The European Central Bank (ECB) has begun enforcement measures against banks failing to assess climate and environmental risks across their portfolios.

Banks that have not yet complied with the ECB's supervisory expectations on climate risk management have been given a final deadline, after which they will be subject to financial penalties for continued non-compliance.

Speaking at a Brussels sustainable finance conference on November 14th, ECB Executive Board member and Supervisory Board Vice-Chair Frank Elderson said that currently "none of the banks under our supervision fully meet all of our expectations."

Banks have until the end of 2024 to comply but must also meet interim deadlines, including a March 2023 deadline for performing a materiality assessment of climate and environmental risks across their portfolios. It is banks that have failed to meet this interim deadline that are now the subject of enforcement measures.

We have issued binding supervisory decisions, including the potential imposition of periodic penalty payments if banks fail on their requirements. In other words, we have told those banks to remedy the shortcomings by a certain date and, if they don't comply, they will have to pay a penalty for every day the shortcoming remains unresolved."

Frank Elderson, European Central Bank Executive Board Member

Daily fines of up to 5% of revenue for non-compliance

Elderson did not specify the amount of the potential penalty or the number of lenders subject to enforcement.

However, Bloomberg has reported that about 20 banks have been sent letters warning of financial penalties for non-compliance with ECB climate risk management expectations, citing unnamed sources familiar with the matter.

These penalties would be applied daily and could amount to 5% of average daily revenue, the report said, suggesting daily penalties of up to €1.4 million for a bank with an annual turnover of €10 billion.

ECB supervisory expectations on climate risk

The ECB's 13 supervisory expectations on climate risk management and disclosure were published in 2020 and apply to the 109 most systemically significant banks in Europe (with less significant institutions also encouraged to comply).

It warns that both physical and transition climate risks are drivers of credit risk, operational risk, market risk and liquidity risk, as well as non-Pillar 1 risks such as migration risk, credit spread risk in the banking book, real estate risk and strategic risk.

In response to these exposures banks are expected to:

- Explicitly include climate-related and environmental risks in their risk appetite framework.

- Incorporate climate risks into their risk management framework as drivers of existing risk categories.

- Consider climate risks at all relevant stages of the credit-granting process and monitor them in lending portfolios.

- Report data reflecting their exposures to climate-related risks and be capable of generating such data in "a timely manner" in order to meet on-demand reporting requests during crisis situations.

- Monitor the effect of climate-related and environmental factors on their current market risk positions

- Incorporate these factors into their liquidity risk management and liquidity buffer calibration.

Quality of Banks’ disclosures is low

A 2022 assessment of compliance with ECB climate-related expectations found that while the majority of banks now disclose at least basic information for most of the expectations, the quality of the information remains low and is unlikely to provide market participants with actionable insights.

For three-quarters of the institutions the level of substantiation of the disclosures was deemed insufficient, with limited information on portfolio coverage and methodologies used.

The assessment, which covered 103 significant banks and 28 smaller banks, also found that 56% do not disclose which key risk indicators are used for monitoring and managing climate and environmental risks while only 17% of banks provided comprehensive information on how these risks have been integrated into risk management processes.

EU Banking Authorities losing patience with climate laggards

Against a background of increasingly frequent extreme weather events and alarming warnings from climate scientists, the ECB enforcement actions indicate a loss of patience with banks that fail to take climate risk seriously. This concern was evident in Elderson's recent remarks, which were uncharacteristically blunt.

"What we and other banking supervisors around the world have consistently been emphasising is that failing to adequately manage climate and environmental risks is no longer compatible with sound risk management. Such a failure also increasingly calls into question the fitness and propriety of those in charge of establishing and steering banks' practices."

"This is a situation that we can not and will not accept," he concluded.

High Quality, Granular and Transparent Data is available to Banks

Although the performance of European banks in meeting ECB climate-related supervisor expectations remains low, help is available in the form of easily accessible, high quality, granular and transparent climate data.

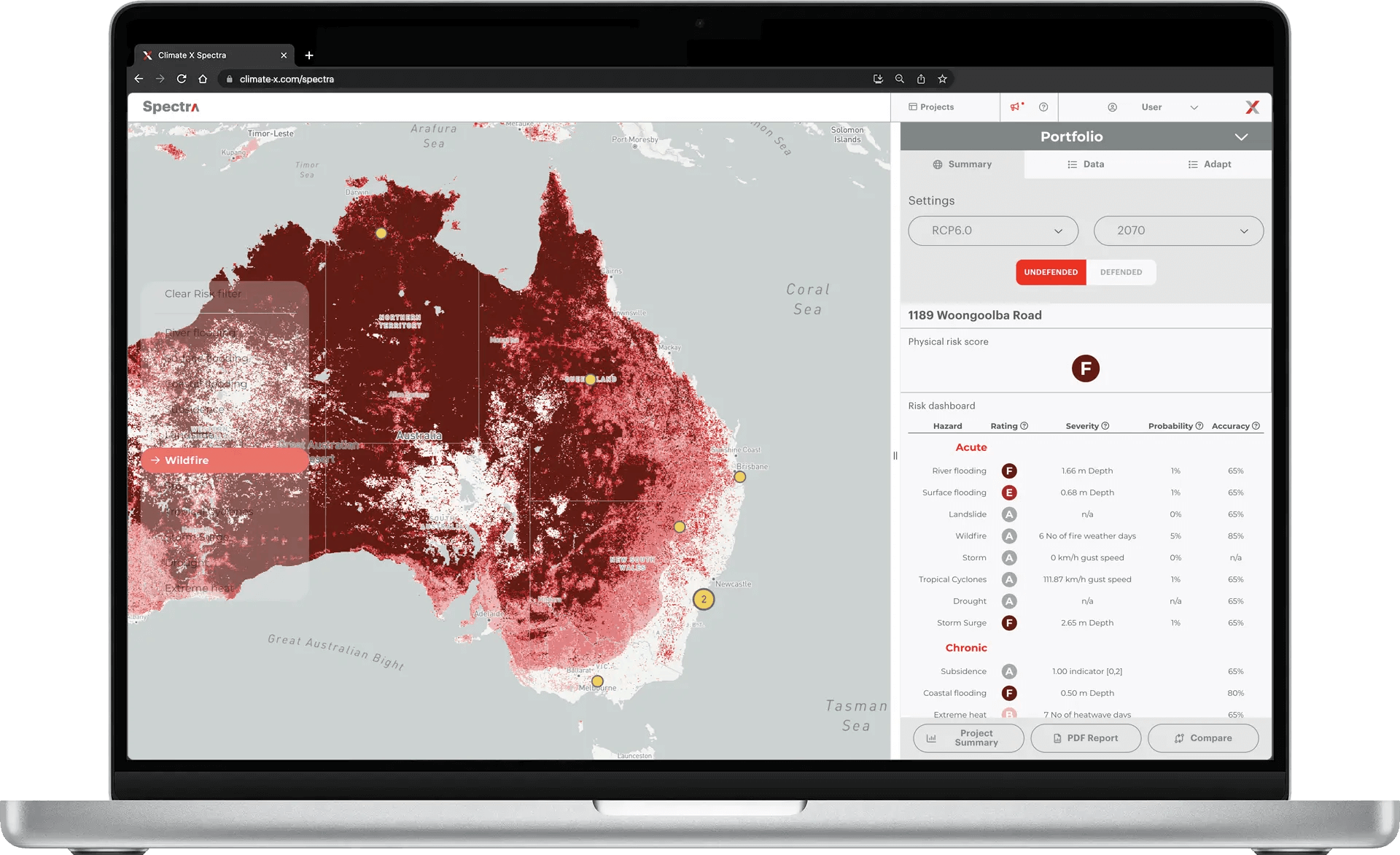

Climate X data solution, Spectra, provides location-specific climate risk ratings and loss estimates under multiple warming scenarios through to the year 2100. Source documentation, methodology and regional accuracy is also provided to ensure complete transparency. Spectra produces both asset and portfolio-level output and allows data to be exported for integration with other software.

See how Climate X can help you to quantify your physical risk profile to support better capital adequacy decisions.

Sources

-

Comfort, N. & Arons, S. - Bloomberg (2023) ECB Threatens 20 Banks With Fines for Mismanaging Climate Risk

-

ECB - Banking Supervision (2020) Final Guide on Climate-related and Environmental Risks

-

EBA (2023) Report on the Role of Environmental and Social Risks in the Prudential Framework

- Elderson, F. (2023) Keynote Speech: Making finance fit for Paris: achieving “negative splits”

-

Euronews (2023) ECB Threatens Fines on Banks Failing to Integrate Climate Risk