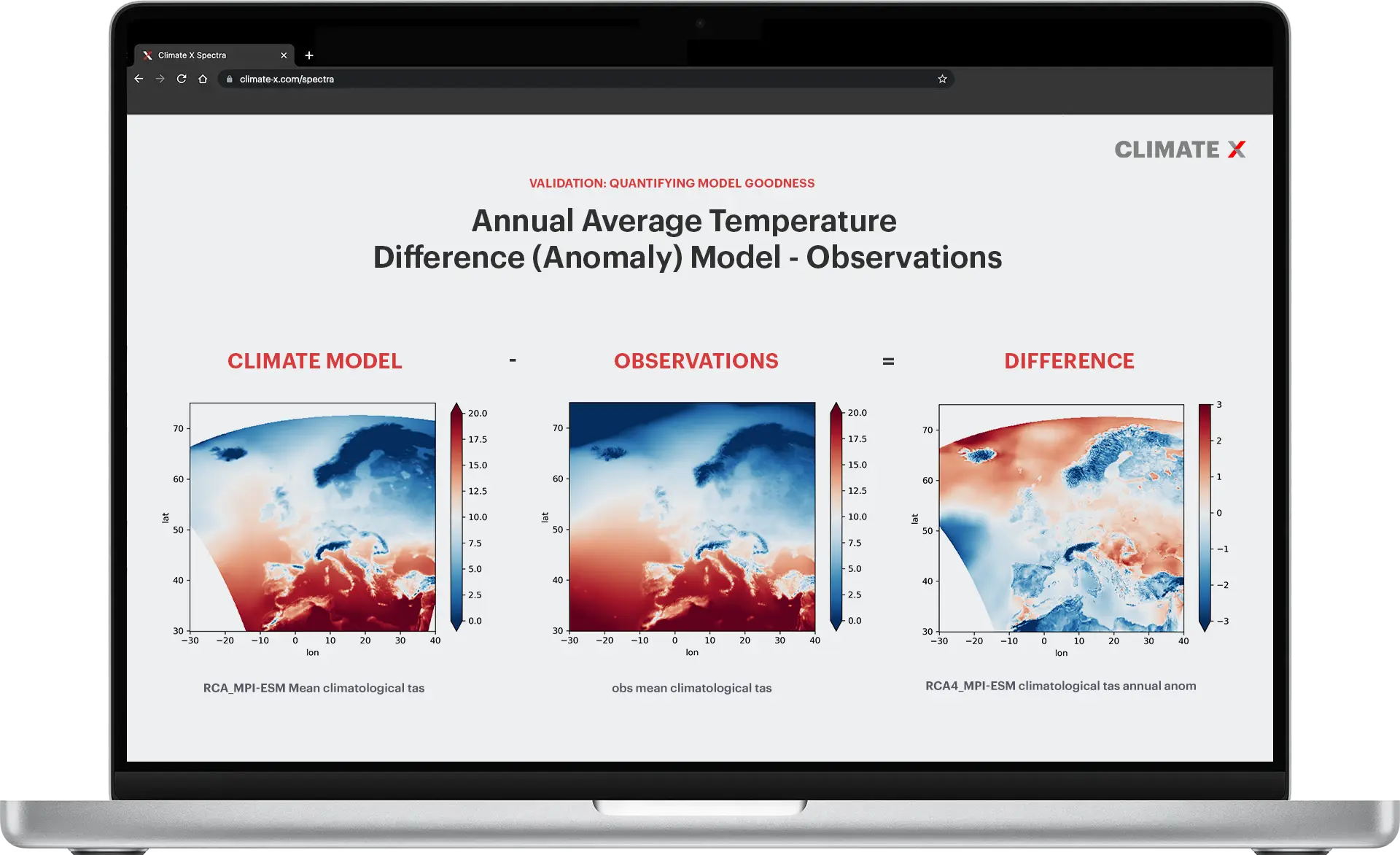

The customer was also dissatisfied with their heritage provider as well as open source data – both lacked critical hazards in their library, e.g. subsidence and failed to perform well when benchmarked against respective environmental agencies.

Should the customer continue with a status quo, they could be forced to raise a higher provision for potentially unaccounted exposure - or worse - risk regulatory intervention.

Building a Solution

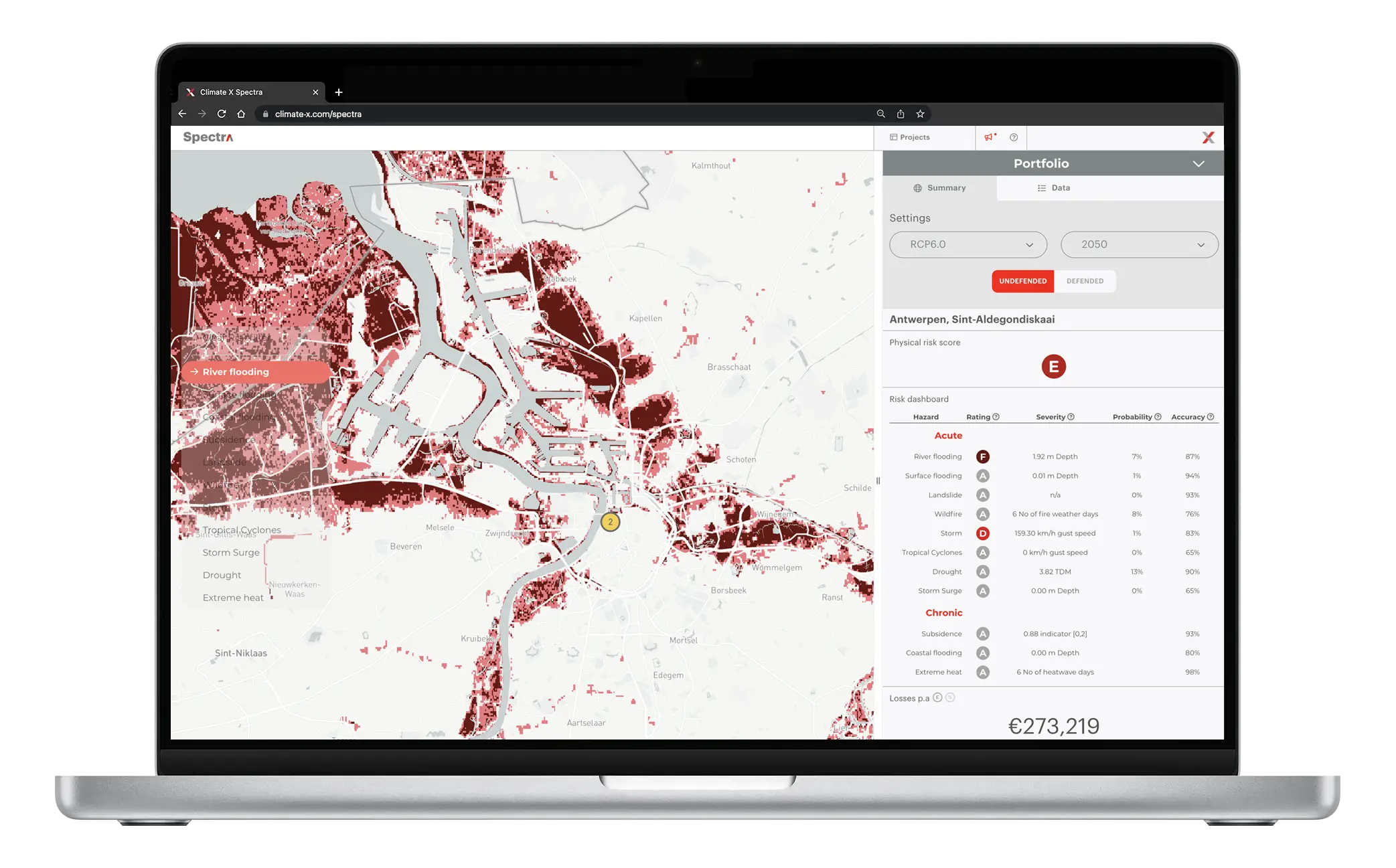

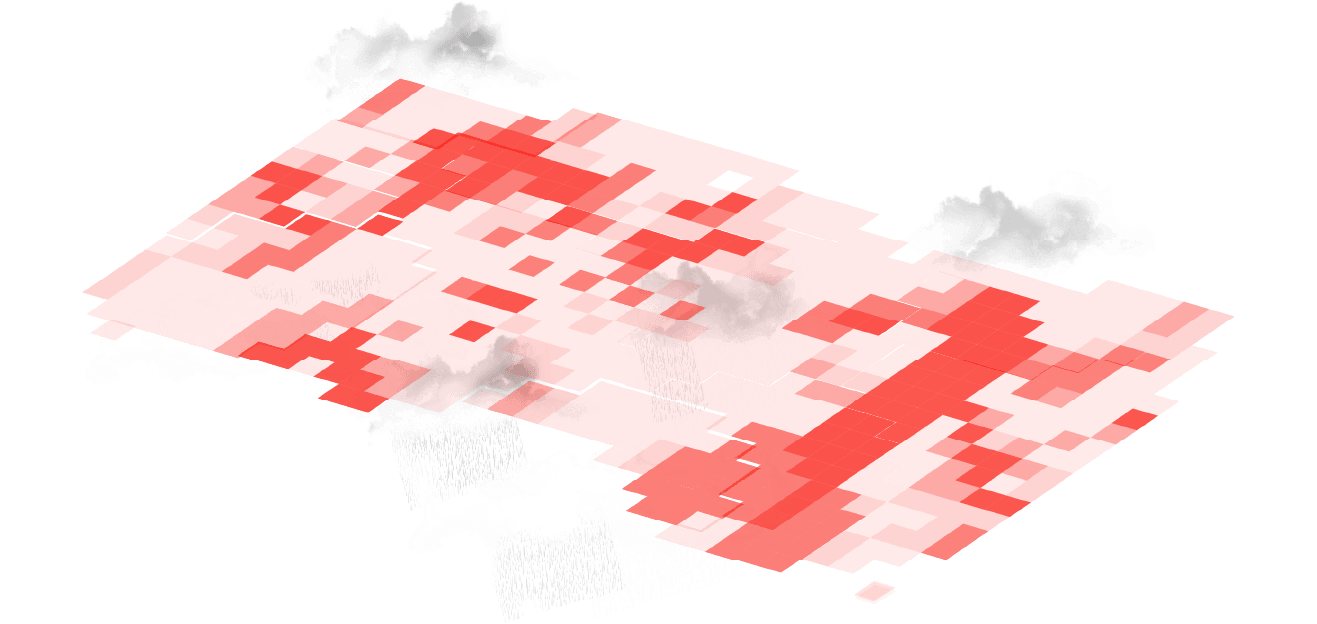

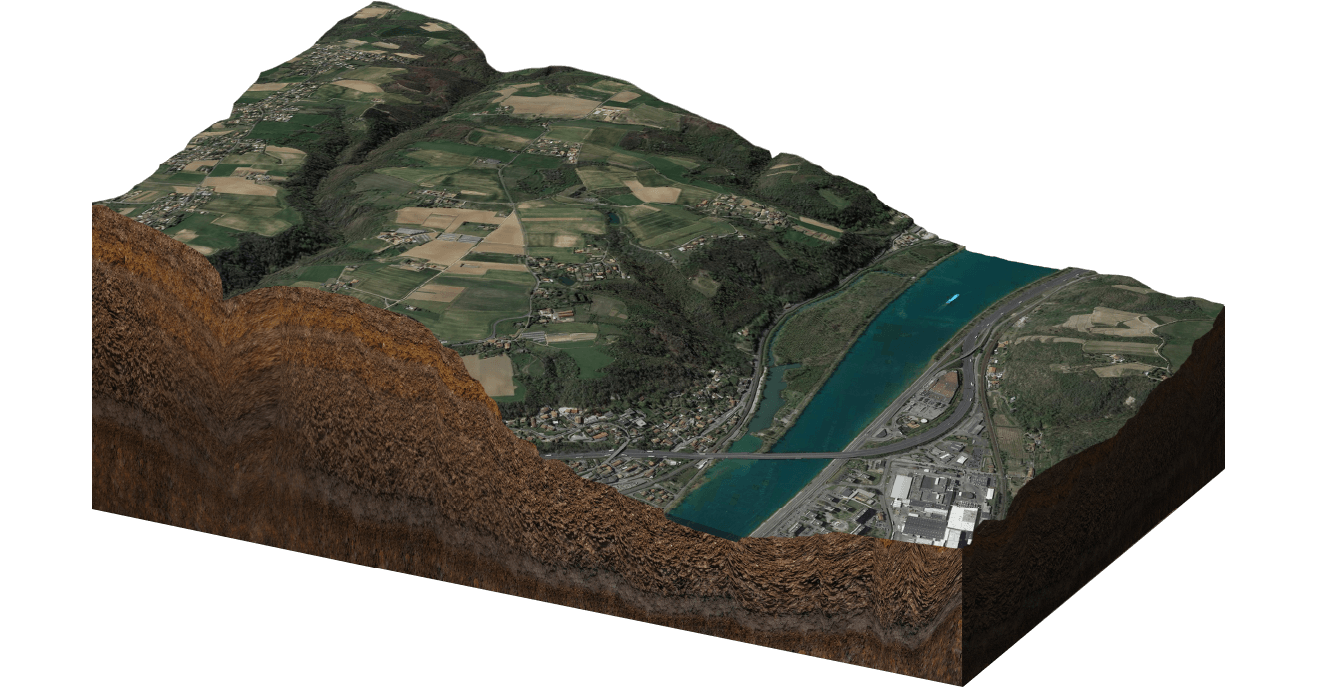

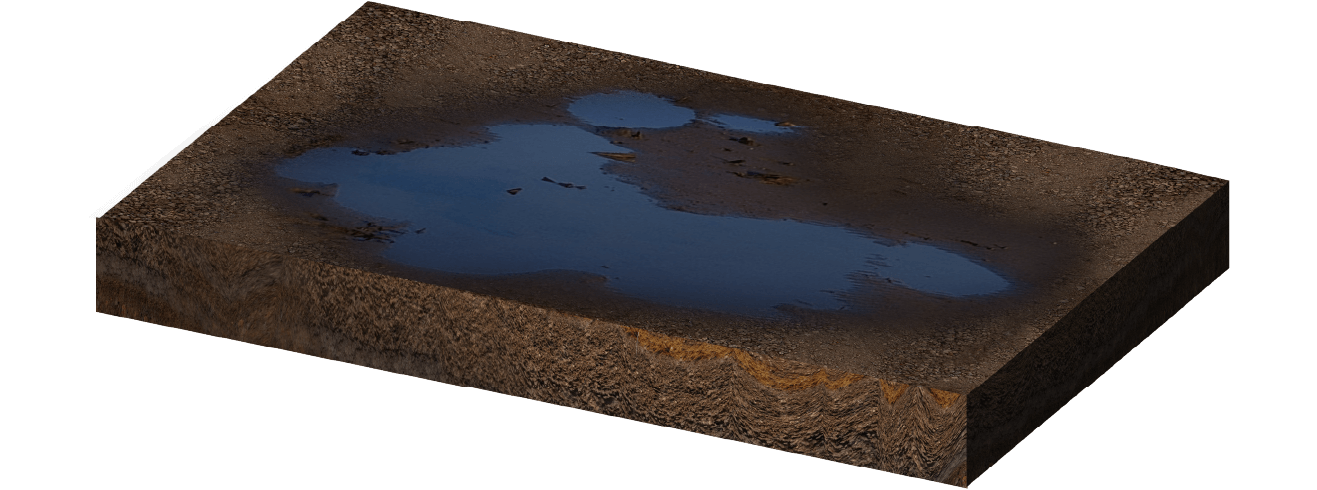

The data was delivered under several carbon emissions pathways (RCP2.6 and RCP8.5) at 5-yearly until the end of a century. Spectra also gave them the functionality to see what different types of flooding can look like with or without defences.

Finally, Climate X also delivered EPCs (Energy Performance Certificates) for 99% of the client’s assets, helping them feed our data directly into their physical and transition risk modelling capabilities in a plug-and-play fashion.

Climate X built their software-as-a-service (SaaS) offering on Amazon Web Services (AWS) to provide customers the agility and security they need to support analysis at scale. In partnering with AWS, Climate X can deploy a turnkey climate risk analysis solution for the customer in a matter of hours.

of physics

data points

of infrastructure

mapped assets

of coastline

perils

Why the customer chose Climate X

Climate X Spectra was ultimately a winner following an extensive due diligence process. We topped in all five of their scoring categories:

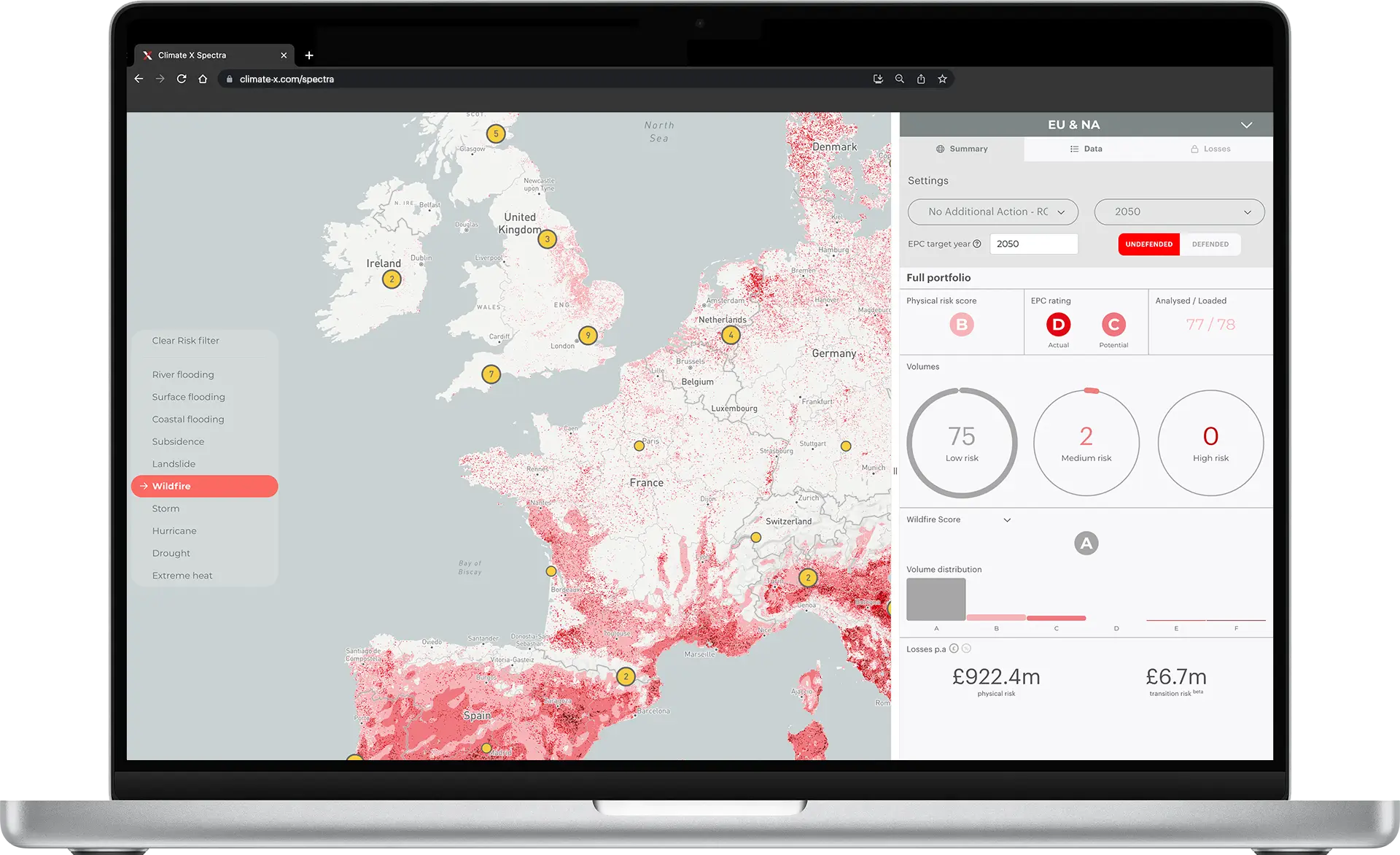

- Breadth of offering – Climate X provides an extensive physical and transition risk library as well as associated losses and adaptation measures deployed through AWS’s global infrastructure.

- Data quality - with strict benchmarking and Model Risk Management practices in place.

- Sample portfolio analysis – value add Proof of Concept.

- Commercial partnership enabling flexible terms.

- Size/scale – our financial services and real estate expertise reflecting on our top-tier customers from these industry verticals.

The Results and Benefits

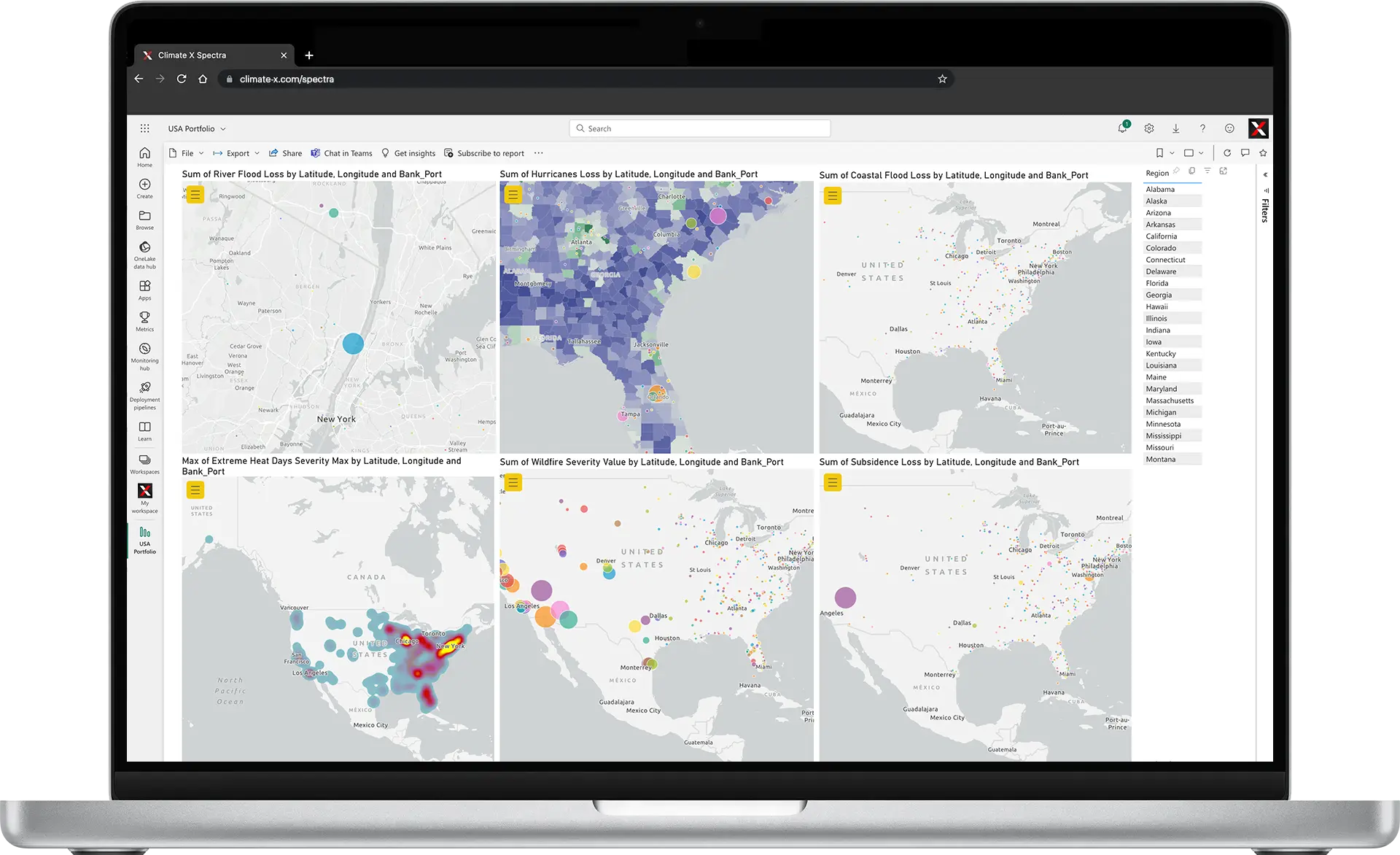

The benefit to the Bank was three-fold. Most importantly, they understood which specific properties in their close to 0.5m portfolio were at risk. This has been followed by a $ provision quantification and a deep rethink of business strategy, e.g. which postcodes to continue lending to or where to encourage retrofitting and infrastructure climate adaption.

In addition, they met their regulatory and various disclosure requirements and, finally, satisfied their board and shareholders.

The Next Steps

The Tier 1 Bank's climate risk journey doesn’t end here. We’re now assessing incorporating Climate X Spectra into their mortgage underwriting, building on the work completed to date. On this occasion, the Bank wants to use Climate X APIs to help assess each mortgage application in real time as customers request new banking products.

The scope of the assessment is also broader, taking into account more asset parameters like its adaptive capacity or actual CO2 emissions. We’re very excited to share this next endeavour together.

About Climate X

Climate X is a London-based company that was established with one goal in mind: to deliver data and analytics that will help build resiliency to the impacts of climate change to societies all around the world.

Our strategy’s cornerstone is providing best-in-class physical climate risk insights for firms in the Financial Services industry (banks, insurers, investment managers & lenders such as credit mutuals or mortgage providers) and Real Estate (commercial & residential).

In more detail, we enable firms to pinpoint and project and quantify risks & losses from weather events to make property-level business plans and guide their portfolio strategies. The data is provided via our Software-as-a-Service platform, Spectra, which can also be accessed via our API. Spectra has been recognised as not only innovative and ground-breaking but also industry-leading.

In recent months, we’ve won awards from E2E, Cog X, Digital Catapult, Founders Forum Group, GeoAwesomeness, Elite Business Awards, finalist in The Europas, and recognised as a Rising Star by Chartis.

Our latest articles

A selection of some of our latest articles covering industry, policy and climate science.